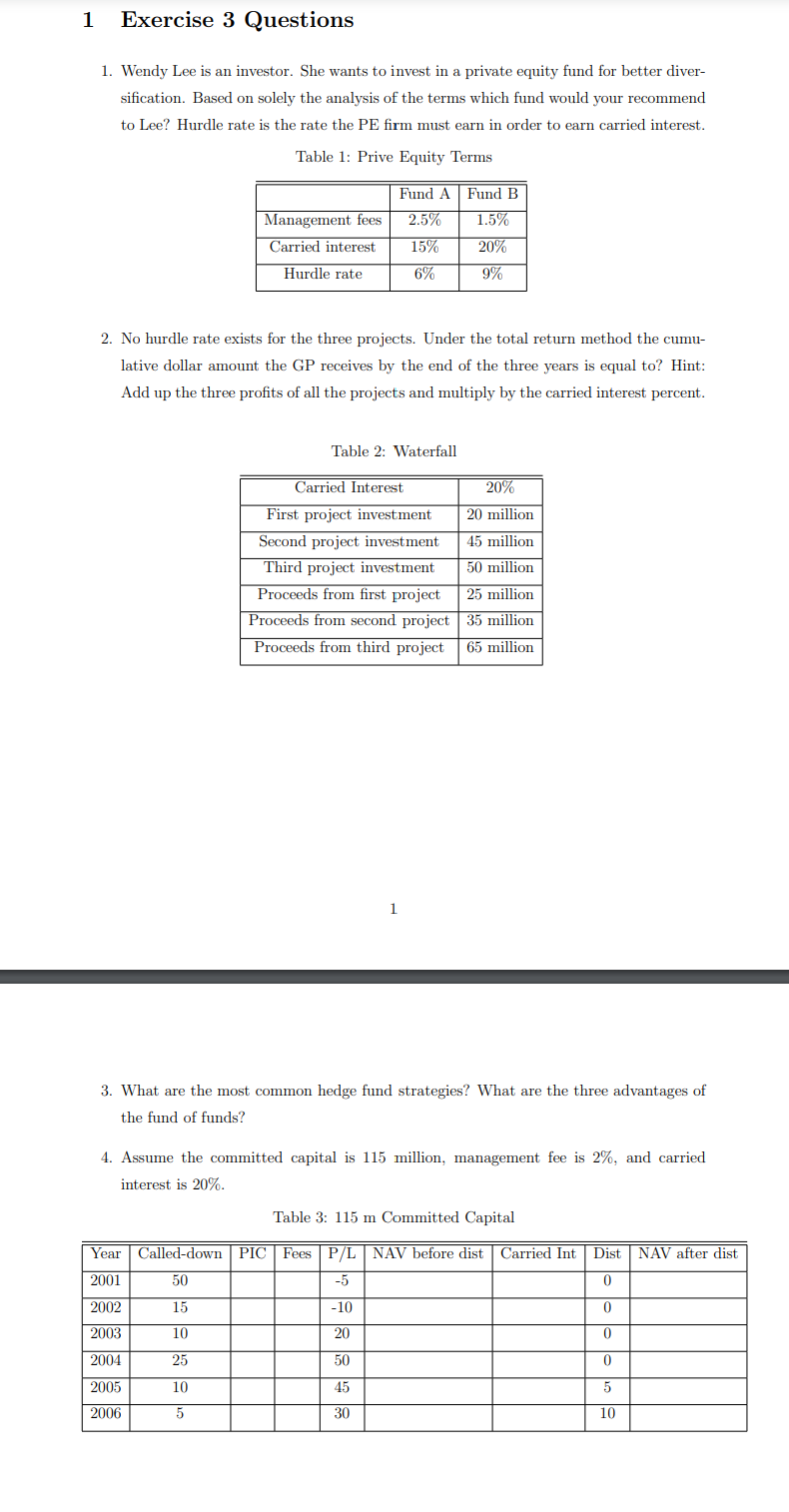

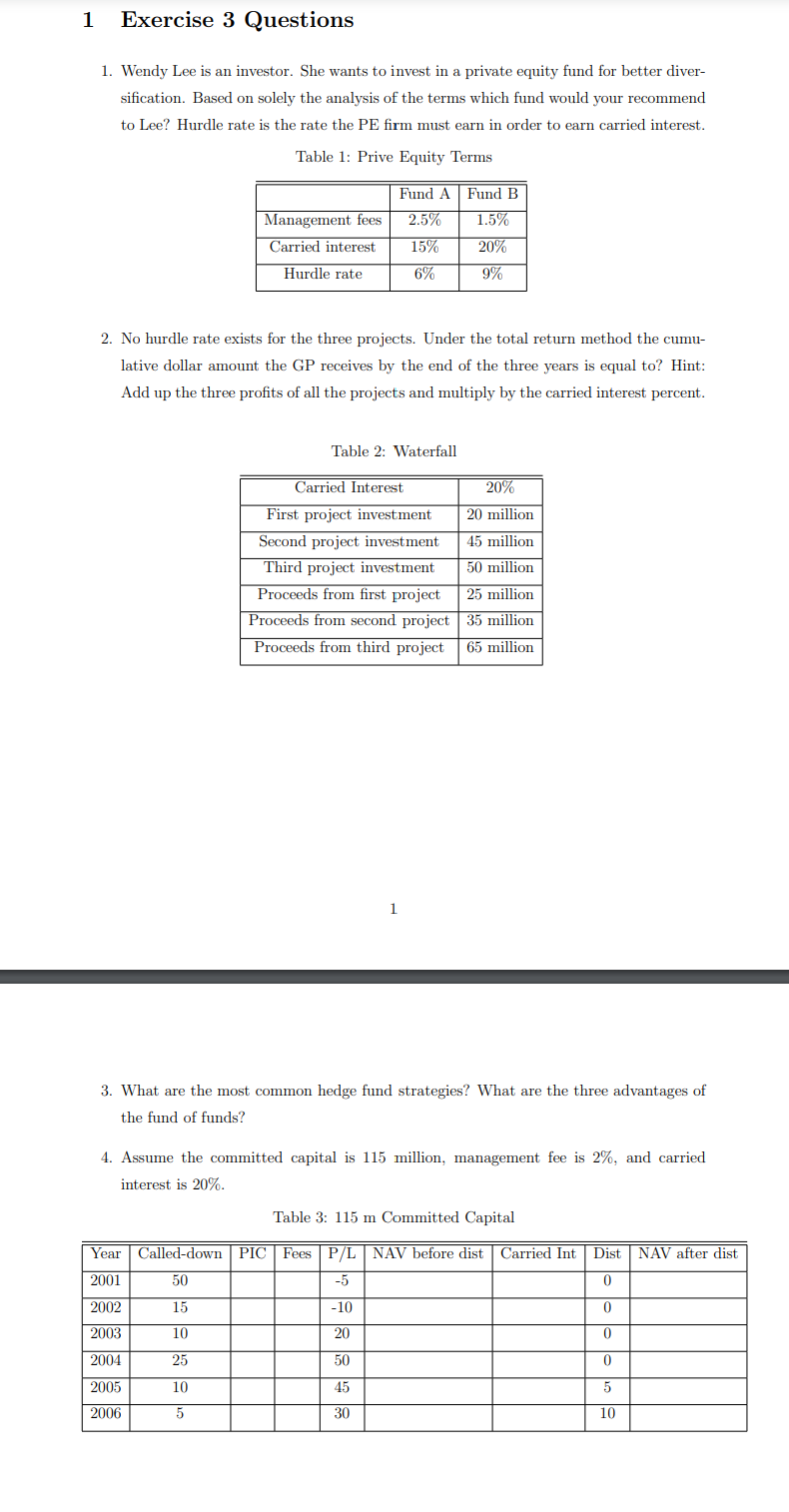

1 Exercise 3 Questions 1. Wendy Lee is an investor. She wants to invest in a private equity fund for better diver- sification. Based on solely the analysis of the terms which fund would your recommend to Lee? Hurdle rate is the rate the PE firm must earn in order to earn carried interest. Table 1: Prive Equity Terms Fund A Fund B 2.5% 1.5% Management fees Carried interest 15% 20% 9% Hurdle rate 6% 2. No hurdle rate exists for the three projects. Under the total return method the cumu- lative dollar amount the GP receives by the end of the three years is equal to? Hint: Add up the three profits of all the projects and multiply by the carried interest percent. Table 2: Waterfall Carried Interest 20% First project investment 20 million Second project investment 45 million Third project investment 50 million Proceeds from first project 25 million Proceeds from second project 35 million Proceeds from third project 65 million 1 3. What are the most common hedge fund strategies? What are the three advantages of the fund of funds? 4. Assume the committed capital is 115 million, management fee is 2%, and carried interest is 20% Table 3: 115 m Committed Capital Year Called-down PIC Fees P/L NAV before dist Carried Int Dist NAV after dist 2001 50 -5 0 2002 15 -10 0 2003 10 