Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Firms generally choose to finance temporary current assets with short-term debt because a. matching the maturities of assets and liabilities reduces risk under some

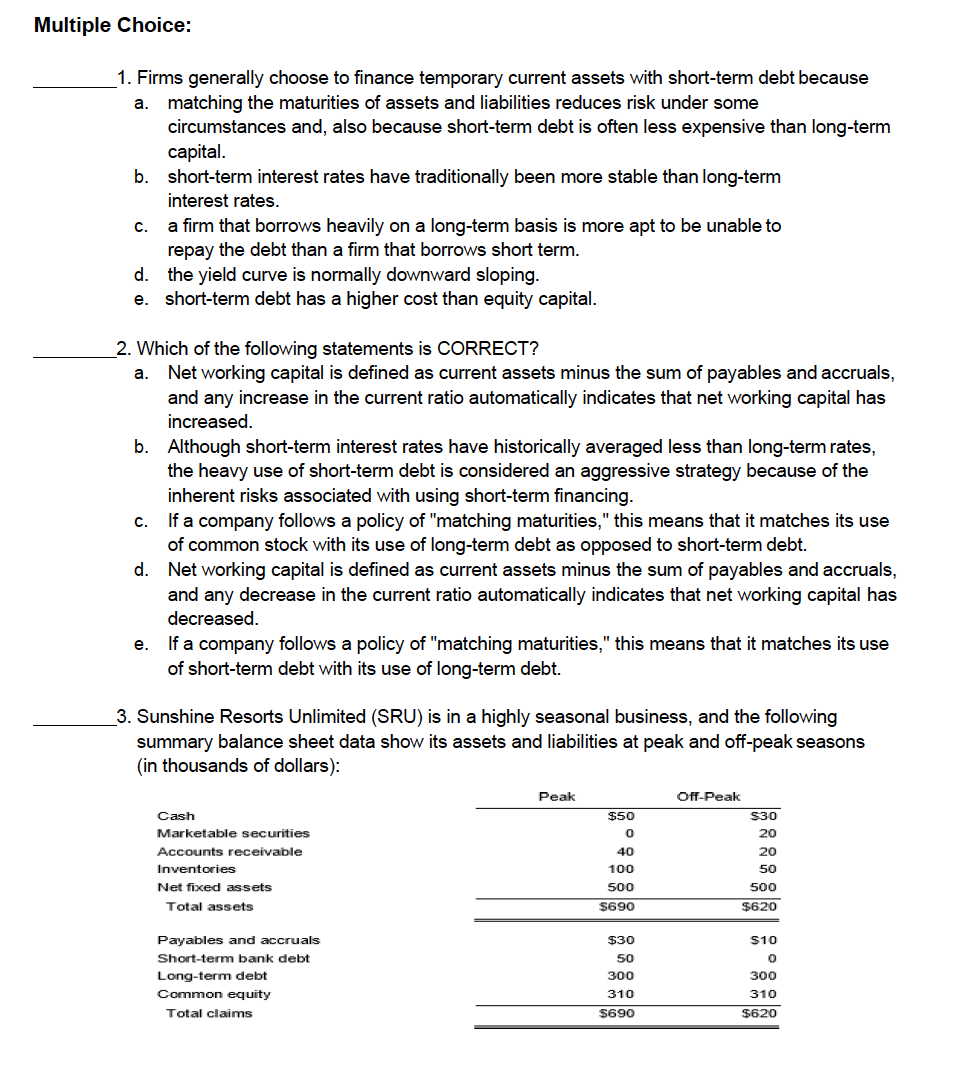

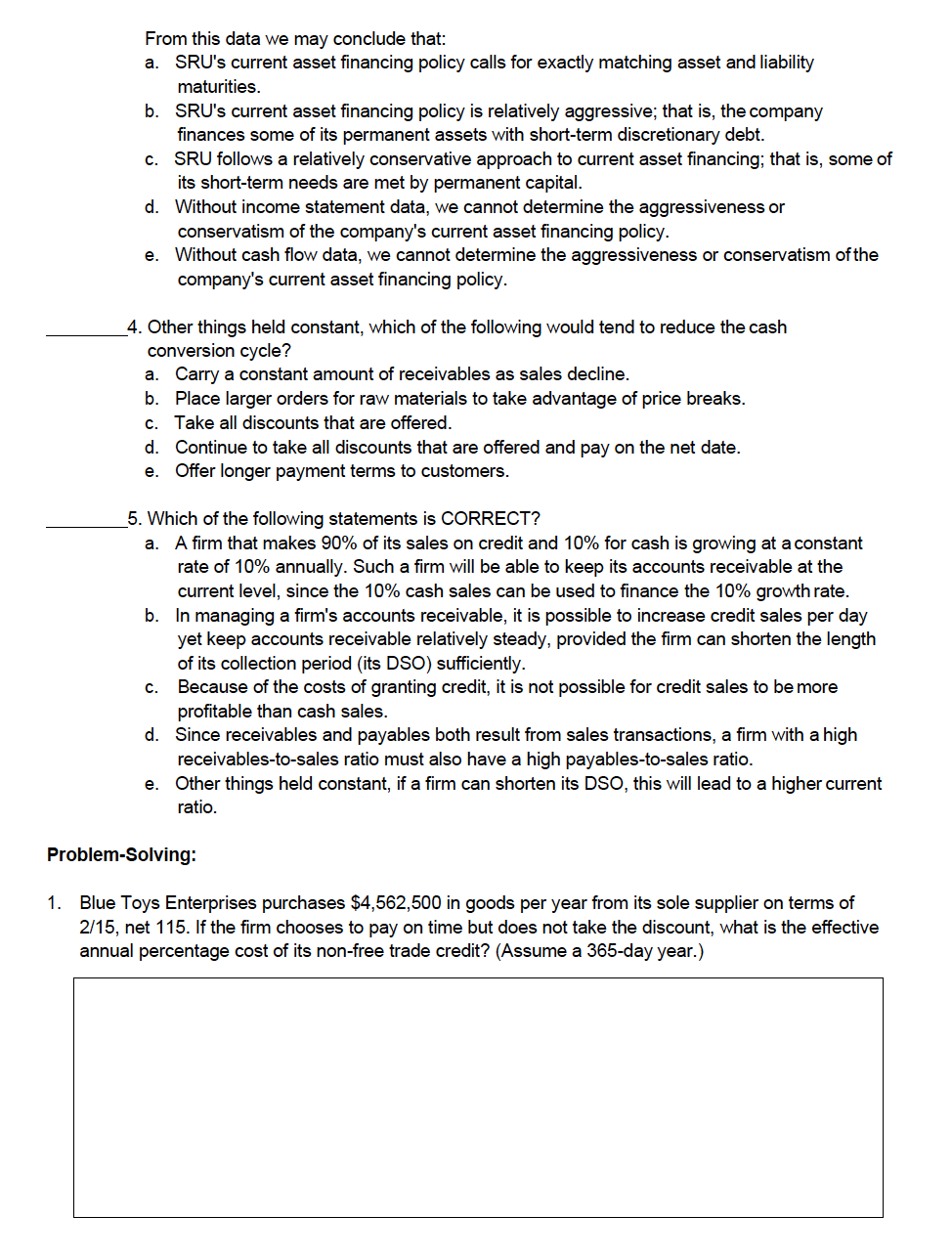

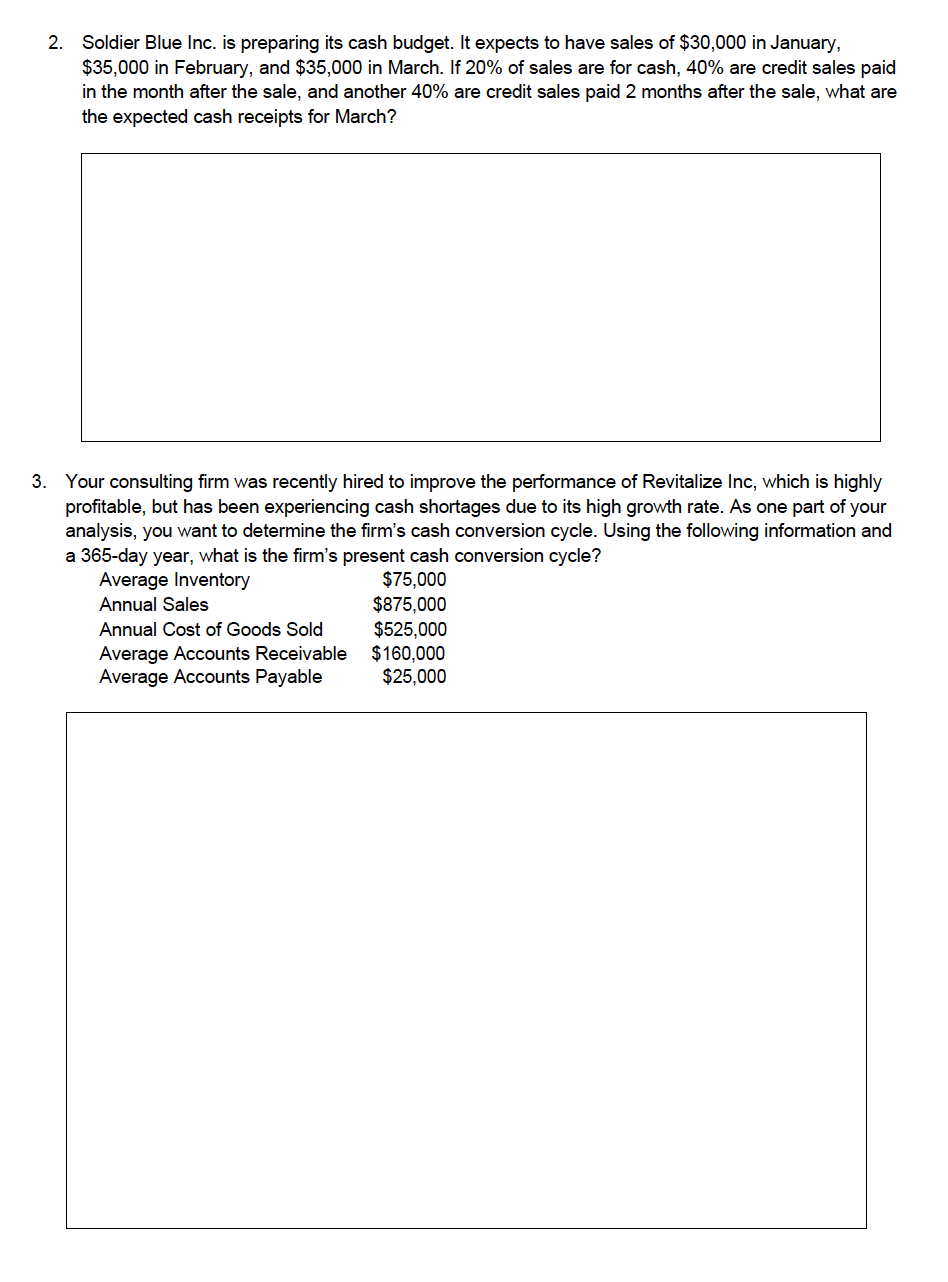

1. Firms generally choose to finance temporary current assets with short-term debt because a. matching the maturities of assets and liabilities reduces risk under some circumstances and, also because short-term debt is often less expensive than long-term capital. b. short-term interest rates have traditionally been more stable than long-term interest rates. c. a firm that borrows heavily on a long-term basis is more apt to be unable to repay the debt than a firm that borrows short term. d. the yield curve is normally downward sloping. e. short-term debt has a higher cost than equity capital. 2. Which of the following statements is CORRECT? a. Net working capital is defined as current assets minus the sum of payables and accruals, and any increase in the current ratio automatically indicates that net working capital has increased. b. Although short-term interest rates have historically averaged less than long-term rates, the heavy use of short-term debt is considered an aggressive strategy because of the inherent risks associated with using short-term financing. c. If a company follows a policy of "matching maturities," this means that it matches its use of common stock with its use of long-term debt as opposed to short-term debt. d. Net working capital is defined as current assets minus the sum of payables and accruals, and any decrease in the current ratio automatically indicates that net working capital has decreased. e. If a company follows a policy of "matching maturities," this means that it matches its use of short-term debt with its use of long-term debt. 3. Sunshine Resorts Unlimited (SRU) is in a highly seasonal business, and the following summary balance sheet data show its assets and liabilities at peak and off-peak seasons (in thousands of dollars): From this data we may conclude that: a. SRU's current asset financing policy calls for exactly matching asset and liability maturities. b. SRU's current asset financing policy is relatively aggressive; that is, the company finances some of its permanent assets with short-term discretionary debt. c. SRU follows a relatively conservative