Answered step by step

Verified Expert Solution

Question

1 Approved Answer

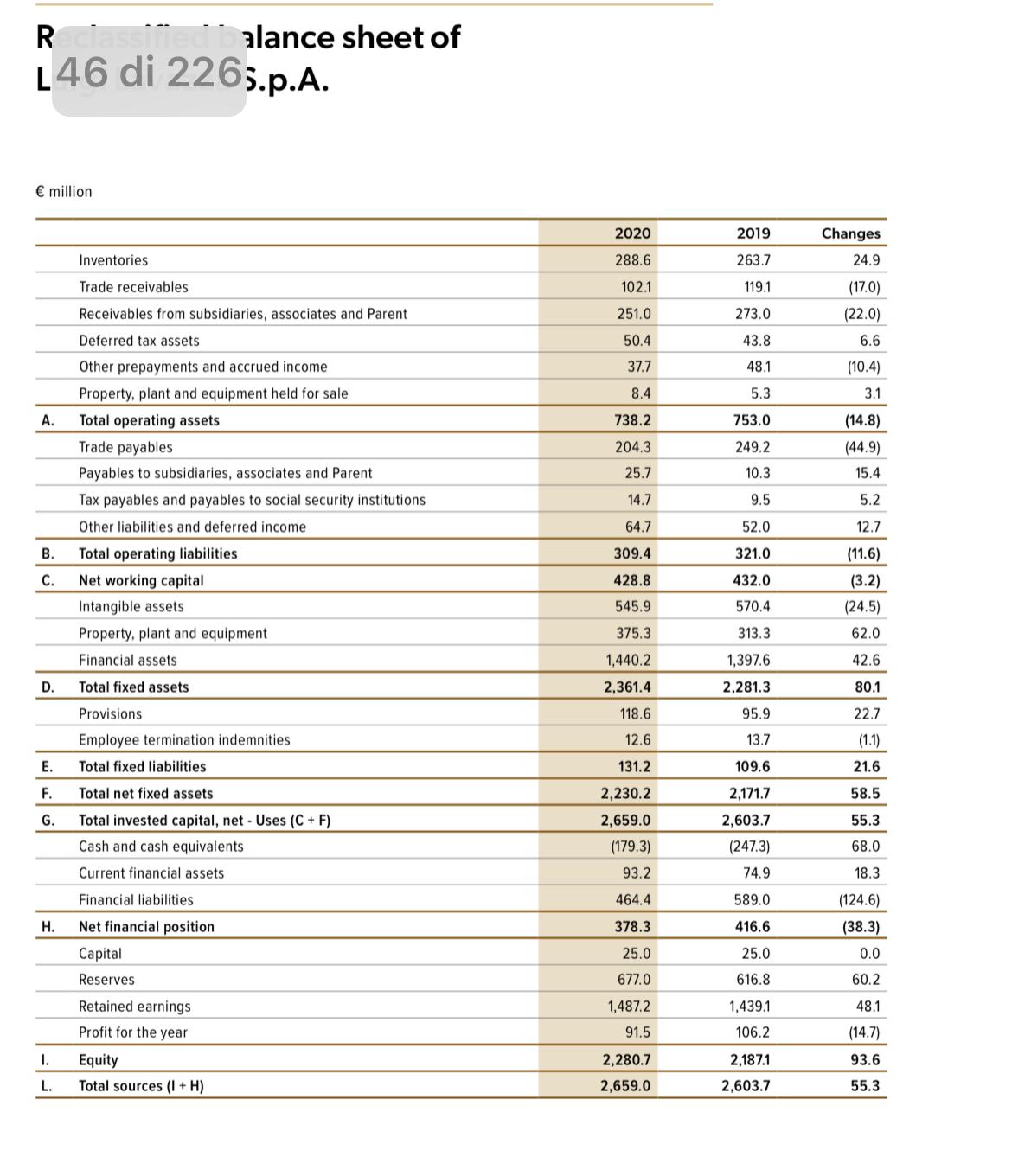

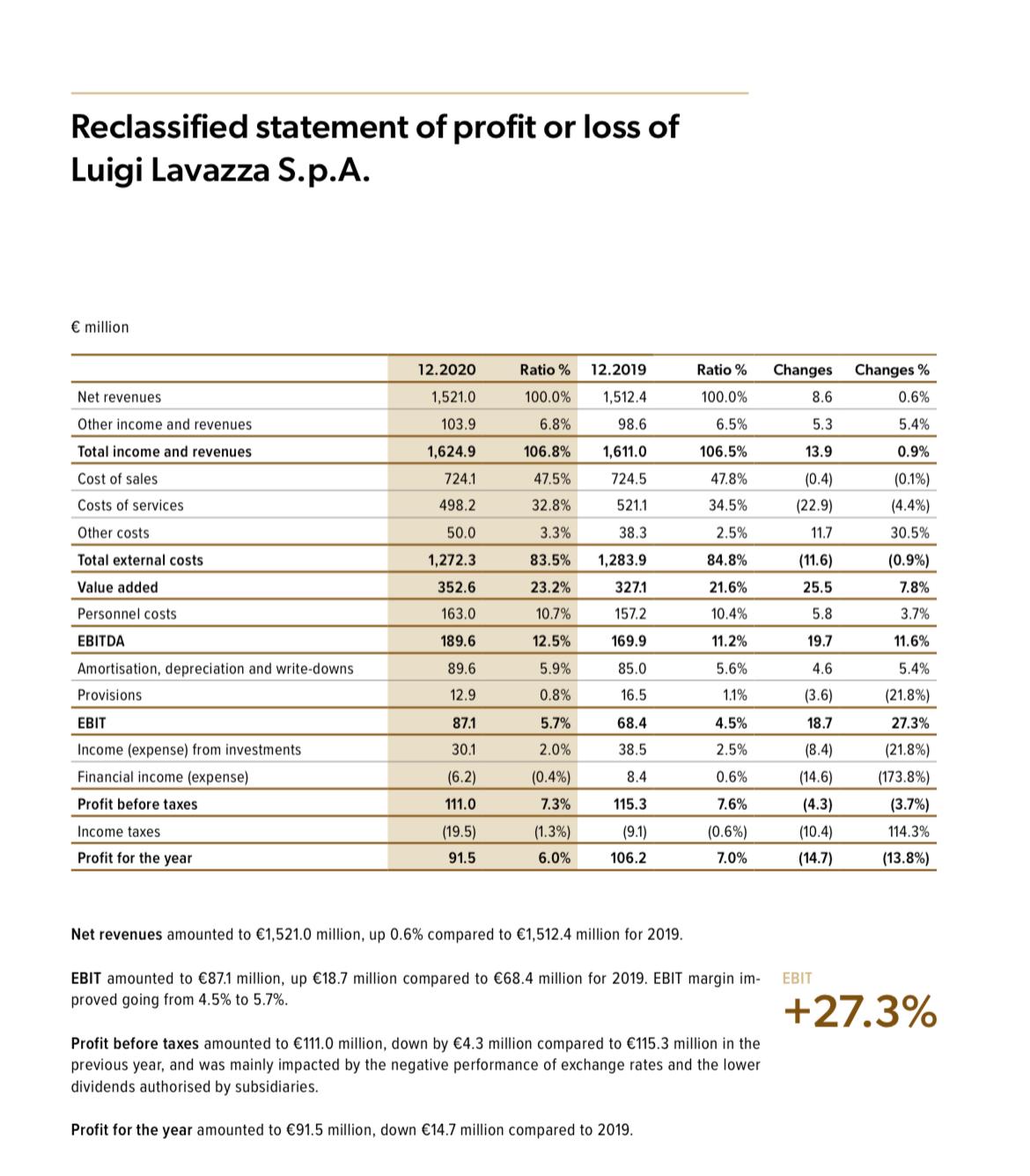

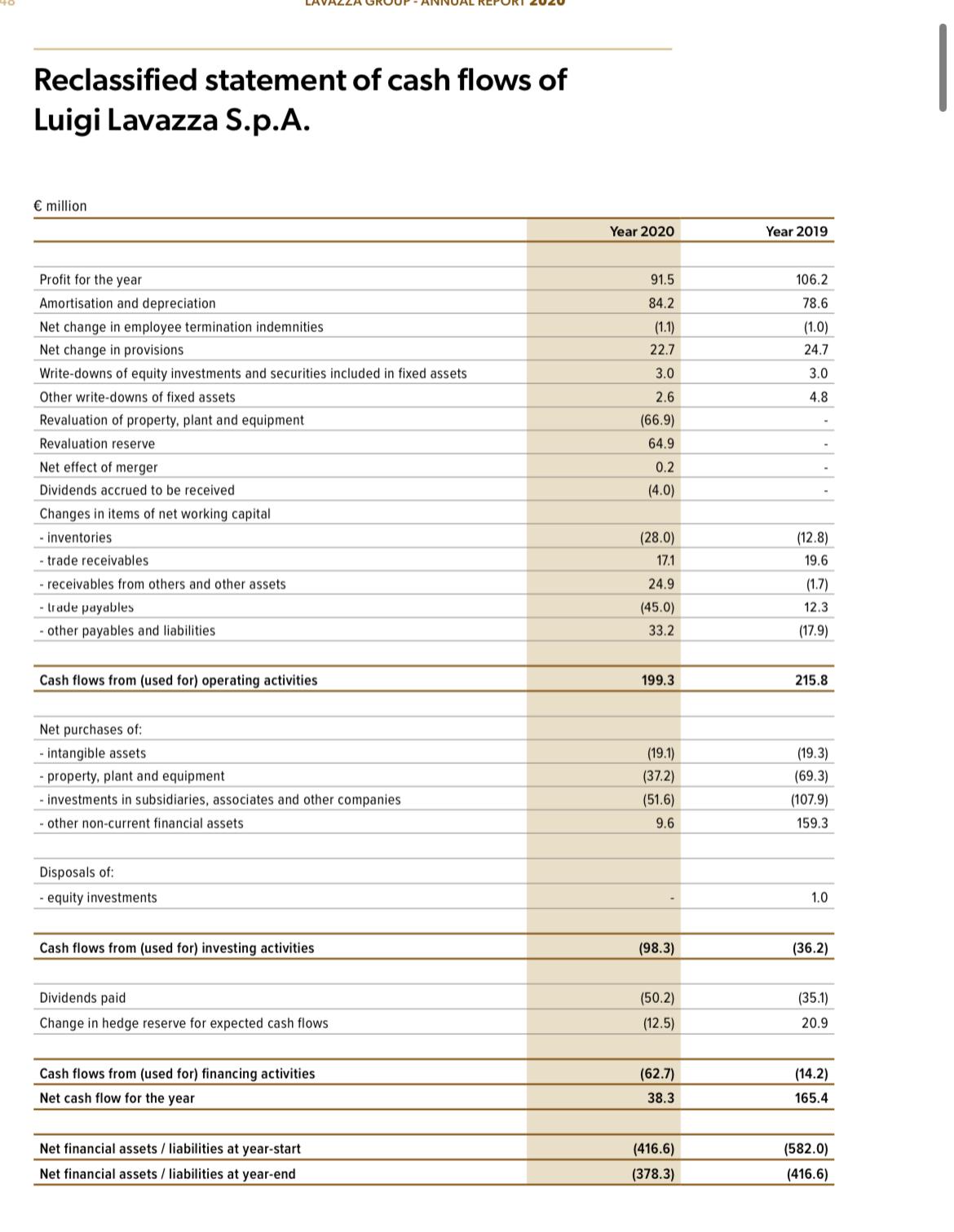

1. Equity Ratio, Gearing Ratio, Dynamic Gearing Ratio, Net Debt/EBITDA ratio, Capex Ratio, Asset Depreciation Ratio, Current Assets to Total Assets Ratio, Non current assets

1. Equity Ratio, Gearing Ratio, Dynamic Gearing Ratio, Net Debt/EBITDA ratio, Capex Ratio, Asset Depreciation Ratio, Current Assets to Total Assets Ratio, Non current assets to total assets ratio and Equity to Fixed Assets ratio.

2. Current Ratio, Quick Ratio, Cash Ratio, Debt to Equity, Debt to assets and Interest Coverage. Also calculate the ALTMAN Z SCORE.

3. Days Sales Outstanding (DSO), Days Payable Outstanding (DPO), Inventory Intensity, Inventory days and Cash Conversion Cycle.

