Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(1) Explain the concepts of hedging, speculation, and arbitrage. Provide an example of each strategy using derivatives. (2) Consider the following information for a

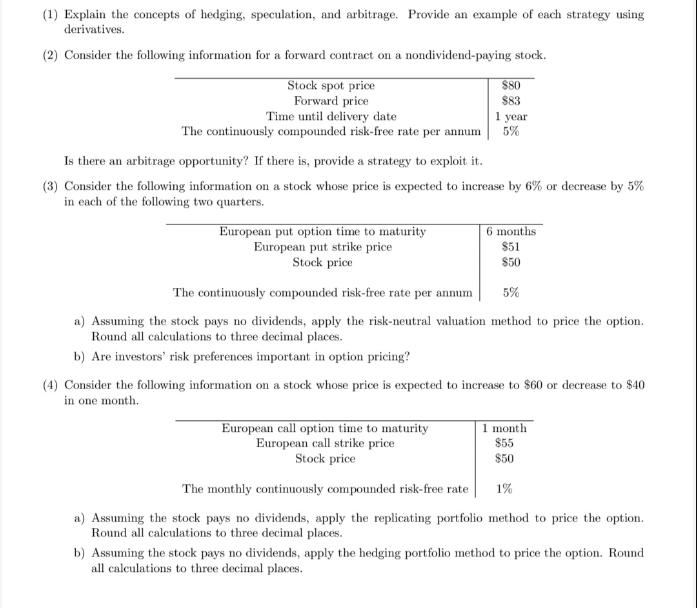

(1) Explain the concepts of hedging, speculation, and arbitrage. Provide an example of each strategy using derivatives. (2) Consider the following information for a forward contract on a nondividend-paying stock. Stock spot price Forward price Time until delivery date The continuously compounded risk-free rate per annum Is there an arbitrage opportunity? If there is, provide a strategy to exploit it. $80 $83 1 year 5% (3) Consider the following information on a stock whose price is expected to increase by 6% or decrease by 5% in each of the following two quarters. European put option time to maturity European put strike price Stock price 6 months $51 $50 5% The continuously compounded risk-free rate per annum a) Assuming the stock pays no dividends, apply the risk-neutral valuation method to price the option. Round all calculations to three decimal places. b) Are investors' risk preferences important in option pricing? (4) Consider the following information on a stock whose price is expected to increase to $60 or decrease to $40 in one month. European call option time to maturity European call strike price Stock price 1 month $55 $50 1% The monthly continuously compounded risk-free rate a) Assuming the stock pays no dividends, apply the replicating portfolio method to price the option. Round all calculations to three decimal places. b) Assuming the stock pays no dividends, apply the hedging portfolio method to price the option. Round all calculations to three decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started