Question

1. Enter the following merchandising transactions as journal entries into the Arizona Coyotes general journal. Merchandising transactions for the month of july: 1.1 on july

Merchandising transactions for the month of july:

1.1 on july 3, sold jersies on account to flagstaff sporting goods for $1,200. The cost of the merchandise sold was $850

1.2 purchased additional merchandise on account from Hockey Stuff LLC for $3.480 on july 10.

1.3 on july 13, sold jersies and sticks to the I Love Hockey, Inc. for $2.650 on account. The cost of the merchandise sold was $950

1.4 Recieved payment from flagstaff sporting goods on july 15th

1.5 july 22, paid hockey stuff LLC for the merchandise purchased on july 10.

1.6 Recieved payment from i love hockey, inc. on july 23rd.

2. calculate gross profit to the right of the general journal

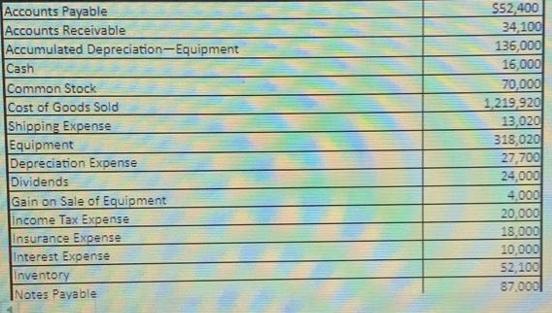

3. The account balances for the Phoniex Rising are presented below.Use these account balances to prepare a multi-step income statement for the company.

3.1 Prepare an income statement for the year ended December 31, 20xx. Remember, you should use referencing/functions to enter the values on financial statements (no direct typing of numbers)

3.2 calculate the gross profit rate and profit margin for the phoniex rising FC below:

3.3 "The vice president of marketing and the director of human resources have developed a proposal whereby phoniex rising FC would compensate the sales force on a strictly commission basis. Given the increased incentive, they expect net sales to increase by 15%. As a result, they estimate that gross profit will increase by $94,395 and expenses by $128,905"

4. Compute the expected new net income. Then, compute the revised profit margin and gross profit rate. Comment on the effect that this plan would have on net income and on the ratios, and evaluate the merit of the proposal. (IGNORE INCOME TAX EFFECTS)

Accounts Payable Accounts Receivable Accumulated Depreciation-Equipment Cash Common Stock Cost of Goods Sold Shipping Expense Equipment Depreciation Expense Dividends Gain on Sale of Equipment Income Tax Expense Insurance Expense Interest Expense Inventory Notes Payable $52,400 34,100 136,000 16,000 70,000 1,219,920 13,020 318,020 27,700 24,000 4,000 20,000 18,000 10,000 52,100 87,000

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

11 Journal Entry for July 3 sale to Flagstaff Sporting Goods Accounts Receivable Flagstaff Sporting Goods 1200 Sales Revenue 1200 Cost of Goods Sold 8...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started