Answered step by step

Verified Expert Solution

Question

1 Approved Answer

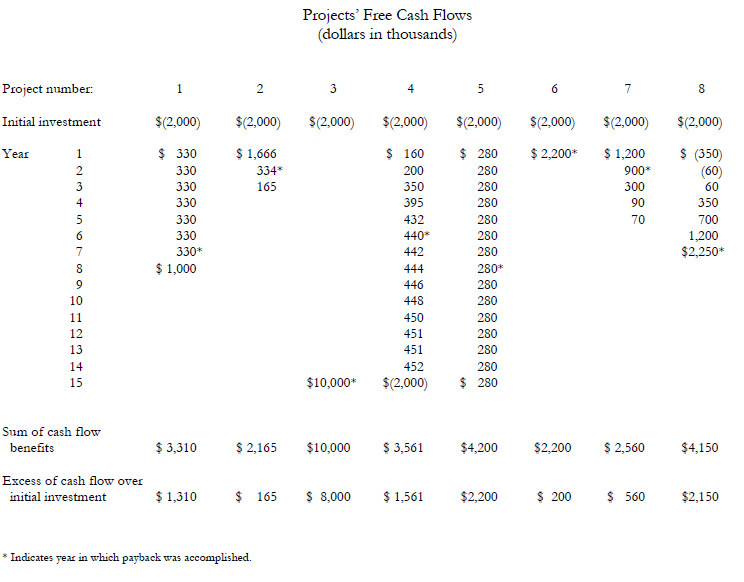

(1) For each of the projects, calculate its NPV, IRR, Payback, and Profitability Index given a Cost of Capital of 11% (2) After completing the

(1) For each of the projects, calculate its NPV, IRR, Payback, and Profitability Index given a Cost of Capital of 11% (2) After completing the above calculations, for each separate capital budgeting technique, rank all the projects from the most desirable to the least desirable, and be able to explain why.

Please show all work including the calculations for each capital budgeting technique.

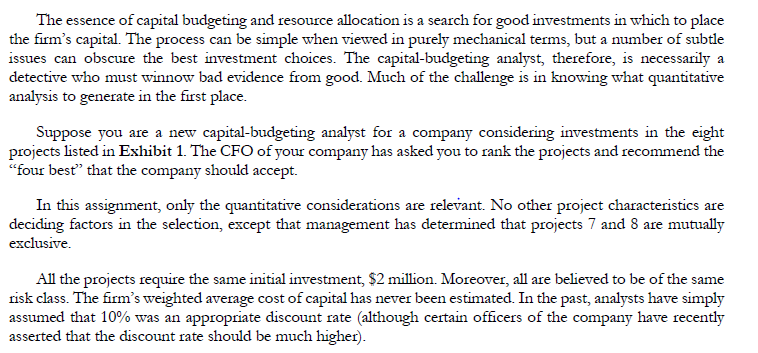

The essence of capital budgeting and resource allocation is a search for good investments in which to place the firm's capital. The process can be simple when viewed in purely mechanical terms, but a number of subtle issues can obscure the best investment choices. The capital-budgeting analyst, therefore, is necessarily a detective who must winnow bad evidence from good. Much of the challenge is in knowing what quantitative analysis to generate in the first place. Suppose you are a new capital-budgeting analyst for a company considering investments in the eight projects listed in Exhibit 1 . The CFO of your company has asked you to rank the projects and recommend the "four best" that the company should accept. In this assignment, only the quantitative considerations are relevant. No other project characteristics are deciding factors in the selection, except that management has determined that projects 7 and 8 are mutually exclusive. All the projects require the same initial investment, $2 million. Moreover, all are believed to be of the same risk class. The firm's weighted average cost of capital has never been estimated. In the past, analysts have simply assumed that 10% was an appropriate discount rate (although certain officers of the company have recently asserted that the discount rate should be much higher). Projects' Free Cash Flows (Anllare in thomeande)

The essence of capital budgeting and resource allocation is a search for good investments in which to place the firm's capital. The process can be simple when viewed in purely mechanical terms, but a number of subtle issues can obscure the best investment choices. The capital-budgeting analyst, therefore, is necessarily a detective who must winnow bad evidence from good. Much of the challenge is in knowing what quantitative analysis to generate in the first place. Suppose you are a new capital-budgeting analyst for a company considering investments in the eight projects listed in Exhibit 1 . The CFO of your company has asked you to rank the projects and recommend the "four best" that the company should accept. In this assignment, only the quantitative considerations are relevant. No other project characteristics are deciding factors in the selection, except that management has determined that projects 7 and 8 are mutually exclusive. All the projects require the same initial investment, $2 million. Moreover, all are believed to be of the same risk class. The firm's weighted average cost of capital has never been estimated. In the past, analysts have simply assumed that 10% was an appropriate discount rate (although certain officers of the company have recently asserted that the discount rate should be much higher). Projects' Free Cash Flows (Anllare in thomeande) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started