Answered step by step

Verified Expert Solution

Question

1 Approved Answer

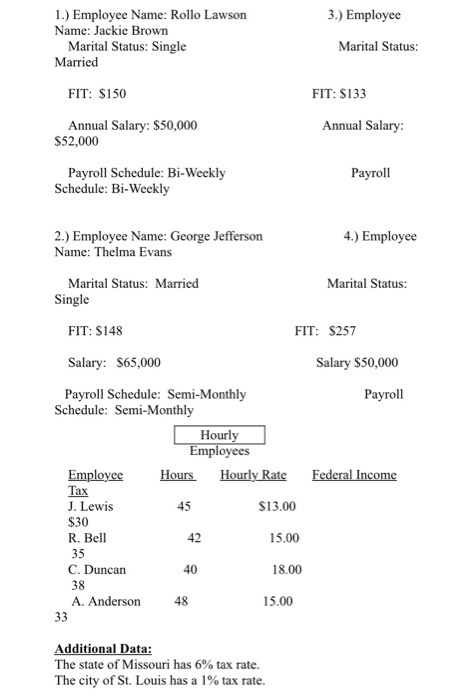

1.) Employee Name: Rollo Lawson Name: Jackie Brown Marital Status: Single Married FIT: $150 Annual Salary: $50,000 $52,000 Payroll Schedule: Bi-Weekly Schedule: Bi-Weekly 2.)

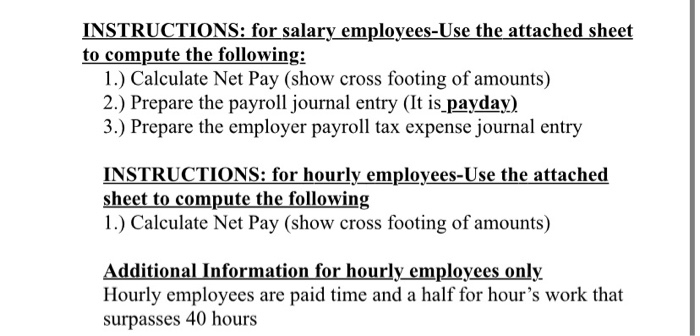

1.) Employee Name: Rollo Lawson Name: Jackie Brown Marital Status: Single Married FIT: $150 Annual Salary: $50,000 $52,000 Payroll Schedule: Bi-Weekly Schedule: Bi-Weekly 2.) Employee Name: George Jefferson Name: Thelma Evans Marital Status: Married Single FIT: $148 Salary: $65,000 Payroll Schedule: Semi-Monthly Schedule: Semi-Monthly Employee Tax J. Lewis $30 R. Bell 35 C. Duncan 38 A. Anderson 33 Hourly Employees Hours 45 42 40 48 Hourly Rate $13.00 Additional Data: The state of Missouri has 6% tax rate. The city of St. Louis has a 1% tax rate. 15.00 15.00 18.00 3.) Employee Marital Status: FIT: $133 Annual Salary: Payroll FIT: $257 4.) Employee Marital Status: Salary $50,000 Payroll Federal Income INSTRUCTIONS: for salary employees-Use the attached sheet to compute the following: 1.) Calculate Net Pay (show cross footing of amounts) 2.) Prepare the payroll journal entry (It is payday) 3.) Prepare the employer payroll tax expense journal entry INSTRUCTIONS: for hourly employees-Use the attached sheet to compute the following 1.) Calculate Net Pay (show cross footing of amounts) Additional Information for hourly employees only Hourly employees are paid time and a half for hour's work that surpasses 40 hours

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 1 Net Pay Calculation for Salaried Employees Employee Name Jackie Brown Annual Salary 52000 F...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started