Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Explain two differences between both of these funds to highlight to your client the key areas that differentiate the funds. 2. If you were

1. Explain two differences between both of these funds to highlight to your client the key areas that differentiate the funds.

2. If you were to invest in either fund knowing your research which fund would you choose to invest in and why ?

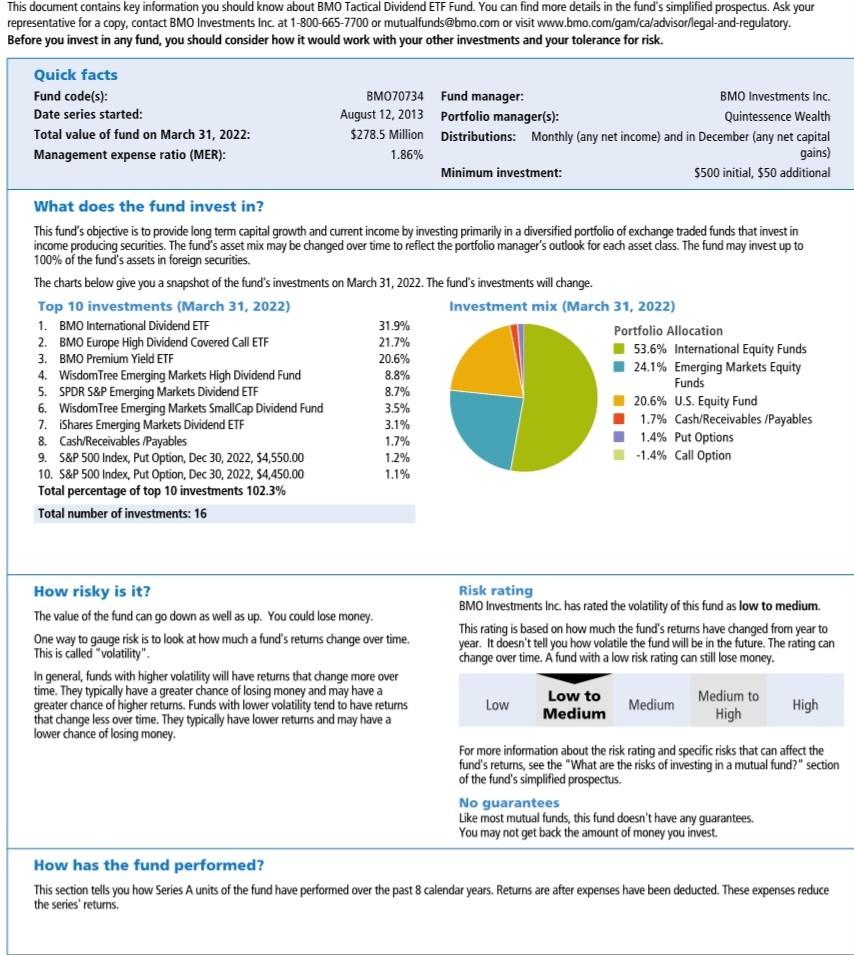

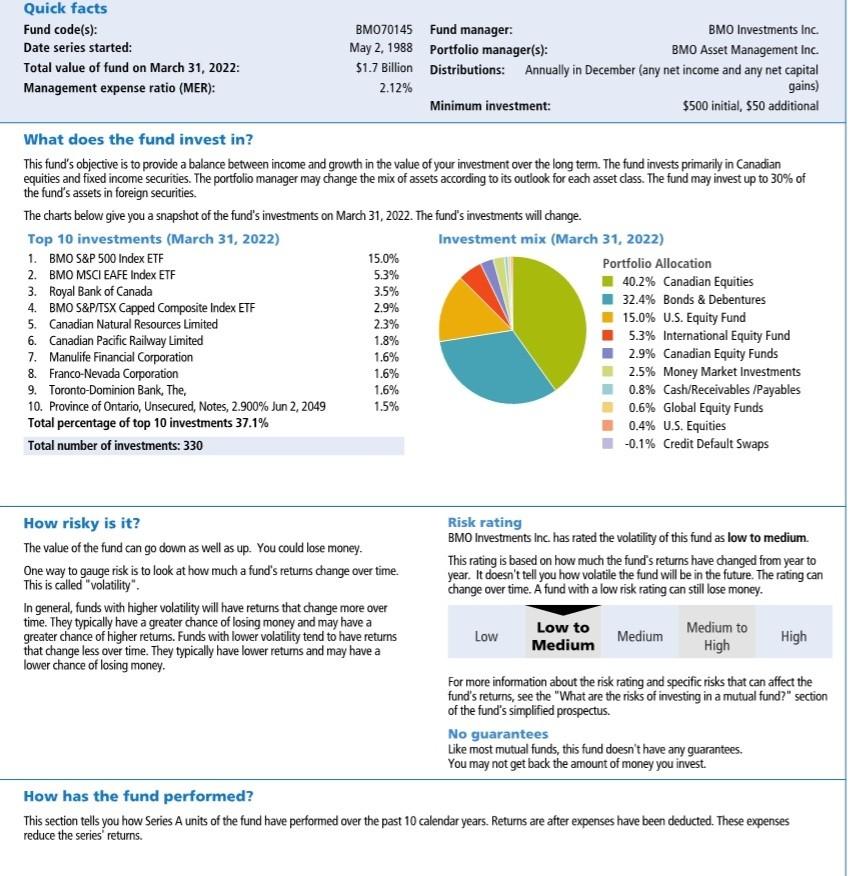

his document contains key information you should know about BMO Tactical Dividend ETF Fund. You can find more details in the fund's simplified prospectus. Ask your epresentative for a copy, contact BMO Investments Inc. at 1-800-665-7700 or mutualfunds@bmo.com or visit www.bmo.com/gam/ca/advisorflegal-and-regulatory. efore you invest in any fund, you should consider how it would work with your other investments and your tolerance for risk. What does the fund invest in? This fund's objective is to provide long term capital growth and current income by investing primarily in a diversified portfolio of exchange traded funds that invest in income producing securities. The fund's asset mix may be changed over time to reflect the portfolio manager's outlook for each asset class. The fund may invest up to 100% of the fund's assets in foreign securities. The charts below give you a snapshot of the fund's investments on March 31, 2022. The fund's investments will change. Investment mix (March 31, 2022) Portfolio Allocation 53.6% International Equity Funds 24.1% Emerging Markets Equity Funds 20.6% U.S. Equity Fund 1.7% Cash/Receivables/Payables 1.4% Put Options 1.4% Call Option How risky is it? Risk rating BMO Investments inc. has rated the volatility of this fund as low to medium. The value of the fund can go down as well as up. You could lose money. One way to gauge risk is to look at how much a fund's retums change over time._. This rating is based on how much the fund's returns have changed from year to year. It doesn't tell you how volatile the fund will be in the future. The rating can This is called "volatility". change over time. A fund with a low risk rating can still lose money. In general, funds with higher volatility will have returns that change more over time. They typically have a greater chance of losing money and may have a greater chance of higher returns. Funds with lower volatility tend to have returns that change less over time. They typically have lower returns and may have a lower chance of losing money. For more information about the risk rating and specific risks that can affect the fund's retums, see the "What are the risks of investing in a mutual fund?" section of the fund's simplified prospectus. No guarantees Like most mutual funds, this fund doesn't have any guarantees. You may not get back the amount of money you invest. How has the fund performed? This section tells you how Series A units of the fund have performed over the past 8 calendar years. Returns are after expenses have been deducted. These expenses reduce the series' returns. What does the fund invest in? This fund's objective is to provide a balance between income and growth in the value of your investment over the long term. The fund invests primarily in Canadian equities and fixed income securities. The portfolio manager may change