Question

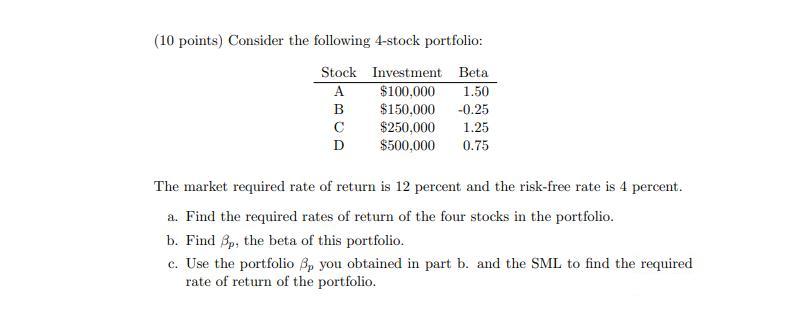

(10 points) Consider the following 4-stock portfolio: Stock Investment Beta $100,000 1.50 $150,000 -0.25 $250,000 1.25 $500,000 0.75 A B C D The market

(10 points) Consider the following 4-stock portfolio: Stock Investment Beta $100,000 1.50 $150,000 -0.25 $250,000 1.25 $500,000 0.75 A B C D The market required rate of return is 12 percent and the risk-free rate is 4 percent. a. Find the required rates of return of the four stocks in the portfolio. b. Find 3p, the beta of this portfolio. c. Use the portfolio 3, you obtained in part b. and the SML to find the required rate of return of the portfolio.

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Applied Linear Algebra

Authors: Peter J. Olver, Cheri Shakiban

1st edition

131473824, 978-0131473829

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App