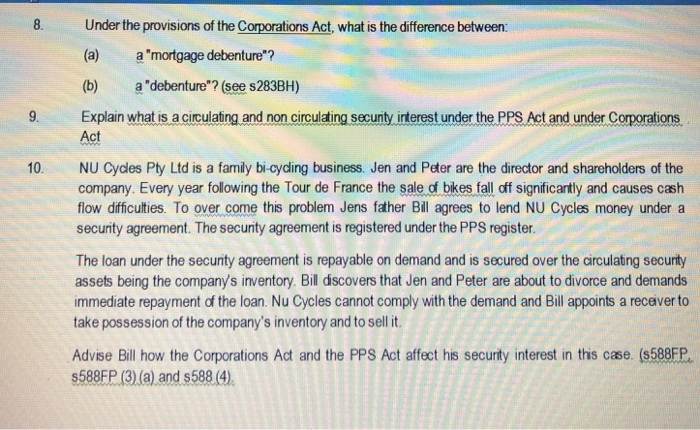

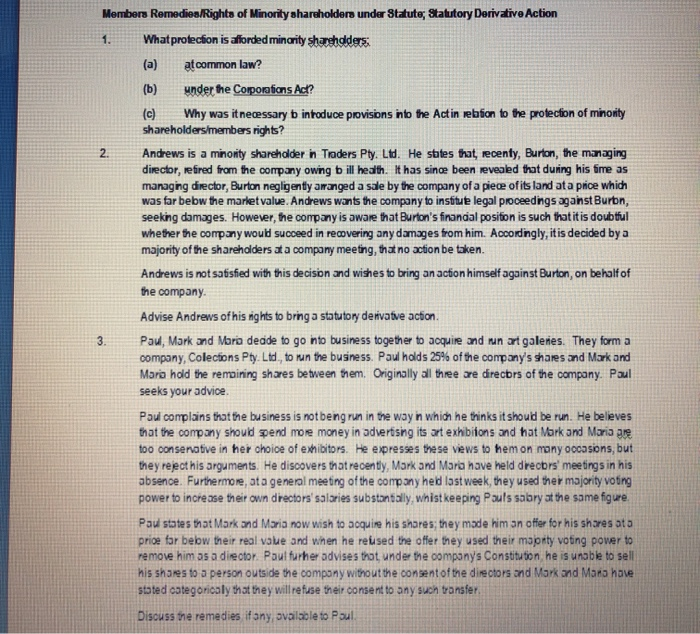

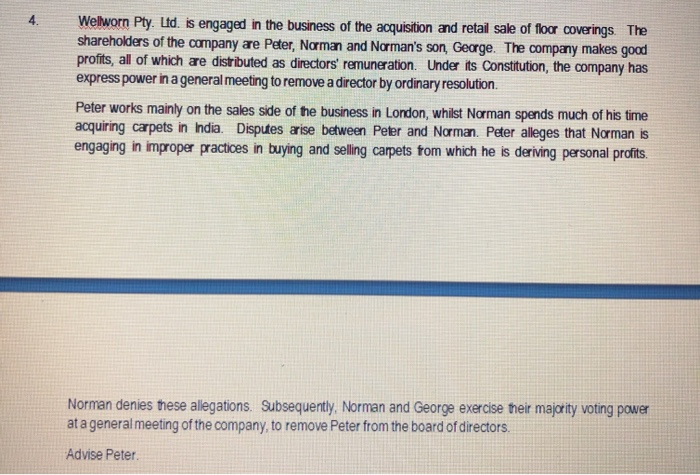

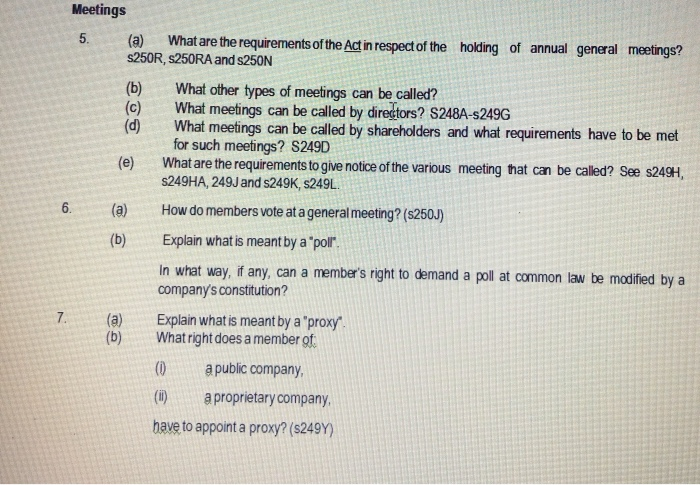

1. Fundraising and Disclosure Documents - Share Capital - Types of Sharee (a) What types of Disdosure Documents can be used for capital raising? (Sect9,5705, 709, 92) (b) When do you have to give a disclosure document to investors? (5704705.706.726.727. (c) What types of issues offers or invitations do not require a Disclosure Document? (see Sect708). (d) What particular benefit does the Offer Information Statement provide to a company raising capital? (Sect709 (4) 2. Explain the General Disclosure Test and the general requirements for disclosure for a prospectus. 5710 3. (a) What is the role of he ASIC in relation to he issue of a Disdosure Document? (Sect 741,711(7), 739,718 Note 1.) What is the requirement for lodging and pre-vetting a Disclosure Document? See Sect 718 and $727(3). (b) 4. Aust Co Ltd is a new technobgy company registered in Australa. The decision was oken to foat the company and a prospectusdisclosure document was issued in March. The prospectus contained a cbim that forecast the doubling of earnings in the next hee years. This was confirmed by the merchant bank MAC Bank Ltd who also advised on the fundraising. John was appointed a director of AustCo Ltd just before the prospectus was issued and was not involve its preparation. He is concerned that the forecast in the prospecus was overy optimistic. Two years down the track the company's share price has dropped after a fall in its earnings. Many investors are angry. Advise John of the potential lability that he and the company may face under the Corporations Act 2001. Also advise John of any detences that may be available under Corporations Act 2001 (5730-733) 5. Albert is the managing direcbr of Retai Pty Ltd. He advises that the company is trading profitably, but is in need of further capital forexpansion. He asks you whether it would be in order to place notices in several of the bocal shop windows, inviting people who might be interested in a sound investment, to apply to the company's secretary for shares in the company Advise. 6 (a) What is the nature of a share? (s1070A) (b) What is the contractual analysis the purchase of a share? 7. Is it correct to say that uncalled capital is an asset of the company and can a company borrow against its uncalled capital? 8. Broadly, what rights does a person acquire when they become a shareholder in a company? Why may company wish to have different classes of shares? a 9. Explain the rights attaching to the following types of shares: ordinary shares preference shares cumulative preference shares, participating preference shares; redeemable preference shares (5254A (2) (3) 10. In what ways do shareholders differ from debenture holders? In what ways are dividends to be distinguished from interest payments? 