the mix of assets according to its outlook for each asset class. The fund may invest up to 30% of the fund's assets in foreign securities. The charts below give you a snapshot of the fund's investments on March 31, 2022. The fund's investments will change. Investment mix (March 31, 2022) Portfolio Allocation 40.2% Canadian Equities 32.4% Bonds \& Debentures 15.0% U.S. Equity Fund 5.3\% International Equity Fund 2.9\% Canadian Equity Funds 2.5\% Money Market Investments 0.8% Cash/Receivables /Payables 0.6% Global Equity Funds 0.4% U.S. Equities 0.1% Credit Default Swaps How risky is it? Risk rating BMO Investments Inc. has rated the volatility of this fund as low to medium. The value of the fund can go down as well as up. You could lose money. One way to gauge risk is to look at how much a fund's returns change over time. This rating is based on how much the fund's returns have changed from year to year. It doesn't tell you how volatile the fund will be in the future. The rating can This is called "volatility". In general, funds with higher volatility will have returns that change more over time. They typically have a greater chance of losing money and may have a greater chance of higher retums. Funds with lower volatility tend to have returns that change less over time. They typically have lower returns and may have a lower chance of losing money. For more information about the risk rating and specific risks that can affect the fund's returns, see the "What are the risks of investing in a mutual fund?" section of the fund's simplified prospectus. No guarantees Like most mutual funds, this fund doesn't have any guarantees. You may not get back the amount of money you invest. How has the fund performed? This section tells you how Series A units of the fund have performed over the past 10 calendar years. Returns are after expenses have been deducted. These expenses reduce the series' returns. his document contains key information you should know about BMO Tactical Dividend ETF Fund. You can find more details in the fund's simplified prospectus. Ask your epresentative for a copy, contact BMO Investments Inc. at 1-800-665-7700 or mutualfunds@bmo.com or visit www.bmo.com/gam/ca/advisorflegal-and-regulatory. efore you invest in any fund, you should consider how it would work with your other investments and your tolerance for risk. What does the fund invest in? This fund's objective is to provide long term capital growth and current income by investing primarily in a diversified portfolio of exchange traded funds that invest in income producing securities. The fund's asset mix may be changed over time to reflect the portfolio manager's outlook for each asset class. The fund may invest up to 100% of the fund's assets in foreign securities. The charts below give you a snapshot of the fund's investments on March 31, 2022. The fund's investments will change. Investment mix (March 31, 2022) Portfolio Allocation 53.6% International Equity Funds 24.1% Emerging Markets Equity Funds 20.6% U.S. Equity Fund 1.7% Cash/Receivables/Payables 1.4% Put Options 1.4% Call Option How risky is it? Risk rating BMO Investments inc. has rated the volatility of this fund as low to medium. The value of the fund can go down as well as up. You could lose money. One way to gauge risk is to look at how much a fund's retums change over time._. This rating is based