approach to current asset financing; that is, some of its short-term needs are met by permanent capital. d. Without income statement data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy. e. Without cash flow data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy. 4. Other things held constant, which of the following would tend to reduce the cash conversion cycle? a. Carry a constant amount of receivables as sales decline. b. Place larger orders for raw materials to take advantage of price breaks. c. Take all discounts that are offered. d. Continue to take all discounts that are offered and pay on the net date. e. Offer longer payment terms to customers. 5. Which of the following statements is CORRECT? a. A firm that makes 90% of its sales on credit and 10% for cash is growing at a constant rate of 10% annually. Such a firm will be able to keep its accounts receivable at the current level, since the 10% cash sales can be used to finance the 10% growth rate. b. In managing a firm's accounts receivable, it is possible to increase credit sales per day yet keep accounts receivable relatively steady, provided the firm can shorten the length of its collection period (its DSO) sufficiently. c. Because of the costs of granting credit, it is not possible for credit sales to be more profitable than cash sales. d. Since receivables and payables both result from sales transactions, a firm with a high receivables-to-sales ratio must also have a high payables-to-sales ratio. e. Other things held constant, if a firm can shorten its DSO, this will lead to a higher current ratio. Problem-Solving: 1. Blue Toys Enterprises purchases $4,562,500 in goods per year from its sole supplier on terms of 2/15, net 115 . If the firm chooses to pay on time but does not take the discount, what is the effective annual percentage cost of its non-free trade credit? (Assume a 365-day year.) 2. Soldier Blue Inc. is preparing its cash budget. It expects to have sales of $30,000 in January, $35,000 in February, and $35,000 in March. If 20% of sales are for cash, 40% are credit sales paid in the month after the sale, and another 40% are credit sales paid 2 months after the sale, what are the expected cash receipts for March? 3. Your consulting firm was recently hired to improve the performance of Revitalize Inc, which is highly profitable, but has been experiencing cash shortages due to its high growth rate. As one part of your analysis, you want to determine the firm's cash conversion cycle. Using the following information and a 365-day year, what is the firm's present cash conversion cycle

