Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. (FIXED AMOUNT - calculating the FV) If Clark University tuition is currently $52,000. Assuming annual increases of 4%, what will the tuition cost be

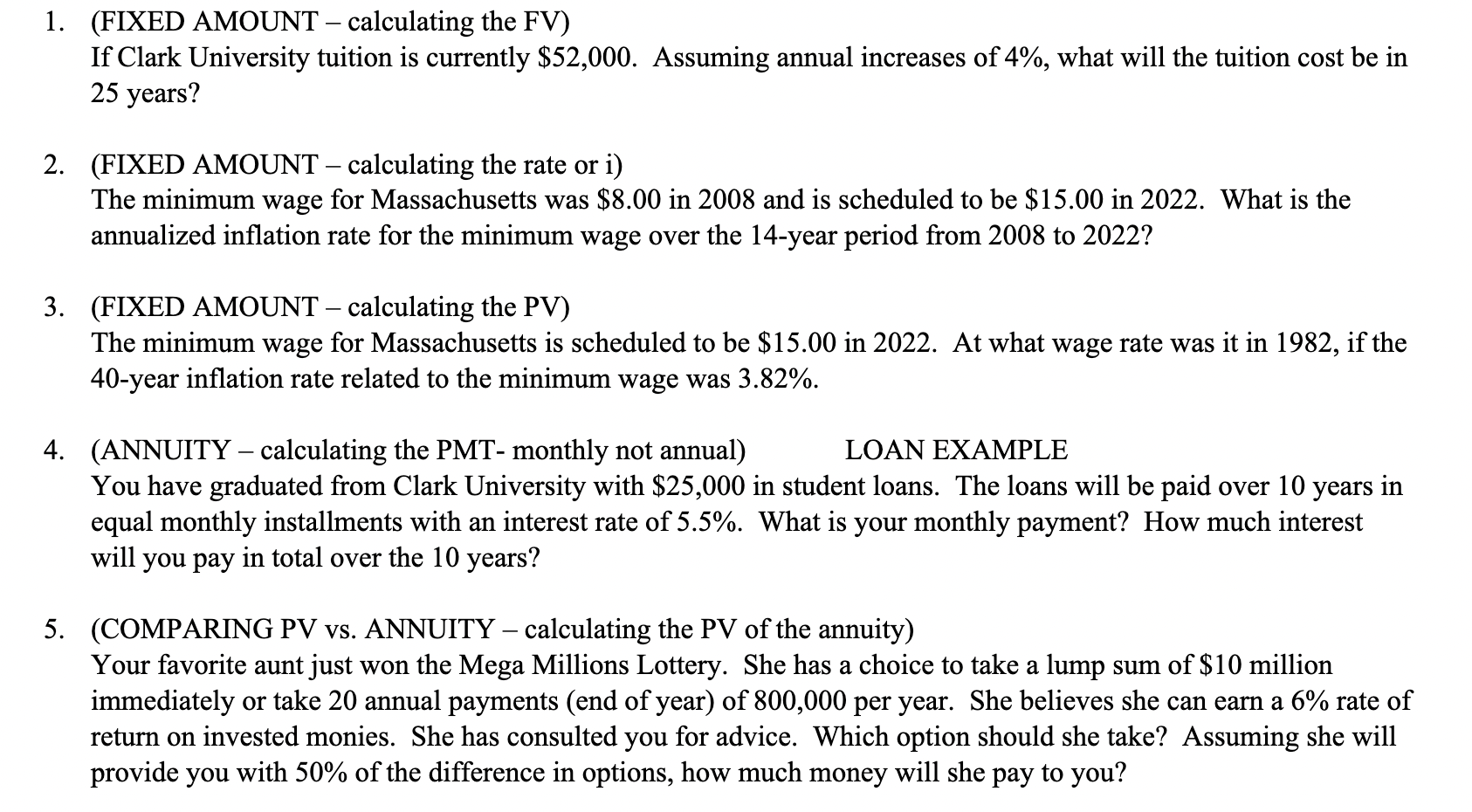

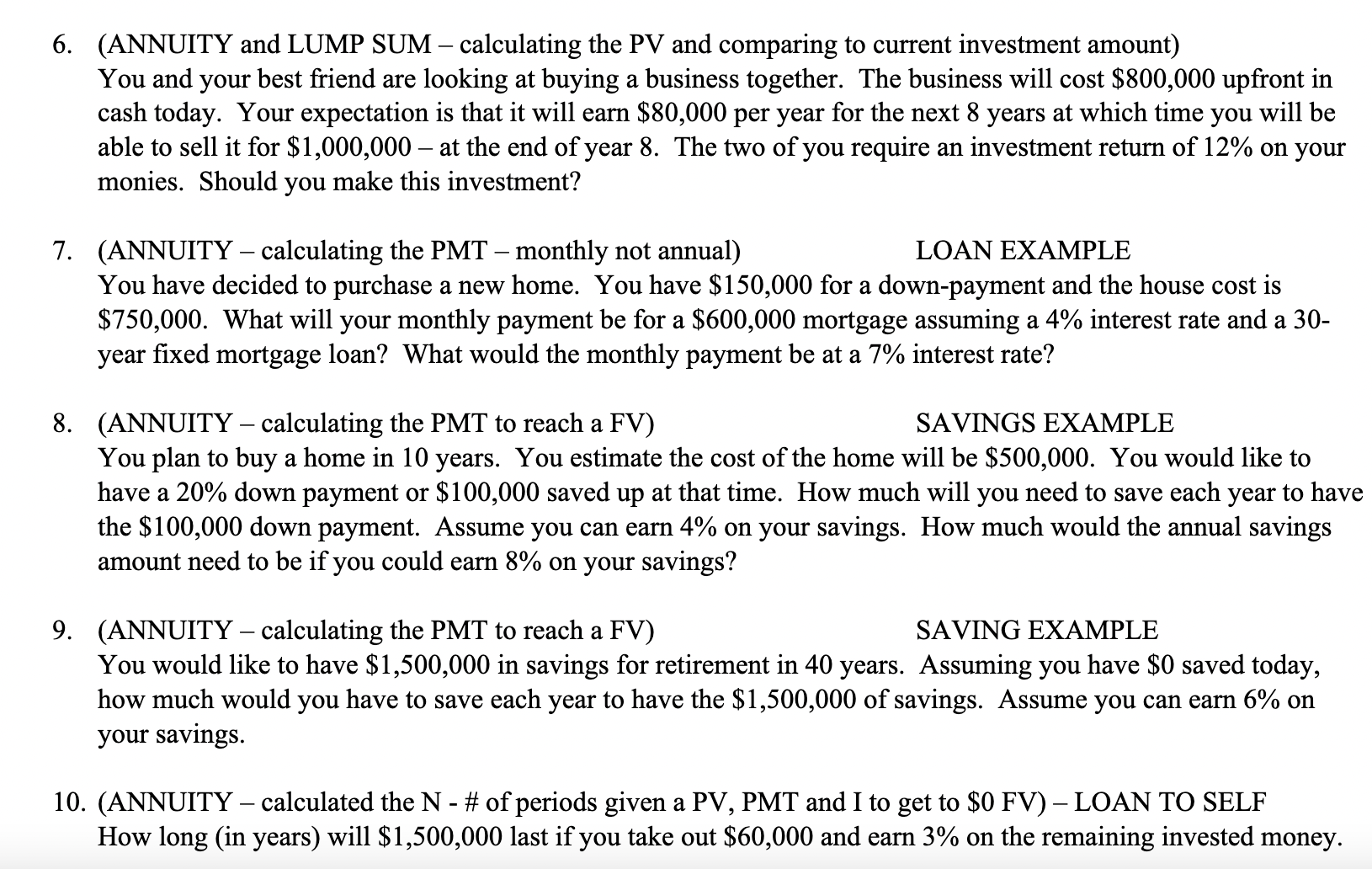

1. (FIXED AMOUNT - calculating the FV) If Clark University tuition is currently $52,000. Assuming annual increases of 4%, what will the tuition cost be in 25 years? 2. (FIXED AMOUNT - calculating the rate or i) The minimum wage for Massachusetts was $8.00 in 2008 and is scheduled to be $15.00 in 2022 . What is the annualized inflation rate for the minimum wage over the 14-year period from 2008 to 2022 ? 3. (FIXED AMOUNT - calculating the PV) The minimum wage for Massachusetts is scheduled to be $15.00 in 2022 . At what wage rate was it in 1982 , if the 40 -year inflation rate related to the minimum wage was 3.82%. 4. (ANNUITY - calculating the PMT- monthly not annual) LOAN EXAMPLE You have graduated from Clark University with $25,000 in student loans. The loans will be paid over 10 years in equal monthly installments with an interest rate of 5.5%. What is your monthly payment? How much interest will you pay in total over the 10 years? 5. (COMPARING PV vs. ANNUITY - calculating the PV of the annuity) Your favorite aunt just won the Mega Millions Lottery. She has a choice to take a lump sum of $10 million immediately or take 20 annual payments (end of year) of 800,000 per year. She believes she can earn a 6% rate of return on invested monies. She has consulted you for advice. Which option should she take? Assuming she will provide you with 50% of the difference in options, how much money will she pay to you? 6. (ANNUITY and LUMP SUM - calculating the PV and comparing to current investment amount) You and your best friend are looking at buying a business together. The business will cost $800,000 upfront in cash today. Your expectation is that it will earn $80,000 per year for the next 8 years at which time you will be able to sell it for $1,000,000 - at the end of year 8 . The two of you require an investment return of 12% on your monies. Should you make this investment? 