Question

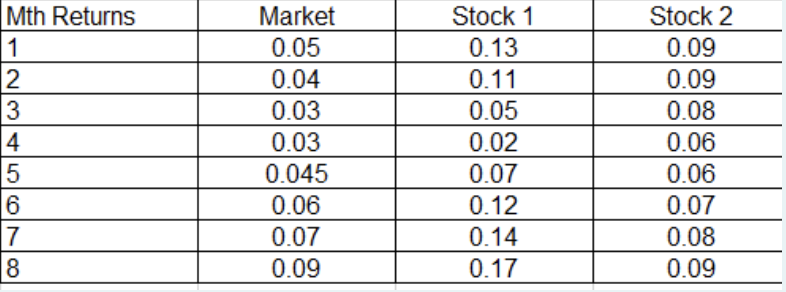

1) From the following market data: Calculate the Beta of each stock. Stock 1 Beta = a)1.15 b)2.15 c)0.15 Stock 2 Beta = a)0.85 b)0.52

1) From the following market data:

Calculate the Beta of each stock.

Stock 1 Beta =

a)1.15

b)2.15

c)0.15

Stock 2 Beta =

a)0.85

b)0.52

c)0.25

Which stock is more sensative to market risk?

a)stock 1

b)stock 2

2)The Rf = 2% and the return of the ASX200 = 10%. The ASX200 is a share index that can be used to proxy the return of the market.

The E(R) of stock 1 is

a)17.17%

b)21.17%

c)19.17%

The E(R) of stock 2 is

a)3.97%

b)2.97%

c)1.97%

3)A market analyst estimates that the E(r) for Stock 1 as 21% and Stock 1 as 1%.

Comparing these to the appropriate CAPM E(r), the market analyst return estimates will lead to......of Stock 1

a)under-pricing

b)over-pricing

Comparing these to the appropriate CAPM E(r), the market analyst return estimates will lead to......of Stock 2

a)under-pricing

b)over-pricing

This is because the E(r) is used as the discount rate to value the cash flows of the stock and using a discount rate that is too.........will result in underpricing

a)low

b)high

This is because the E(r) is used as the discount rate to value the cash flows of the stock and using a discount rate that is too.........will lead to overpricing.

a)low

b)high

\begin{tabular}{l|c|c|c} \hline Mth Returns & Market & Stock 1 & Stock 2 \\ \hline 1 & 0.05 & 0.13 & 0.09 \\ \hline 2 & 0.04 & 0.11 & 0.09 \\ \hline 3 & 0.03 & 0.05 & 0.08 \\ \hline 4 & 0.03 & 0.02 & 0.06 \\ \hline 5 & 0.045 & 0.07 & 0.06 \\ \hline 6 & 0.06 & 0.12 & 0.07 \\ \hline 7 & 0.07 & 0.14 & 0.08 \\ \hline 8 & 0.09 & 0.17 & 0.09 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started