Answered step by step

Verified Expert Solution

Question

1 Approved Answer

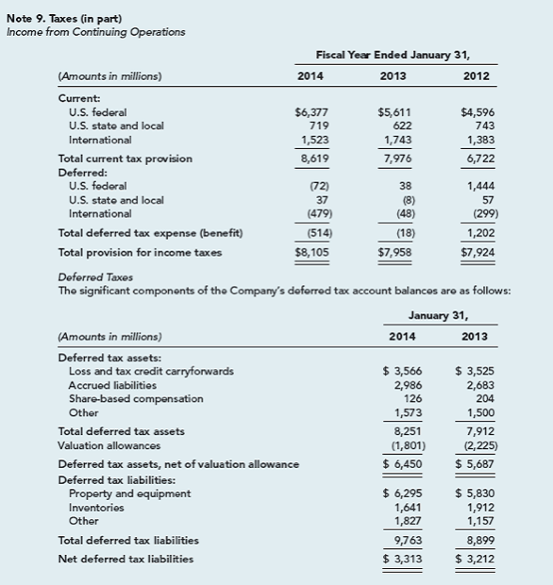

1. Focusing on only the first part of Note 9, relating current, deferred, and total provision for income taxes, prepare a summary journal entry that

1. Focusing on only the first part of Note 9, relating current, deferred, and total provision for income taxes, prepare a summary journal entry that records Company's 2014 tax expense associated with income from continuing operations.

2. Compare the change in deferred taxes you recorded in your summary journal entry to the actual change in Company's net deferred tax liability for fiscal 2014. Do they reconcile? What besides continuing operations might affect deferred taxes?

Note 9. Taxes (in part) Income from Continuing Operations Fiscal Year Ended January 31. VAmounts in millions) 2014 2013 2012 Current U.S. federal $5,611 $4,596 U.S. stato and local 719 743 622 1,523 1,743 1,383 International Total current tax provision 8,619 7,976 6,722 U.S. federal 720 1,444 U.S. state and local International (479) (48) Total deferred tax expense (benefit) (514) 1,202 $7,958 $8,105 $7,924 Total provision for income taxes Deferred Taxes The significant components of the Company's doforrod tax account balancos are as follows: January 31, 2014 (Amounts in millions) 2013 Deferred tax assets: Loss and tax credit carryforwards 3,566 3,525 2,986 Accrued liabilities Share-based compensation 126 204 Other 1,573 1,500 Total deferred tax assets 8,251 7,912 Valuation allowances 1,801) (2,225) Deferred tax assets, net of valuation allowance 6,450 5 Deferred tax liabilities: 6,295 5,830 Property and equipment Inventories 1,641 1,912 Other 1,827 1,157 Total deferred tax liabilities 9,763 8,899 3,313 3,212 Net deferred tax liabilitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started