Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) For its taxation year ending December 31, 2021, Axel Ltd. has estimated that its net and taxable income, before any deductions for CCA,

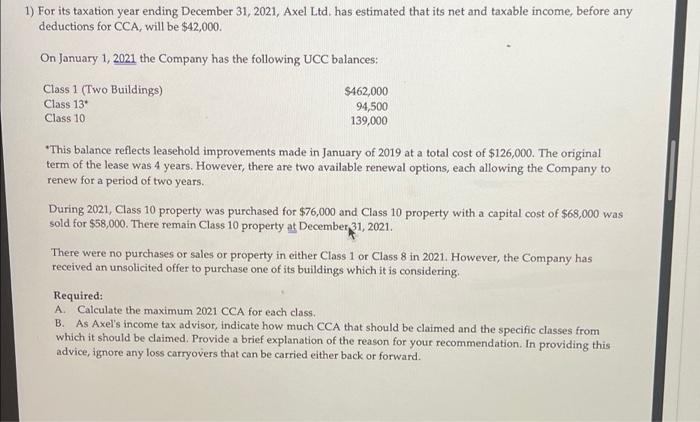

1) For its taxation year ending December 31, 2021, Axel Ltd. has estimated that its net and taxable income, before any deductions for CCA, will be $42,000. On January 1, 2021 the Company has the following UCC balances: Class 1 (Two Buildings) Class 13* Class 10 $462,000 94,500 139,000 *This balance reflects leasehold improvements made in January of 2019 at a total cost of $126,000. The original term of the lease was 4 years. However, there are two available renewal options, each allowing the Company to renew for a period of two years. During 2021, Class 10 property was purchased for $76,000 and Class 10 property with a capital cost of $68,000 was sold for $58,000. There remain Class 10 property at December 31, 2021. There were no purchases or sales or property in either Class 1 or Class 8 in 2021. However, the Company has received an unsolicited offer to purchase one of its buildings which it is considering. Required: A. Calculate the maximum 2021 CCA for each class. B. As Axel's income tax advisor, indicate how much CCA that should be claimed and the specific classes from which it should be claimed. Provide a brief explanation of the reason for your recommendation. In providing this advice, ignore any loss carryovers that can be carried either back or forward.

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

A Maximum CCA for Class 1 462000 x 20 92400 Maximum CCA for Class 10 139000 x 30 41700 B The Company ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started