Answered step by step

Verified Expert Solution

Question

1 Approved Answer

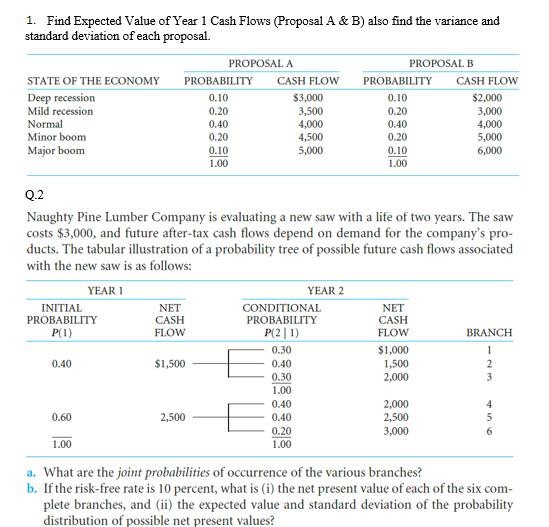

1. Find Expected Value of Year 1 Cash Flows (Proposal A & B) also find the variance and standard deviation of each proposal. PROPOSAL

1. Find Expected Value of Year 1 Cash Flows (Proposal A & B) also find the variance and standard deviation of each proposal. PROPOSAL A PROPOSAL B STATE OF THE ECONOMY PROBABILITY CASH FLOW PROBABILITY CASH FLOW Deep recession Mild recession 0.10 $3,000 3,500 4,000 4,500 5,000 0.10 $2,000 0.20 0.20 3,000 4,000 5,000 Normal 0.40 0.40 Minor boom 0.20 0.20 Major boom 0.10 0.10 1.00 6,000 1.00 Q.2 Naughty Pine Lumber Company is evaluating a new saw with a life of two years. The saw costs $3,000, and future after-tax cash flows depend on demand for the company's pro- ducts. The tabular illustration of a probability tree of possible future cash flows associated with the new saw is as follows: YEAR 1 YEAR 2 INITIAL PROBABILITY NET CASH CONDITIONAL PROBABILITY NET CASH P(2 | 1) P(1) FLOW FLOW BRANCH 0.30 $1,000 1 0.40 $1,500 0.40 1,500 2,000 2 0.30 3 1.00 0.40 2,000 2,500 4 0.60 2,500 0.40 0.20 3,000 6. 1.00 1.00 a. What are the joint probabilities of occurrence of the various branches? b. If the risk-free rate is 10 percent, what is (i) the net present value of each of the six com- plete branches, and (ii) the expected value and standard deviation of the probability distribution of possible net present values?

Step by Step Solution

★★★★★

3.28 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

feaposalA CF Boobability Experted value Variance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started