Question

1) Following on from the above: with a strategy that goes either long or short $1 in Portfolio Z, what should the amount invested in

1) Following on from the above: with a strategy that goes either long or short $1 in Portfolio Z, what should the amount invested in Portfolio Z be? (use + for long and - for short)

2) Following on from the above: with a strategy that goes either long or short $1 in Portfolio Z, what should the amount invested in the risk-free asset be? (use + for long and - for short)

3) Following on from the above: with a strategy that goes either long or short $1 in Portfolio Z, what should the amount invested in Factor Portfolio P be? (use + for long and - for short)

4) Following on from the above: with a strategy that goes either long or short $1 in Portfolio Z, what should the amount invested in Factor Portfolio Q be? (use + for long and - for short)

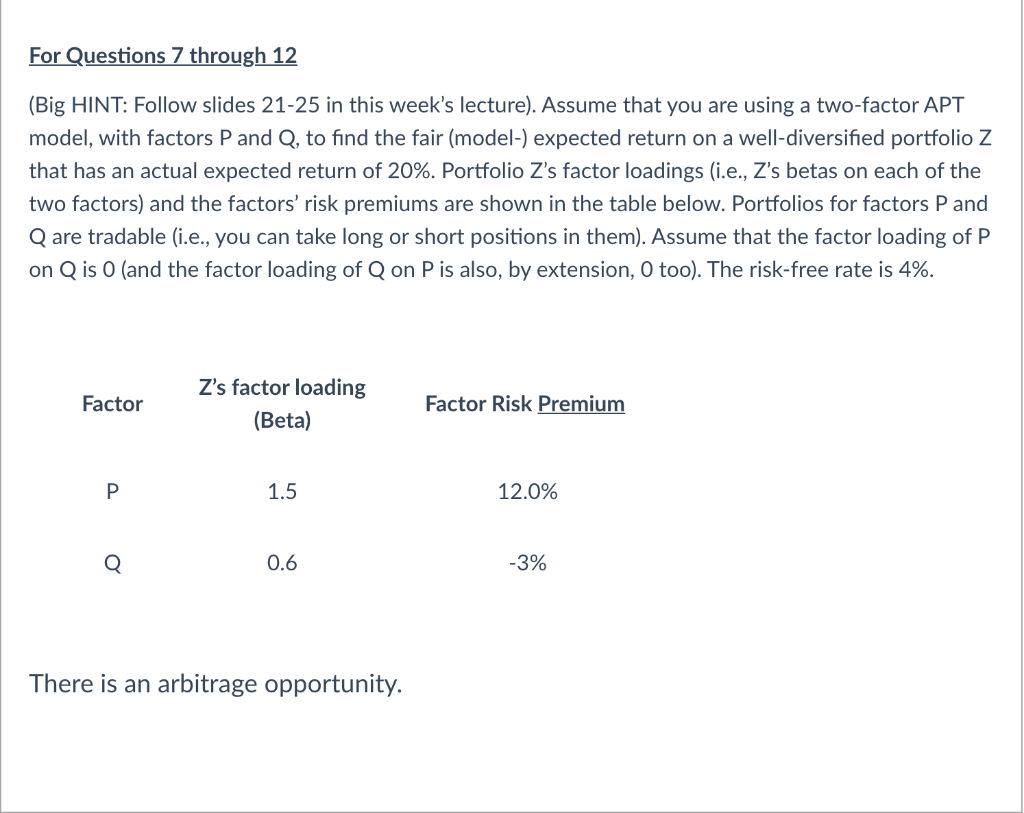

For Questions 7 through 12 (Big HINT: Follow slides 21-25 in this week's lecture). Assume that you are using a two-factor APT model, with factors P and Q, to find the fair (model-) expected return on a well-diversified portfolio Z that has an actual expected return of 20%. Portfolio Z's factor loadings (i.e., Z's betas on each of the two factors) and the factors' risk premiums are shown in the table below. Portfolios for factors P and Q are tradable (i.e., you can take long or short positions in them). Assume that the factor loading of P on Q is 0 (and the factor loading of Q on P is also, by extension, 0 too). The risk-free rate is 4%. Factor Z's factor loading (Beta) Factor Risk Premium P 1.5 12.0% 0.6 -3% There is an arbitrage opportunity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started