on how much the fund's returns have changed from year to year. It doesn't tell you how volatile the fund will be in the future. The rating can This is called "volatility". change over time. A fund with a low risk rating can still lose money. In general, funds with higher volatility will have returns that change more over time. They typically have a greater chance of losing money and may have a greater chance of higher returns. Funds with lower volatility tend to have returns that change less over time. They typically have lower returns and may have a lower chance of losing money. For more information about the risk rating and specific risks that can affect the fund's retums, see the "What are the risks of investing in a mutual fund?" section of the fund's simplified prospectus. No guarantees Like most mutual funds, this fund doesn't have any guarantees. You may not get back the amount of money you invest. How has the fund performed? This section tells you how Series A units of the fund have performed over the past 8 calendar years. Returns are after expenses have been deducted. These expenses reduce the series' returns. What does the fund invest in? This fund's objective is to provide a balance between income and growth in the value of your investment over the long term. The fund invests primarily in Canadian equities and fixed income securities. The portfolio manager may change the mix of assets according to its outlook for each asset class. The fund may invest up to 30% of the fund's assets in foreign securities. The charts below give you a snapshot of the fund's investments on March 31, 2022. The fund's investments will change. Investment mix (March 31, 2022) Portfolio Allocation 40.2% Canadian Equities 32.4% Bonds \& Debentures 15.0% U.S. Equity Fund 5.3\% International Equity Fund 2.9\% Canadian Equity Funds 2.5\% Money Market Investments 0.8% Cash/Receivables /Payables 0.6% Global Equity Funds 0.4% U.S. Equities 0.1% Credit Default Swaps How risky is it? Risk rating BMO Investments Inc. has rated the volatility of this fund as low to medium. The value of the fund can go down as well as up. You could lose money. One way to gauge risk is to look at how much a fund's returns change over time. This rating is based on how much the fund's returns have changed from year to year. It doesn't tell you how volatile the fund will be in the future. The rating can This is called "volatility". In general, funds with higher volatility will have returns that change more over time. They typically have a greater chance of losing money and may have a greater chance of higher retums. Funds with lower volatility tend to have returns that change less over time. They typically have lower returns and may have a lower chance of losing money. For more information about the risk rating and specific risks that can affect the fund's returns, see the "What are the risks of investing in a mutual fund?" section of the fund's simplified prospectus. No guarantees Like most mutual funds, this fund doesn't have any guarantees. You may not get back the amount of money you invest. How has the fund performed? This section tells you how Series A units of the fund have performed over the past 10 calendar years. Returns are after expenses have been deducted. These expenses reduce the series' returnsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started