Answered step by step

Verified Expert Solution

Question

1 Approved Answer

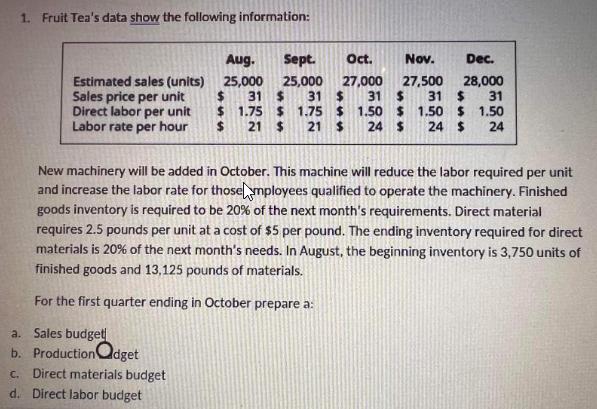

1. Fruit Tea's data show the following information: Aug. Sept. Oct. Nov. Dec. Estimated sales (units) Sales price per unit Direct labor per unit

1. Fruit Tea's data show the following information: Aug. Sept. Oct. Nov. Dec. Estimated sales (units) Sales price per unit Direct labor per unit 25,000 31 $ 31 25,000 27,000 %24 27,500 31 $ 28,000 31 31 $ $ 1.75 $ 1,75 $ 1.50 $ 1.50 $ 1.50 %24 Labor rate per hour $ 21 $ 21 24 $ 24 $ 24 New machinery will be added in October. This machine will reduce the labor required per unit and increase the labor rate for thosemployees qualified to operate the machinery. Finished goods inventory is required to be 20% of the next month's requirements. Direct material requires 2.5 pounds per unit at a cost of $5 per pound. The ending inventory required for direct materials is 20% of the next month's needs. In August, the beginning inventory is 3,750 units of finished goods and 13,125 pounds of materials. For the first quarter ending in October prepare a: a. Sales budget b. ProductionQdget c. Direct materials budget d. Direct labor budget

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Sales Budget Aug Sep Oct First Quarter Estimated sales units a 25000 25000 27000 77000 Budgeted se...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started