Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Fill in the blanks (type your answers only, no need to type the questions) (14 points in total) a. Securities with maturity less than

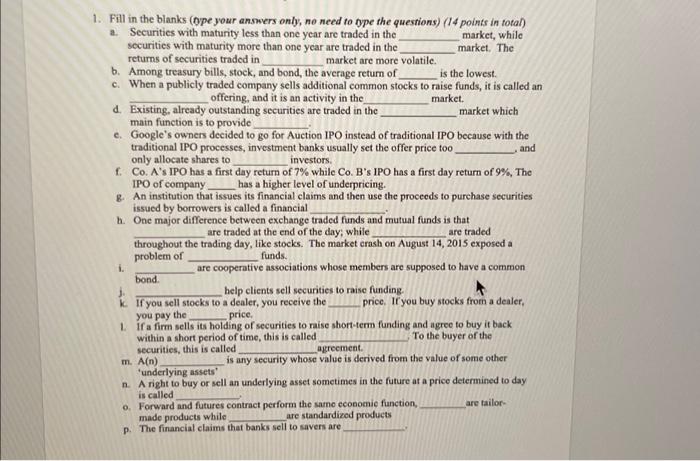

1. Fill in the blanks (type your answers only, no need to type the questions) (14 points in total) a. Securities with maturity less than one year are traded in the securities with maturity more than one year are traded in the returns of securities traded in market, while market. The b. Among treasury bills, stock, and bond, the average return of is the lowest. c. When a publicly traded company sells additional common stocks to raise funds, it is called an market. offering, and it is an activity in the d. Existing, already outstanding securities are traded in the main function is to provide e. market are more volatile. i. f. Co. A's IPO has a first day return of 7% while Co. B's IPO has a first day return of 9%, The IPO of company. has a higher level of underpricing. g. An institution that issues its financial claims and then use the proceeds to purchase securities issued by borrowers is called a financial h. One major difference between exchange traded funds and mutual funds is that are traded at the end of the day; while are traded throughout the trading day, like stocks. The market crash on August 14, 2015 exposed a problem of funds. are cooperative associations whose members are supposed to have a common j. Google's owners decided to go for Auction IPO instead of traditional IPO because with the traditional IPO processes, investment banks usually set the offer price too and only allocate shares to investors. k. market which bond. help clients sell securities to raise funding. If you sell stocks to a dealer, you receive the you pay the price. 1. If a firm sells its holding of securities to raise short-term funding and agree to buy it back within a short period of time, this is called To the buyer of the securities, this is called m. A(n) price. If you buy stocks from a dealer, agreement. is any security whose value is derived from the value of some other "underlying assets' n. A right to buy or sell an underlying asset sometimes in the future at a price determined to day is called o. Forward and futures contract perform the same economic function, made products while are standardized products p. The financial claims that banks sell to savers are are tailor-

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started