Question

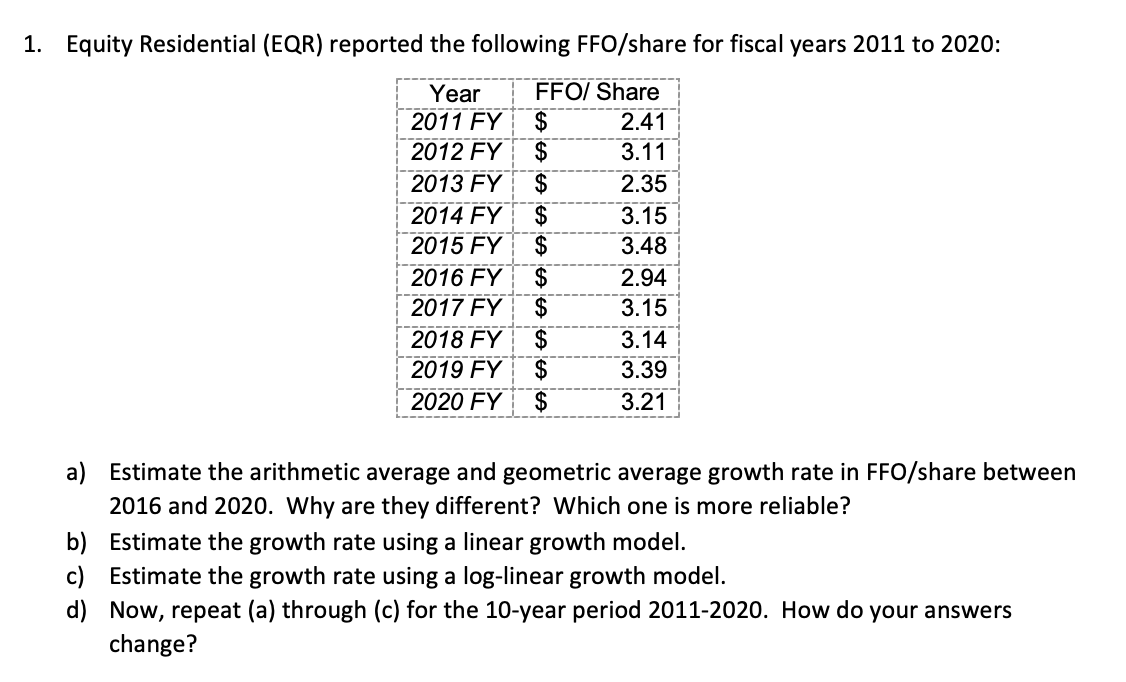

1. Equity Residential (EQR) reported the following FFO/share for fiscal years 2011 to 2020: Year 2011 FY FFO/ Share $ 2.41 2012 FY $

1. Equity Residential (EQR) reported the following FFO/share for fiscal years 2011 to 2020: Year 2011 FY FFO/ Share $ 2.41 2012 FY $ 3.11 2013 FY $ 2.35 2014 FY $ 3.15 2015 FY $ 3.48 2016 FY $ 2.94 2017 FY $ 3.15 2018 FY $ 3.14 2019 FY $ 3.39 2020 FY $ 3.21 a) Estimate the arithmetic average and geometric average growth rate in FFO/share between 2016 and 2020. Why are they different? Which one is more reliable? b) Estimate the growth rate using a linear growth model. Estimate the growth rate using a log-linear growth model. d) Now, repeat (a) through (c) for the 10-year period 2011-2020. How do your answers change?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Robert Libby, Patricia Libby, Daniel Short, George Kanaan, M

5th Canadian edition

9781259105692, 978-1259103285

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App