20 0 2004 25 50 0 2005 10 45 5 2006 5 30 10 1 Exercise 3 Questions 1. Wendy Lee is an investor. She wants to invest in a private equity fund for better diver- sification. Based on solely the analysis of the terms which fund would your recommend to Lee? Hurdle rate is the rate the PE firm must earn in order to earn carried interest. Table 1: Prive Equity Terms Fund A Fund B 2.5% 1.5% Management fees Carried interest 15% 20% 9% Hurdle rate 6% 2. No hurdle rate exists for the three projects. Under the total return method the cumu- lative dollar amount the GP receives by the end of the three years is equal to? Hint: Add up the three profits of all the projects and multiply by the carried interest percent. Table 2: Waterfall Carried Interest 20% First project investment 20 million Second project investment 45 million Third project investment 50 million Proceeds from first project 25 million Proceeds from second project 35 million Proceeds from third project 65 million 1 3. What are the most common hedge fund strategies? What are the three advantages of the fund of funds? 4. Assume the committed capital is 115 million, management fee is 2%, and carried interest is 20% Table 3: 115 m Committed Capital Year Called-down PIC Fees P/L NAV before dist Carried Int Dist NAV after dist 2001 50 -5 0 2002 15 -10 0 2003 10 20 0 2004 25 50 0 2005 10 45 5 2006 5 30 10