Question

1. Enter beginning balances in the T-accounts from the Beginning Balance Sheet, all accounts have normal balances. Common Stock has 200,000 shares issued and outstanding.

1. Enter beginning balances in the T-accounts from the Beginning Balance Sheet, all accounts have normal balances. Common Stock has 200,000 shares issued and outstanding. 2. Additional information: Company uses a perpetual inventory system (discounts and freight are recorded in the inventory account). Suppliers offer a 2% discount; the company does not offer discounts to customers. No adjustment for inventory is needed.

3. Record the following summarized August transactions in a general journal. Use a blank line between transactions. Use the account titles as shown in the T-accounts, do not add any accounts. a. Purchased inventory on account, $35,000 b. Paid $3,200 freight fees c. Sold inventory on account, $25,000, cogs $12,500 d. Paid Wages and Salaries, $10,000, includes the amount due from the previous month's e. Received payments from customers on account, $35,000 f. Cash sales, $110,000, cogs $55,000 g. Paid for 6 months of business insurance, $6,000 h. Paid for 1 years rent, $12,000 i. Received cash advance payments from customers $6,000 j. Paid outstanding accounts payable within the discount period, $38,300 k. Completed $2,000 of work for customers that paid in advance (use Sales Account)

4. Post the transactions to the T-accounts; use reference numbers when posting, calculate the balance in each account after all posting is complete.

5. Prepare a trial balance.

6. Journalize and post any necessary adjusting entries; continue using the journal to record the entries. Hint: There are 3 entries. After adjusting entries have been posted all accounts will be used and have normal balances.

7. Additional adjusting entry: Wages earned but not paid totaled $1,000

8. Prepare an adjusted trial balance

9. Prepare a multiple-step Income Statement, a Retained Earnings Statement, and a Classified Balance Sheet

10. Journalize and post your closing entries

11. Prepare a post-closing Trial Balance

14. Check Figures: Trial balance before adjustment: $391,750 dr/cr

Beginning balances: Net Income: $57,200 Beginning Balance sheet July 31,20XX Cash $142,000 Accounts Payable $13,300 Accounts Receivable 13,250 Wage payable 1,200 Inventory 40,000 Common Stock 200,000 Fixed Assets (6,000 per year depreciation) 60,000 Retained earnings 34,750 Accum. Depr. (cr. Bal) (6,000) Total assets 249,250 Total liabilities & equity 249,250

This is all the info that was given to me to do this project.

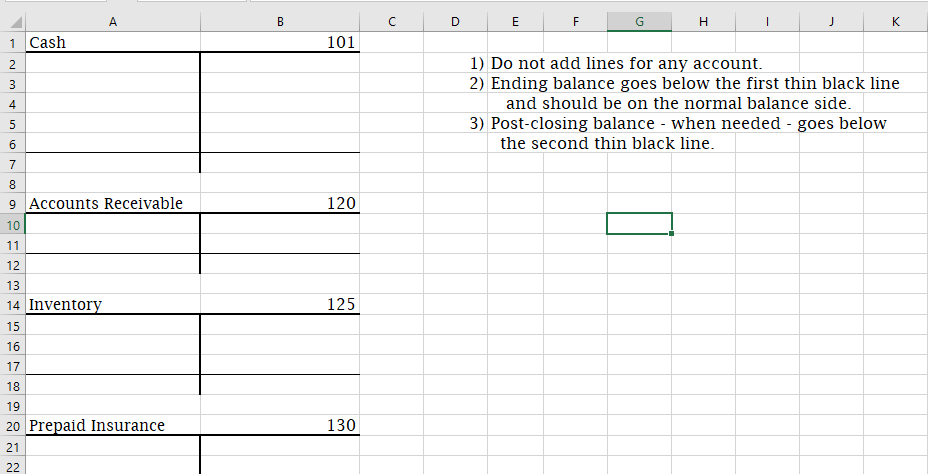

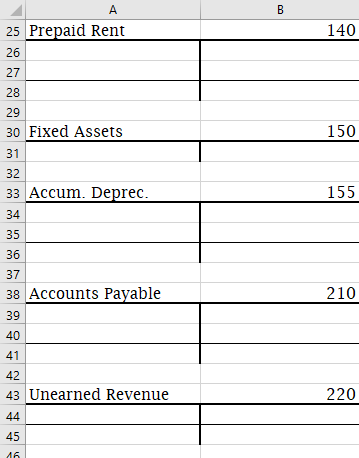

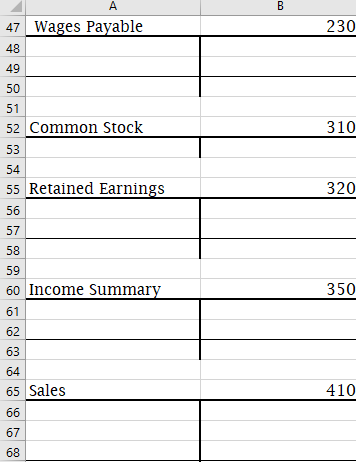

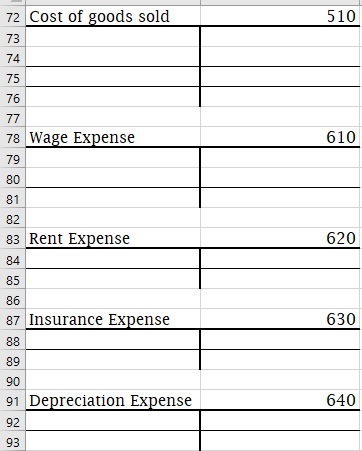

C D E F G H I J K 1 Cash 1) Do not add lines for any account. 2) Ending balance goes below the first thin black line and should be on the normal balance side. 3) Post-closing balance - when needed - goes below the second thin black line. 9 Accounts Receivable 120 12 13 125 14 Inventory 15 20 Prepaid Insurance 25 Prepaid Rent 140 30 Fixed Assets 150 33 Accum. Deprec. 155 38 Accounts Payable 210 Unearned Revenue 220 47 Wages Payable 230 Common Stock 310 55 Retained Earnings 320 57 60 Income Summary 350 65 Sales 410 72 Cost of goods sold 510 Wage Expense 610 Rent Expense 620 Insurance Expense 630 Depreciation Expense 640Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started