11. What restrictions, if any, are imposed on the alteration of class rights in respect of shares? (5246B-D) 2 1. What are the reasons for the rules established by the courts requiring companies to maintain their issued share capital? Action Insurance Ltd (Action) has faired well following losses following the Queensland flood in 2011, however, the Board is concerned that it shares are undervalued by the market. The Board is also concerned that the low share price may make the company a takeover target. Action decides to engage in a share buy back of 20% of its preference shares. Action also has "A" class shares that have the same rights as ordinary shares and "B" Class shares that have dividend rights but no voting rights. The Board proposes to reduce the number of its "A" class shares by 12% and depending on the market reaction it may consider a further reduction in the next 12 months. D) The directors seek your advice on the procedure to buy back the shares and the type of buy back scheme that can be used. The directors also seek you advice about the share capital reduction they propose to undertake Advise the directors of Action Insurance Pty Ltd. I) Your answer should consider the consequence of failing to comply with the share capital reduction procedure and the buy back procedure? (2560, 5257) 3 Maria a director of Action Insurance Ltd (Action). Action finds itself in a poor financial position following a jump in claims due to recent storm damage in Melbourne. Actions share price is falling. Bil the Managing director of Action proposes to lend Maria $1M through her company Maz Pty Ltd. Maz Pty Ltd will use the funds to buy shares in Action in order to prop up the share price The directors seek your advice as to the rules and the procedure that allow companies to provide financial assistance to a person for the purpose of or in connection with the acquisition of its shares or those of its holding company under the Corporations Act 2001. (S260A, s260B, s260C, s260D) Dividends 4. If directors are given a discretion as to whether or not a dividend is declared, in what circumstances, if any. willa court interfere with that discretion? (s254U). (s254W) 5. What test should be applied by the company before it dedares a dividend? (s254T) Can a shareholder sue to recover a declared dividend? If so on what basis? (s254V) Membership and Shareholding 6. Andrew, a shareholder in a smal family Proprietary company, wants to transfer his shares to his brother Michael. Andrew tells you that the directors approve the transfer and that the Secretary proposes simply to cancel his share certificate and issue a new certificate in Michael's name. Advise. s1071B 7 Danny agrees to sell his shares in Familia Pty Ltd to his cousin Minh. As a result of a falling out between Danny and his father and uncle, the directors of Familia Pty Ltd, they have indicated they will refuse to register the transfer. If directors of a company refuse to register a transfer of shares, in what circumstances, if any, will the transferee (Minh) have a remedy? (s1072G; s1071D-1071F) (also S232-235?) 8. 9. 10 Under the provisions of the Corporations Act, what is the difference between: (a) a "mortgage debenture"? (b) a "debenture"? (see s283BH) Explain what is a circulating and non circulating security interest under the PPS Act and under Corporations Act NU Cydes Pty Ltd is a family bi-cycling business. Jen and Peter are the director and shareholders of the company. Every year following the Tour de France the sale of bikes fall off significantly and causes cash flow difficulties. To over come this problem Jens father Bill agrees to lend NU Cycles money under a security agreement. The security agreement is registered under the PPS register. The loan under the security agreement is repayable on demand and is secured over the circulating security assets being the company's inventory. Bill discovers that Jen and Peter are about to divorce and demands immediate repayment of the loan. Nu Cycles cannot comply with the demand and Bill appoints a receiver to take possession of the company's inventory and to sell it. Advise Bill how the Corporations Act and the PPS Act affect his security interest in this case. (s588FP. $588FP (3) (a) and s588 (4). 