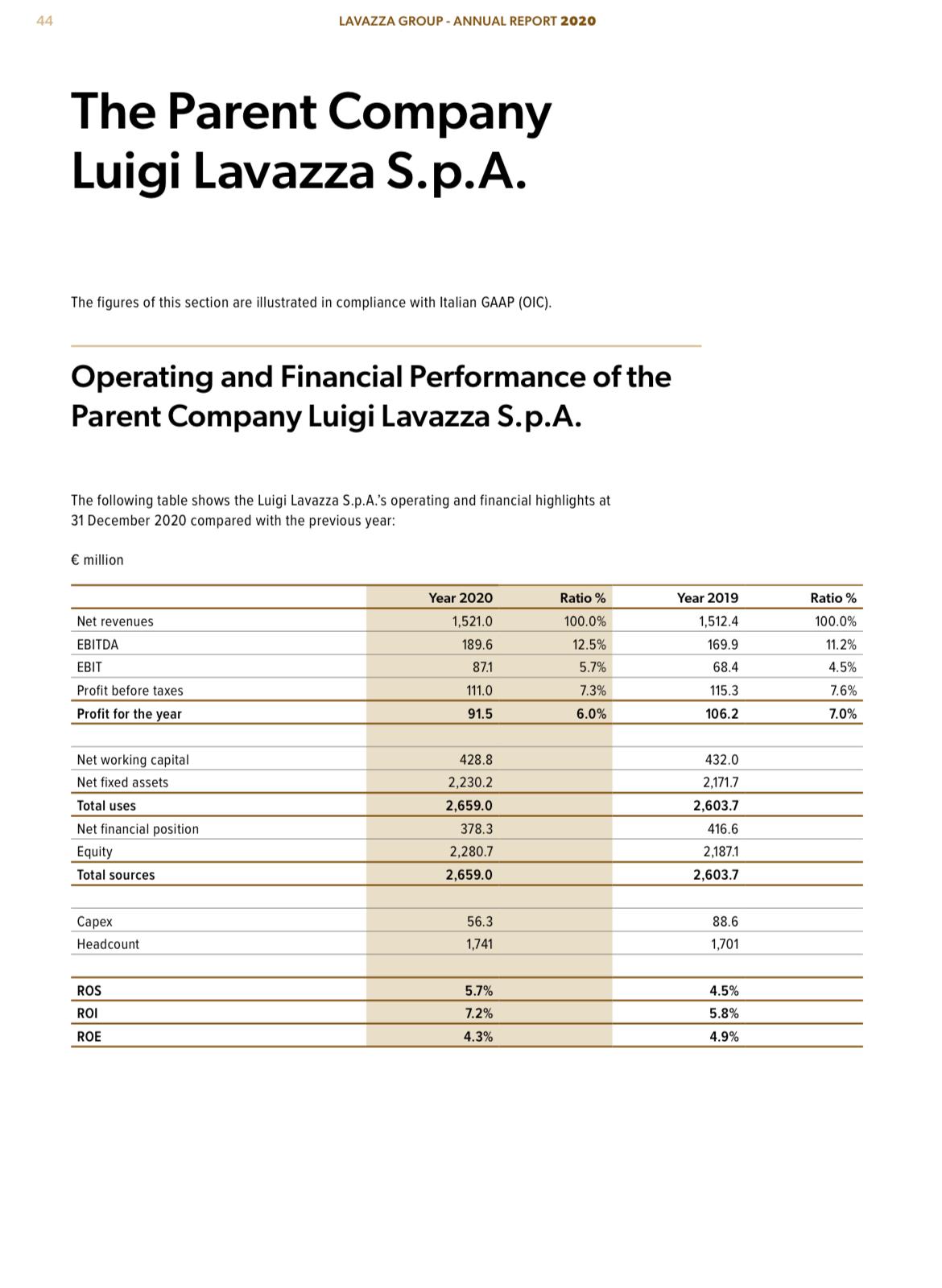

44 The Parent Company Luigi Lavazza S.p.A. The figures of this section are illustrated in compliance with Italian GAAP (OIC). Operating and Financial Performance of the Parent Company Luigi Lavazza S.p.A. The following table shows the Luigi Lavazza S.p.A.'s operating and financial highlights at 31 December 2020 compared with the previous year: million LAVAZZA GROUP - ANNUAL REPORT 2020 Net revenues EBITDA EBIT Profit before taxes Profit for the year Net working capital Net fixed assets Total uses Net financial position Equity Total sources Capex. Headcount ROS ROI ROE Year 2020 1,521.0 189.6 87.1 111.0 91.5 428.8 2,230.2 2,659.0 378.3 2,280.7 2,659.0 56.3 1,741 5.7% 7.2% 4.3% Ratio % 100.0% 12.5% 5.7% 7.3% 6.0% Year 2019 1,512.4 169.9 68.4 115.3 106.2 432.0 2,171.7 2,603.7 416.6 2,187.1 2,603.7 88.6 1,701 4.5% 5.8% 4.9% Ratio % 100.0% 11.2% 4.5% 7.6% 7.0%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the stepbystep workings 1 Financial Ratios Equity Ratio EquityTotal Assets 228072659 0858 o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started