Question: 1. Express the balance sheets in common-size percents. 2. Assuming annual sales have not changed in the last three years, is the change in

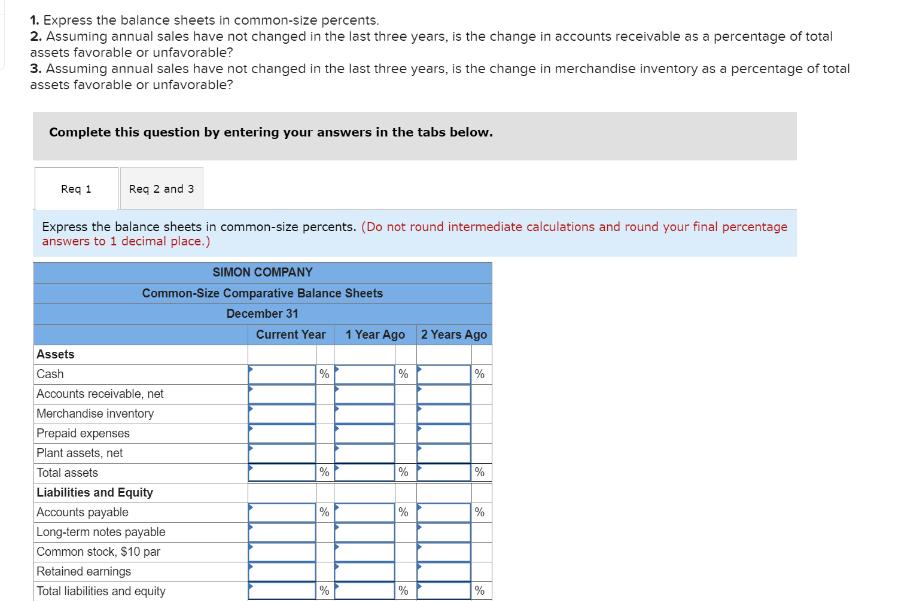

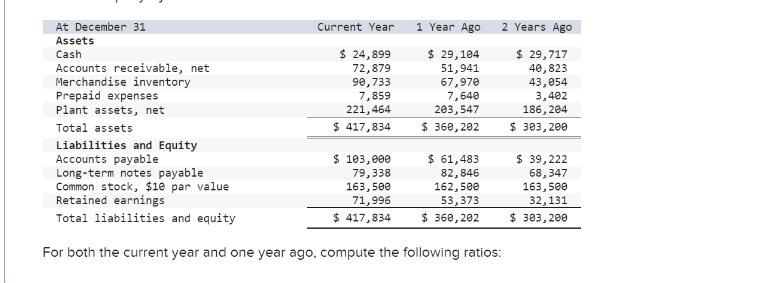

1. Express the balance sheets in common-size percents. 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Req 1 Reg 2 and 3 Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) SIMON COMPANY Common-Size Comparative Balance Sheets December 31 Current Year 1 Year Ago 2 Years Ago Assets Cash % Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets % % Liabilities and Equity Accounts payable % Long-term notes payable Common stock, $10 par Retained earnings Total liabilities and equity At December 31 Current Year 1 Year Ago 2 Years Ago Assets $ 24, 899 $ 29,104 51,941 67,970 7,640 203,547 $ 29,717 40,823 43,054 3,402 186, 204 Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net 72,879 90,733 7,859 221,464 Total assets $ 417,834 $ 360, 202 $ 303, 200 Liabilities and Equity Accounts payable Long-term notes payable Common stock, $1e par value Retained earnings Total liabilities and equity $ 103,000 79,338 $ 39,222 $ 61,483 82,846 162,500 53,373 68,347 163, 500 163,500 71,996 $ 417,834 32,131 $ 360, 202 $ 303, 200 For both the current year and one year ago, compute the following ratios:

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts