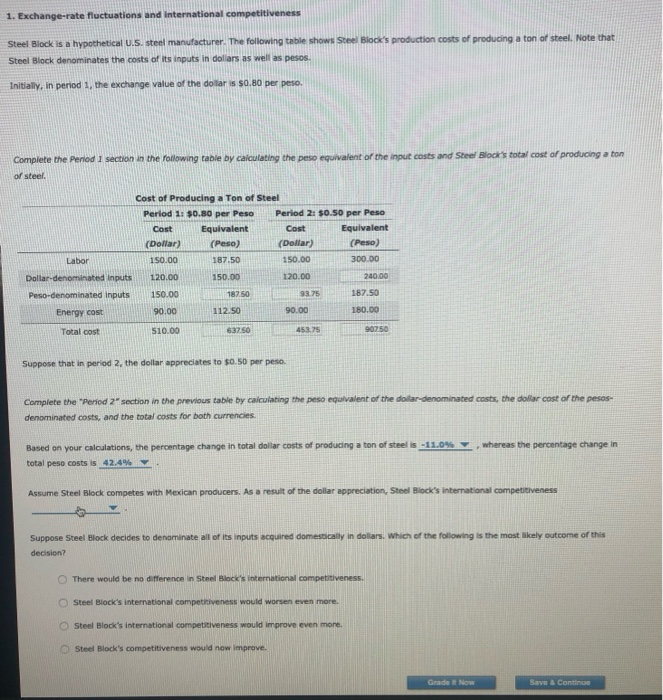

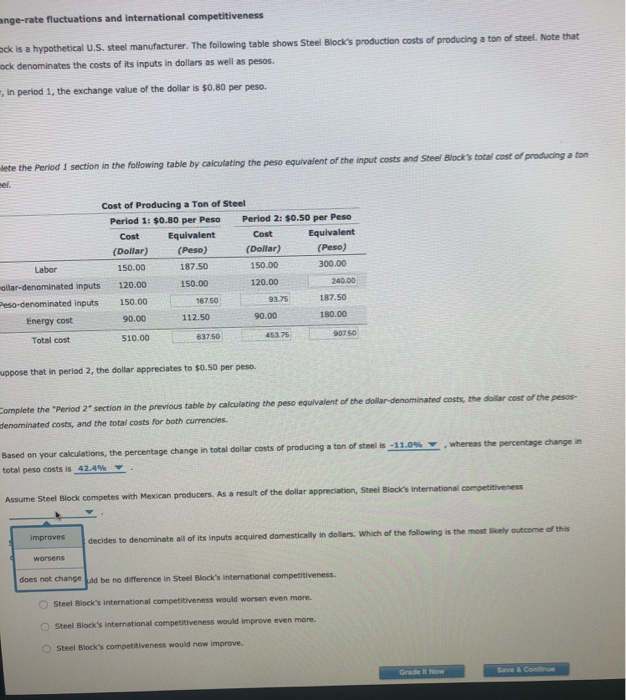

1. Exchange-rate fluctuations and international competitiveness Steel Block is a hypothetical U.S. steel manufacturer. The following table shows Steel Block's production costs of producing a ton of steel. Note that Steel Block denominates the costs of its inputs in dollars as well as pesos Initially, in period 1, the exchange value of the dollar is $0.80 per peso, Complete the Period 1 section in the following table by calculating the peso equivalent of the input costs and Steel Blocks total cost of producing a ton of steel Cost of producing a Ton of Steel Period 1: $0.80 per Peso Period 2: $0.50 per Pesc Equivalent (Peso) Dollar (Peso) (Dollar Labor 150.00 150.00 300.00 Dollar-denominated Inputs 120.00 Peso-denominated inputs 150.00 93.75 187.50 Energy cost 90.00 112.50 90.00 150.00 Total cost $10.00 453.75 Suppose that in period 2, the dollar appreciates to $0.50 per peso Complete the "Period 2" section in the previous table by calculating the peso equivalent of the dollar-denominated costs, the dollar cost of the pesos denominated costs, and the total costs for both currencies whereas the percentage change in Based on your calculations, the percentage change in total dollar costs of producing a ton of steelis -11.0% total peso costs is 42.4% Assume Steel Block competes with Mexican producers. As a result of the dollar appreciation, Steel Block's International competitiveness Suppose Steel Block decides to denominate all of its inputs acquired domestically in dollars. Which of the following is the most likely outcome of the decision? There would be no difference in Steel Blocks international competitiveness Steel Block's international competitiveness would worsen even more Steel Blocks international competitiveness would improve even more Steel Block's competitiveness would now improve Save & Co inge-rate fluctuations and international competitiveness yok is a hypothetical U.S. steel manufacturer. The following table shows Steel Block's production costs of producing a ton of steel. Note that ock denominates the costs of its inputs in dollars as well as pesos. in period 1, the exchange value of the dollar is $0.80 per peso. lete the Period 1 section in the following table by calculating the peso equivalent of the input costs and Steel Block's total cost of producing a ton Cost of Producing a ton of Steel Period 1: $0.50 per Peso Period 2: $0.50 per Peso Cost Equivalent Cost Equivalent (Dollar) (Peso) (Dollar) (Peso) Labor 150.00 187.50 150.00 300.00 ollar-denominated inputs 120.00 150.00 120.00 reso-denominated inputs 150.00 18750 93.75 187.50 Energy cost 90.00 112.50 90.00 180.00 Total cost 510.00 63750 453.75 240.00 OS wppose that in period 2, the dollar appreciates to $0.50 per peso. Complete the "Period 2 section in the previous table by calculating the peso equivalent of the dollar denominated costs, the dollar cost of the pesos enominated costs, and the total costs for both currencies. Based on your calculations, the percentage change in total dollar costs of producing a ton of steel is -11.0% total peso costs is 42.4% whereas the percentage change in Assume Steel Block competes with Mexican producers. As a result of the dollar appreciation, Steel Blocks international competitiveness Improves decides to denominate all of its inputs acquired domestically in dollars. Which of the following is the most rely outcome of the worsens does not changed be no difference in Steel Blocks international competitiveness Steel Block's International competitiveness would worsen even more. Steel Block's international competitiveness would improve even more. Steel Block's competitiveness