Answered step by step

Verified Expert Solution

Question

1 Approved Answer

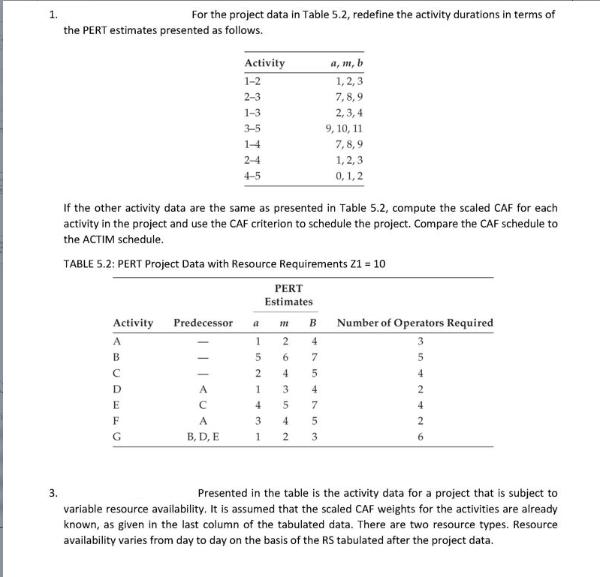

1. For the project data in Table 5.2, redefine the activity durations in terms of the PERT estimates presented as follows. Activity a, m,

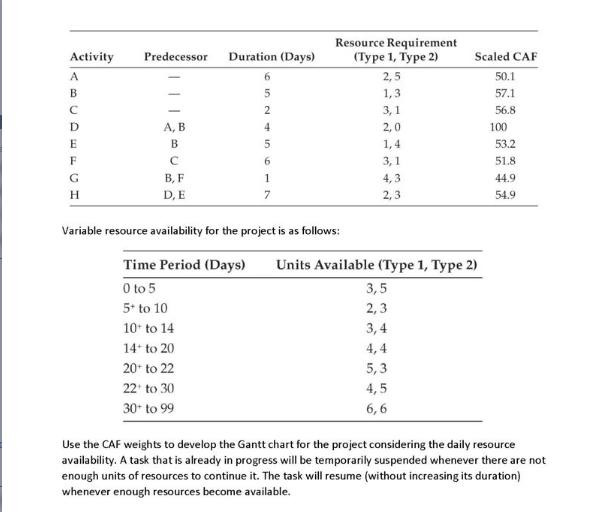

1. For the project data in Table 5.2, redefine the activity durations in terms of the PERT estimates presented as follows. Activity a, m, b 1-2 1,2,3 2-3 7,8,9 1-3 2,3,4 3-5 9, 10, 11 14 7,8,9 1,2,3 0,1,2 2-4 4-5 If the other activity data are the same as presented in Table 5.2, compute the scaled CAF for each activity in the project and use the CAF criterion to schedule the project. Compare the CAF schedule to the ACTIM schedule. TABLE 5.2: PERT Project Data with Resource Requirements Z1 = 10 PERT Estimates Activity Predecessor am B Number of Operators Required A 1 24 B 5 6 C 2 4 175 3 4 D A 1 3 4 2 E C 4 5 7 4 F A 3 4 5 G B, D, E 1 2 3 3. Presented in the table is the activity data for a project that is subject to variable resource availability. It is assumed that the scaled CAF weights for the activities are already known, as given in the last column of the tabulated data. There are two resource types. Resource availability varies from day to day on the basis of the RS tabulated after the project data. Resource Requirement Activity Predecessor Duration (Days) A B (Type 1, Type 2) Scaled CAF 6 2,5 50.1 5 1,3 57.1 C 2 3,1 56.8 D A, B 4. 2,0 100 E B 5. 1,4 53.2 F C 6 3,1 51.8 G B, F 1 4,3 44.9 H D, E 7 2,3 54.9 Variable resource availability for the project is as follows: Time Period (Days) Units Available (Type 1, Type 2) 0 to 5 5- to 10 10 to 14 14+ to 20 20+ to 22 22 to 30 30 to 99 3,5 2,3 3,4 4,4 5,3 4,5 6,6 Use the CAF weights to develop the Gantt chart for the project considering the daily resource availability. A task that is already in progress will be temporarily suspended whenever there are not enough units of resources to continue it. The task will resume (without increasing its duration) whenever enough resources become available.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started