1. Firms generally choose to finance temporary current assets with short-term debt because a. matching the maturities of assets and liabilities reduces risk under some circumstances and, also because short-term debt is often less expensive than long-term capital. b. short-term interest rates have traditionally been more stable than long-term interest rates. c. a firm that borrows heavily on a long-term basis is more apt to be unable to repay the debt than a firm that borrows short term. d. the yield curve is normally downward sloping. e. short-term debt has a higher cost than equity capital. 2. Which of the following statements is CORRECT? a. Net working capital is defined as current assets minus the sum of payables and accruals, and any increase in the current ratio automatically indicates that net working capital has increased. b. Although short-term interest rates have historically averaged less than long-term rates, the heavy use of short-term debt is considered an aggressive strategy because of the inherent risks associated with using short-term financing. c. If a company follows a policy of "matching maturities," this means that it matches its use of common stock with its use of long-term debt as opposed to short-term debt. d. Net working capital is defined as current assets minus the sum of payables and accruals, and any decrease in the current ratio automatically indicates that net working capital has decreased. e. If a company follows a policy of "matching maturities," this means that it matches its use of short-term debt with its use of long-term debt. 3. Sunshine Resorts Unlimited (SRU) is in a highly seasonal business, and the following summary balance sheet data show its assets and liabilities at peak and off-peak seasons (in thousands of dollars): From this data we may conclude that: a. SRU's current asset financing policy calls for exactly matching asset and liability maturities. b. SRU's current asset financing policy is relatively aggressive; that is, the company finances some of its permanent assets with short-term discretionary debt. c. SRU follows a relatively conservative approach to current asset financing; that is, some of its short-term needs are met by permanent capital. d. Without income statement data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy. e. Without