1. Find the net present value of an income stream which has a negative flow of $1000 per year for three years, a positive

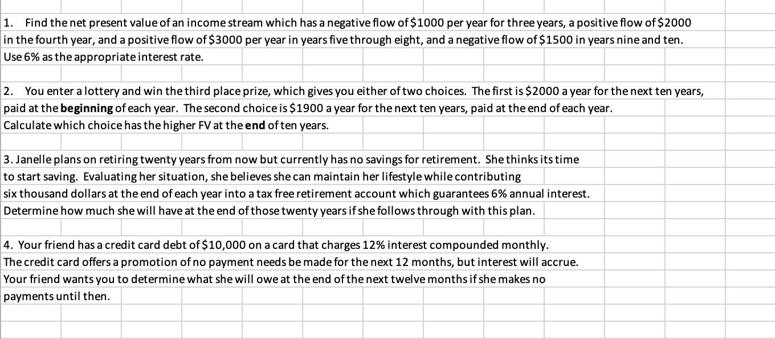

1. Find the net present value of an income stream which has a negative flow of $1000 per year for three years, a positive flow of $2000 in the fourth year, and a positive flow of $3000 per year in years five through eight, and a negative flow of $1500 in years nine and ten. Use 6% as the appropriate interest rate. 2. You enter a lottery and win the third place prize, which gives you either of two choices. The first is $2000 a year for the next ten years, paid at the beginning of each year. The second choice is $1900 a year for the next ten years, paid at the end of each year. Calculate which choice has the higher FV at the end of ten years. 3. Janelle plans on retiring twenty years from now but currently has no savings for retirement. She thinks its time to start saving. Evaluating her situation, she believes she can maintain her lifestyle while contributing six thousand dollars at the end of each year into a tax free retirement account which guarantees 6% annual interest. Determine how much she will have at the end of those twenty years if she follows through with this plan. 4. Your friend has a credit card debt of $10,000 on a card that charges 12% interest compounded monthly. The credit card offers a promotion of no payment needs be made for the next 12 months, but interest will accrue. Your friend wants you to determine what she will owe at the end of the next twelve months if she makes no payments until then.

Step by Step Solution

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Lets solve each of these financial problems step by step Problem 1 Net Present Value NPV To find the Net Present Value NPV of this income stream well ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started