Question

1. Financial management involves decisions about which of the following: A. Which projects to fund. B. How to minimize taxation. C. What type of capital

1. Financial management involves decisions about which of the following:

A. Which projects to fund.

B. How to minimize taxation.

C. What type of capital should be raised.

D. All of these.

E. Only A and C above.

2. When determining a form of business organization in the U.S., all of the following are considered EXCEPT:

A. Who owns the firm.

B. What are the owners' risks.

C. What are the tax ramifications.

D. The physical location of the business.

E. None of the above.

3. The practice generally known as double taxation is due to

A. shareholders' dividends being taxed at both the federal and state levels.

B. corporate income being taxed at both the federal and state levels.

C. both A and B above.

D. corporate incomes being taxed at the corporate level, then again at the shareholder level when corporate profits are paid out as dividends.

E. None of the above

4. For corporations, maximizing the value of owner's equity can also be stated as

A. maximizing retained earnings.

B. maximizing earnings per share.

C. maximizing net income.

D. maximizing revenue

E. maximizing the stock price.

5. If a company reports a large amount of net income on its income statement during a year, the firm will have

A. positive cash flow.

B. negative cash flow.

C. zero cash flow.

D. any of these scenarios are possible.

6. Income Statement Barnyard, Inc.'s 2008 income statement lists the following income and expenses: EBIT = $500,000, Interest expense = $50,000, and Net income = $315,000. What is the 2008 Taxes reported on the income statement?

A. $135,000

B. $450,000

C. $495,000

D. There is not enough information to calculate 2008 Taxes.

7. Balance Sheet You are evaluating the balance sheet for Cypress Corporation. From the balance sheet you find the following balances: Cash and marketable securities = $600,000, Accounts receivable = $800,000, Inventory = $500,000, Accrued wages and taxes = $50,000, Accounts payable = $200,000, and Notes payable = $1,000,000. What is Cypress's net working capital?

A. $152,000

B. $650,000

C. $1,900,000

D. $3,150,000

8. Which of these statements is true?

A. In general, the lower the total asset turnover and the lower the capital intensity ratio, the more efficient the overall asset management of the firm will be.

B. In general, the lower the total asset turnover and the higher the capital intensity ratio, the more efficient the overall asset management of the firm will be.

C. In general, the higher the total asset turnover and the lower the capital intensity ratio, the more efficient the overall asset management of the firm will be.

D. In general, the higher the total asset turnover and the higher the capital intensity ratio, the more efficient the overall asset management of the firm will be.

E. None of the above.

9. DuPont Analysis You observe that a firms profit margin is below the industry average, its debt ratio is below the industry average, and its return on equity exceeds the industry average. What can you conclude?

A. Return on assets is above the industry average.

B. Total assets turnover is above the industry average.

C. Total assets turnover is below the industry average.

D. Both statements a and b are correct.

E. None of the statements above is correct.

10. Internal Growth Rate Leash N Collar reported a profit margin of 8%, total asset turnover ratio of 1.5 times, debt-to-equity ratio of 0.75 times, net income of $400,000, and dividends paid to common stockholders of $200,000. The firm has no preferred stock outstanding. What is Leash N Collar's internal growth rate?

A. 5.2632%

B. 7.3333%

C. 8.6956%

D. 6.383%

E. 9.1477%

11. Solving for Rates What annual rate of return is earned on a $5,000 investment when it grows to $7,000 in six years? Assuming annual compounding.

A. 1.40%

B. 5.45%

C. 5.77%

D. 4.00%

E. 6.53%

12. Solving for Time How many years will it take $100 to grow to $1,000 with an annual interest rate of 8 percent? Assuming annual compounding.

A. 9.00 years

B. 10.00 years

C. 29.92 years

D. 33.35 years

E. 44.68 years

Part II

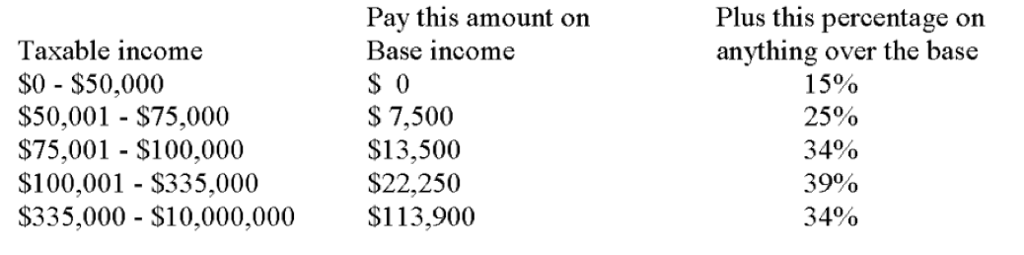

1. Corporate Taxes Landscaping, Inc. is concerned about the taxes paid by the company in 2008. In addition to $250,000 of taxable income, the firm received $1,000 of interest on state-issued bonds and $6,000 of dividends on common stock it owns in Sprinklers, Inc. Using the tax schedule from Table 2-3, what is Scuba's tax liability, average tax rate, and marginal tax rate, respectively?

2. DuPont Analysis and sustainable growth rate You have located the following information on Rock Company: debt ratio = 40%, capital intensity ratio = 2.25 times, profit margin = 8%, and dividend payout ratio = 25%.

a. What is the return on equity for Rock?

b. What is the sustainable growth rate for Rock?

3. Future Value At age 20 you invest $1,000 that earns 7 percent each year. At age 30 you invest $1,000 that earns 10 percent per year. In which case would you have more money at age 60?

4.Annuity due As a young graduate, you have plans on buying your dream car in three years. You believe the car will cost $50,000. You have two sources of money to reach your goal of $50,000. First, you will save money for the next three years in a money market fund that will return 8% annually. You plan on making $5,000 annual payments to this fund. You will make yearly investments at the BEGINNING of the year. The second source of money will be a car loan that you will take out on the day you buy the car. You anticipate the car dealer to offer you a 6% APR loan with monthly compounding for a term of 60 months, the car loan is repaid at the beginning of each month.

a.What is the future value of your savings in three years?

c.What will be your monthly car loan repayment?

5. Effective Annual Rate John Smith has shopped around for the best interest rates for his investment of $10,000 over the next year. He has found the following:

| Stated Rate | Compounding |

| 5.00% | Semi Annual |

| 4.95% | Quarterly |

| 4.90% | Monthly |

Calculate the effective annual rate for each investment option decide which one to choose.

6. Moving Cash Flow You are scheduled to receive a $800 cash flow in one year, a $950 cash flow in two years, and pay a $1,000 payment in three years. If interest rates are 8 percent per year, what is the combined present value of these cash flows?

Plus this percentage on anything over the base Taxable income $0 $50,000 $50,001 - $75,000 $75,001 - $100,000 $100,001 - S335,000 $335,000 - $10,000,000 Pav this amount on Base income S 0 $ 7,500 $13,500 $22,250 S113,900 15% 25% 34% 3990 34%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started