cash flow data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy. 4. Other things held constant, which of the following would tend to reduce the cash conversion cycle? a. Carry a constant amount of receivables as sales decline. b. Place larger orders for raw materials to take advantage of price breaks. c. Take all discounts that are offered. d. Continue to take all discounts that are offered and pay on the net date. e. Offer longer payment terms to customers. 5. Which of the following statements is CORRECT? a. A firm that makes 90% of its sales on credit and 10% for cash is growing at a constant rate of 10% annually. Such a firm will be able to keep its accounts receivable at the current level, since the 10% cash sales can be used to finance the 10% growth rate. b. In managing a firm's accounts receivable, it is possible to increase credit sales per day yet keep accounts receivable relatively steady, provided the firm can shorten the length of its collection period (its DSO) sufficiently. c. Because of the costs of granting credit, it is not possible for credit sales to be more profitable than cash sales. d. Since receivables and payables both result from sales transactions, a firm with a high receivables-to-sales ratio must also have a high payables-to-sales ratio. e. Other things held constant, if a firm can shorten its DSO, this will lead to a higher current ratio. Problem-Solving: 1. Blue Toys Enterprises purchases $4,562,500 in goods per year from its sole supplier on terms of 2/15, net 115 . If the firm chooses to pay on time but does not take the discount, what is the effective annual percentage cost of its non-free trade credit? (Assume a 365-day year.) 2. Soldier Blue Inc. is preparing its cash budget. It expects to have sales of $30,000 in January, $35,000 in February, and $35,000 in March. If 20% of sales are for cash, 40% are credit sales paid in the month after the sale, and another 40% are credit sales paid 2 months after the sale, what are the expected cash receipts for March? 3. Your consulting firm was recently hired to improve the performance of Revitalize Inc, which is highly profitable, but has been experiencing cash shortages due to its high growth rate. As one part of your analysis, you want to determine the firm's cash conversion cycle. Using the following information and a 365-day year, what is the firm's present cash conversion cycle Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started