would now improve Grad Now Save & Co 1. Exchange-rate fluctuations and international competitiveness Steel Block is a hypothetical U.S. steel manufacturer. The following table shows Steel Block's production costs of producing a ton of steel. Note that Steel Block denominates the costs of its inputs in dollars as well as pesos Initially, in period 1, the exchange value of the dollar is $0.80 per peso, Complete the Period 1 section in the following table by calculating the peso equivalent of the input costs and Steel Blocks total cost of producing a ton of steel Cost of producing a Ton of Steel Period 1: $0.80 per Peso Period 2: $0.50 per Pesc Equivalent (Peso) Dollar (Peso) (Dollar Labor 150.00 150.00 300.00 Dollar-denominated Inputs 120.00 Peso-denominated inputs 150.00 93.75 187.50 Energy cost 90.00 112.50 90.00 150.00 Total cost $10.00 453.75 Suppose that in period 2, the dollar appreciates to $0.50 per peso Complete the "Period 2" section in the previous table by calculating the peso equivalent of the dollar-denominated costs, the dollar cost of the pesos denominated costs, and the total costs for both currencies whereas the percentage change in Based on your calculations, the percentage change in total dollar costs of producing a ton of steelis -11.0% total peso costs is 42.4% Assume Steel Block competes with Mexican producers. As a result of the dollar appreciation, Steel Block's International competitiveness Suppose Steel Block decides to denominate all of its inputs acquired domestically in dollars. Which of the following is the most likely outcome of the decision? There would be no difference in Steel Blocks international competitiveness Steel Block's international competitiveness would worsen even more Steel Blocks international competitiveness would improve even more Steel Block's competitiveness would now improve Save & Co inge-rate fluctuations and international competitiveness yok is a hypothetical U.S. steel manufacturer. The following table shows Steel Block's production costs of producing a ton of steel. Note that ock denominates the costs of its inputs in dollars as well as pesos. in period 1, the exchange value of the dollar is $0.80 per peso. lete the Period 1 section in the following table by calculating the peso equivalent of the input costs and Steel Block's total cost of producing a ton Cost of Producing a ton of Steel Period 1: $0.50 per Peso Period 2: $0.50 per Peso Cost Equivalent Cost Equivalent (Dollar) (Peso) (Dollar) (Peso) Labor 150.00 187.50 150.00 300.00 ollar-denominated inputs 120.00 150.00 120.00 reso-denominated inputs 150.00 18750 93.75 187.50 Energy cost 90.00 112.50 90.00 180.00 Total cost 510.00 63750 453.75 240.00 OS wppose that in period 2, the dollar appreciates to $0.50 per peso. Complete the "Period 2 section in the previous table by calculating the peso equivalent of the dollar denominated costs, the dollar cost of the pesos enominated costs, and the total costs for both currencies. Based on your calculations, the percentage change in total dollar costs of producing a ton of steel is -11.0% total peso costs is 42.4% whereas the percentage change in Assume Steel Block competes with Mexican producers. As a result of the dollar appreciation, Steel Blocks international competitiveness Improves decides to denominate all of its inputs acquired domestically in dollars. Which of the following is the most rely outcome of the worsens does not changed be no difference in Steel Blocks international competitiveness Steel Block's International competitiveness would worsen even more. Steel Block's international competitiveness would improve even more. Steel Block's competitiveness would now improve Grad Now Save & Co