7. (ANNUITY - calculating the PMT - monthly not annual) LOAN EXAMPLE You have decided to purchase a new home. You have $150,000 for a down-payment and the house cost is $750,000. What will your monthly payment be for a $600,000 mortgage assuming a 4% interest rate and a 30 year fixed mortgage loan? What would the monthly payment be at a 7% interest rate? 8. (ANNUITY - calculating the PMT to reach a FV) SAVINGS EXAMPLE You plan to buy a home in 10 years. You estimate the cost of the home will be $500,000. You would like to have a 20% down payment or $100,000 saved up at that time. How much will you need to save each year to have the $100,000 down payment. Assume you can earn 4% on your savings. How much would the annual savings amount need to be if you could earn 8% on your savings? 9. (ANNUITY - calculating the PMT to reach a FV) SAVING EXAMPLE You would like to have $1,500,000 in savings for retirement in 40 years. Assuming you have $0 saved today, how much would you have to save each year to have the $1,500,000 of savings. Assume you can earn 6% on your savings. 10. (ANNUITY - calculated the N - \# of periods given a PV, PMT and I to get to $0FV ) - LOAN TO SELF How long (in years) will $1,500,000 last if you take out $60,000 and earn 3% on the remaining invested money

1. (FIXED AMOUNT - calculating the FV) If Clark University tuition is currently $52,000. Assuming annual increases of 4%, what will the tuition cost be in 25 years? 2. (FIXED AMOUNT - calculating the rate or i) The minimum wage for Massachusetts was $8.00 in 2008 and is scheduled to be $15.00 in 2022 . What is the annualized inflation rate for the minimum wage over the 14-year period from 2008 to 2022 ? 3. (FIXED AMOUNT - calculating the PV) The minimum wage for Massachusetts is scheduled to be $15.00 in 2022 . At what wage rate was it in 1982 , if the 40 -year inflation rate related to the minimum wage was 3.82%. 4. (ANNUITY - calculating the PMT- monthly not annual) LOAN EXAMPLE You have graduated from Clark University with $25,000 in student loans. The loans will be paid over 10 years in equal monthly installments with an interest rate of 5.5%. What is your monthly payment? How much interest will you pay in total over the 10 years? 