Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. explain why, the FIRST transaction in YELLOW, do not need an adjustment. 2. explain why, the SECOND transaction in YELLOW needs an adjustment and

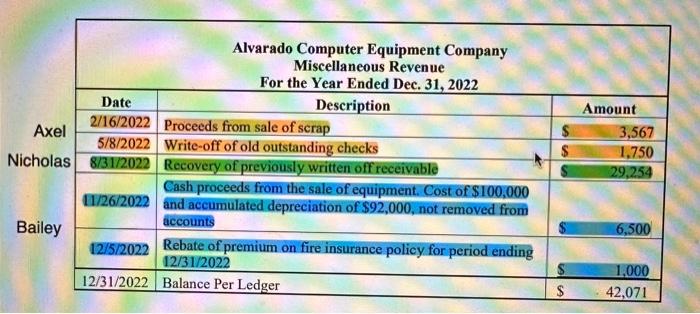

1. explain why, the FIRST transaction in YELLOW, do not need an adjustment.

2. explain why, the SECOND transaction in YELLOW needs an adjustment and how the corrected journal entry would look like.

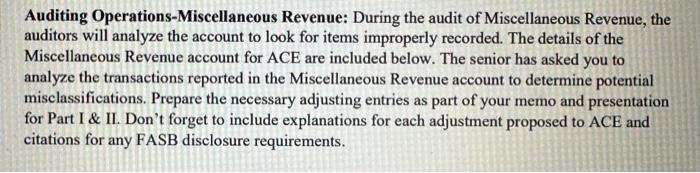

Auditing Operations-Miscellaneous Revenue: During the audit of Miscellaneous Revenue, the auditors will analyze the account to look for items improperly recorded. The details of the Miscellaneous Revenue account for ACE are included below. The senior has asked you to analyze the transactions reported in the Miscellaneous Revenue account to determine potential misclassifications. Prepare the necessary adjusting entries as part of your memo and presentation for Part I & II. Don't forget to include explanations for each adjustment proposed to ACE and citations for any FASB disclosure requirements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started