Answered step by step

Verified Expert Solution

Question

1 Approved Answer

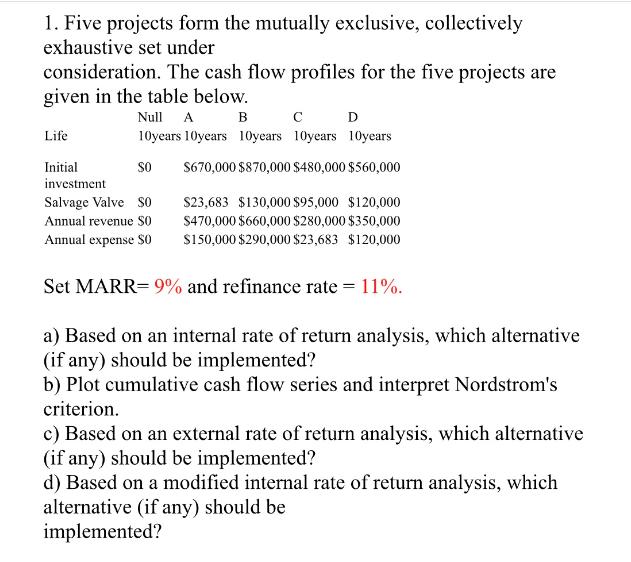

1. Five projects form the mutually exclusive, collectively exhaustive set under consideration. The cash flow profiles for the five projects are given in the

1. Five projects form the mutually exclusive, collectively exhaustive set under consideration. The cash flow profiles for the five projects are given in the table below. Life Null A B D 10years 10years 10years 10years 10years SO $670,000 $870,000 $480,000 $560,000 Initial investment Salvage Valve SO Annual revenue SO Annual expense S0 $23,683 $130,000 $95,000 $120,000 $470,000 $660,000 $280,000 $350,000 $150,000 $290,000 $23,683 $120,000 Set MARR= 9% and refinance rate = 11%. a) Based on an internal rate of return analysis, which alternative (if any) should be implemented? b) Plot cumulative cash flow series and interpret Nordstrom's criterion. c) Based on an external rate of return analysis, which alternative (if any) should be implemented? d) Based on a modified internal rate of return analysis, which alternative (if any) should be implemented?

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Internal Rate of Return analysis Calculate NPV of each project at MARR of 9 Project with highest p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started