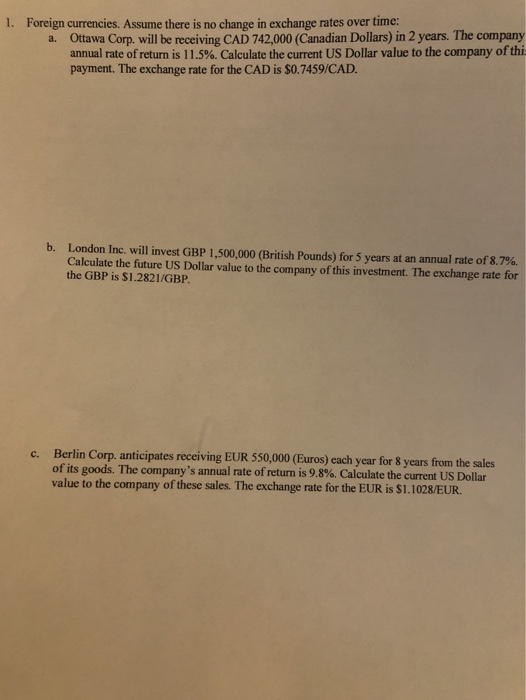

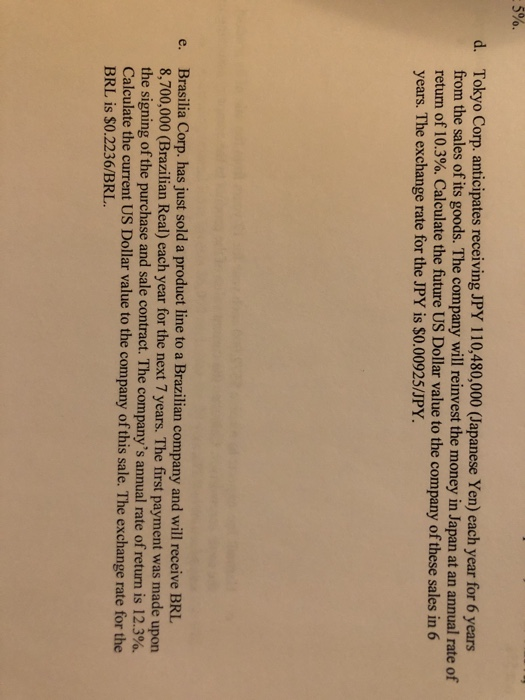

1. Foreign currencies. Assume there is no change in exchange rates over time: a. Ottawa Corp. will be receiving CAD 742,000 (Canadian Dollars) in 2 years. The company annual rate of return is 11.5%. Calculate the current US Dollar value to the company of thi payment. The exchange rate for the CAD is $0.7459/CAD. b. London Inc. will invest GBP 1,500,000 (British Pounds) for 5 years at an annual rate of 8.7% Calculate the future US Dollar value to the company of this investment. The exchange rate for the GBP is $1.2821/GBP. c. Berlin Corp. anticipates receiving EUR 550,000 (Euros) each year for 8 years from the sales of its goods. The company's annual rate of return is 9.8%. Calculate the current US Dollar value to the company of these sales. The exchange rate for the EUR is $1.1028/EUR 5% d. Tokyo Corp. anticipates receiving JPY 110,480,000 (Japanese Yen) each year for 6 years from the sales of its goods. The company will reinvest the money in Japan at an annual rate of return of 10.3%. Calculate the future US Dollar value to the company of these sales in 6 years. The exchange rate for the JPY is $0.00925/JPY. e. Brasilia Corp. has just sold a product line to a Brazilian company and will receive BRL 8,700,000 (Brazilian Real) each year for the next 7 years. The first payment was made upon the signing of the purchase and sale contract. The company's annual rate of return is 12.3%. Calculate the current US Dollar value to the company of this sale. The exchange rate for the BRL is $0.2236/BRL. 1. Foreign currencies. Assume there is no change in exchange rates over time: a. Ottawa Corp. will be receiving CAD 742,000 (Canadian Dollars) in 2 years. The company annual rate of return is 11.5%. Calculate the current US Dollar value to the company of thi payment. The exchange rate for the CAD is $0.7459/CAD. b. London Inc. will invest GBP 1,500,000 (British Pounds) for 5 years at an annual rate of 8.7% Calculate the future US Dollar value to the company of this investment. The exchange rate for the GBP is $1.2821/GBP. c. Berlin Corp. anticipates receiving EUR 550,000 (Euros) each year for 8 years from the sales of its goods. The company's annual rate of return is 9.8%. Calculate the current US Dollar value to the company of these sales. The exchange rate for the EUR is $1.1028/EUR 5% d. Tokyo Corp. anticipates receiving JPY 110,480,000 (Japanese Yen) each year for 6 years from the sales of its goods. The company will reinvest the money in Japan at an annual rate of return of 10.3%. Calculate the future US Dollar value to the company of these sales in 6 years. The exchange rate for the JPY is $0.00925/JPY. e. Brasilia Corp. has just sold a product line to a Brazilian company and will receive BRL 8,700,000 (Brazilian Real) each year for the next 7 years. The first payment was made upon the signing of the purchase and sale contract. The company's annual rate of return is 12.3%. Calculate the current US Dollar value to the company of this sale. The exchange rate for the BRL is $0.2236/BRL