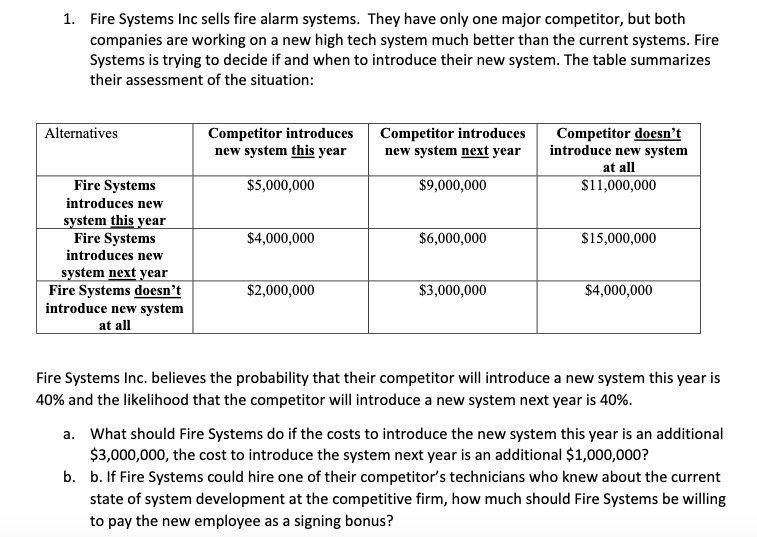

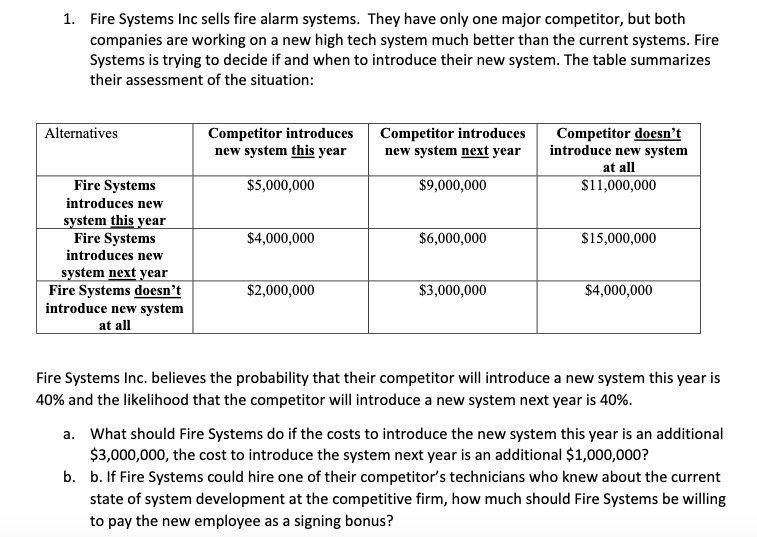

1. Fire Systems Inc sells fire alarm systems. They have only one major competitor, but both companies are working on a new high tech system much better than the current systems. Fire Systems is trying to decide if and when to introduce their new system. The table summarizes their assessment of the situation: Alternatives Competitor introduces new system this year Competitor introduces new system next year Competitor doesn't introduce new system at all $11,000,000 $5,000,000 $9,000,000 $4,000,000 $6,000,000 $15,000,000 Fire Systems introduces new system this year Fire Systems introduces new system next year Fire Systems doesn't introduce new system at all $2,000,000 $3,000,000 $4,000,000 Fire Systems Inc. believes the probability that their competitor will introduce a new system this year is 40% and the likelihood that the competitor will introduce a new system next year is 40%. a. What should Fire Systems do if the costs to introduce the new system this year is an additional $3,000,000, the cost to introduce the system next year is an additional $1,000,000? b. b. If Fire Systems could hire one of their competitor's technicians who knew about the current state of system development at the competitive firm, how much should Fire Systems be willing to pay the new employee as a signing bonus? 1. Fire Systems Inc sells fire alarm systems. They have only one major competitor, but both companies are working on a new high tech system much better than the current systems. Fire Systems is trying to decide if and when to introduce their new system. The table summarizes their assessment of the situation: Alternatives Competitor introduces new system this year Competitor introduces new system next year Competitor doesn't introduce new system at all $11,000,000 $5,000,000 $9,000,000 $4,000,000 $6,000,000 $15,000,000 Fire Systems introduces new system this year Fire Systems introduces new system next year Fire Systems doesn't introduce new system at all $2,000,000 $3,000,000 $4,000,000 Fire Systems Inc. believes the probability that their competitor will introduce a new system this year is 40% and the likelihood that the competitor will introduce a new system next year is 40%. a. What should Fire Systems do if the costs to introduce the new system this year is an additional $3,000,000, the cost to introduce the system next year is an additional $1,000,000? b. b. If Fire Systems could hire one of their competitor's technicians who knew about the current state of system development at the competitive firm, how much should Fire Systems be willing to pay the new employee as a signing bonus