5. (COMPARING PV vs. ANNUITY - calculating the PV of the annuity) Your favorite aunt just won the Mega Millions Lottery. She has a choice to take a lump sum of $10 million immediately or take 20 annual payments (end of year) of 800,000 per year. She believes she can earn a 6% rate of return on invested monies. She has consulted you for advice. Which option should she take? Assuming she will provide you with 50% of the difference in options, how much money will she pay to you? 6. (ANNUITY and LUMP SUM - calculating the PV and comparing to current investment amount) You and your best friend are looking at buying a business together. The business will cost $800,000 upfront in cash today. Your expectation is that it will earn $80,000 per year for the next 8 years at which time you will be able to sell it for $1,000,000 - at the end of year 8 . The two of you require an investment return of 12% on your monies. Should you make this investment? 7. (ANNUITY - calculating the PMT - monthly not annual) LOAN EXAMPLE You have decided to purchase a new home. You have $150,000 for a down-payment and the house cost is $750,000. What will your monthly payment be for a $600,000 mortgage assuming a 4% interest rate and a 30 year fixed mortgage loan? What would the monthly payment be at a 7% interest rate? 8. (ANNUITY - calculating the PMT to reach a FV) SAVINGS EXAMPLE You plan to buy a home in 10 years. You estimate the cost of the home will be $500,000. You would like to have a 20% down payment or $100,000 saved up at that time. How much will you need to save each year to have the $100,000 down payment. Assume you can earn 4% on your savings. How much would the annual savings amount need to be if you could earn 8% on your savings? 9. (ANNUITY - calculating the PMT to reach a FV) SAVING EXAMPLE You would like to have $1,500,000 in savings for retirement in 40 years. Assuming you have $0 saved today, how much would you have to save each year to have the $1,500,000 of savings. Assume you can earn 6% on your savings. 10. (ANNUITY - calculated the N - \# of periods given a PV, PMT and I to get to $0FV ) - LOAN TO SELF How long (in years) will $1,500,000 last if you take out $60,000 and earn 3% on the remaining invested money Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started