1. 2. Members Remediea/Rights of Minority shareholders under Statute, Statutory Derivative Action What protection is afforded minority sharedders: (a) at common law? (b) under the Corporations Act? (c) Why was it necessary b introduce provisions into the Actin ebion to the protection of minority shareholders/members rights? Andrews is a minority shareholder in Traders Pty Ltd. He states that, recenty, Burton, the managing director, retired from the company owing b ill health. It has since been revealed that during his fire as managing director, Burton negligently aranged a sale by the company of a piece of its land at a price which was far bebw the market value. Andrews wants the company to institute legal proceedings against Buron, seeking damages. However, the company is aware that Burton's financial position is such that it is doubtful whether the company would succeed in recovering any damages from him. Accordingly, it is decided by a majority of the shareholders at a company meeting, that no action be taken. Andrews is not satisfied with this decision and wishes to bring an action himself against Burton, on behalf of the company Advise Andrews of his rights to bring a statutory derivatve action. Paul, Mark and Maria decide to go into business together to acquire and nun art galeries. They form a company, Colections Pty Ltd, to run the business. Paul holds 25% of the company's shares and Mark and Mara hold the remaining shares between them. Originally all three se direcbrs of the company. Paul seeks your advice. Poul complains that the business is not being run in the way in which he thinks it should be run. He believes that the company should spend more money in advertising its art exhibitions and that Mark and Maria gre too consenatve in her choice of exhibitors. He expresses these views to them on many occasions, but they reject his arguments. He discovers that recently, Mark and Maria have held direcbrs' meetings in his absence. Furthermore, ata general meeting of the company held last week, they used ther majority voting power to increase their own directors salories substantially, whist keeping Pouls sabry at the same figure Pou states that Mark and Maria now wish to acquire his shares; they made him an offer for his shares at price far bebw their real valle and when he reused the offer they used their majority voting power to remove him as a director. Poulfurher advises that, under the company's Constitution he is unable to sell his shares to a person outside the company without the consent of the directors and Mark and Mana have stated categoricaly that they will refuse their consent to any such transfer. Discuss the remedies if any, available to Poul 3. Wellworn Pty. Ltd. is engaged in the business of the acquisition and retail sale of floor coverings. The shareholders of the company are Peter, Norman and Norman's son, George. The company makes good profits, all of which are distributed as directors' remuneration. Under its Constitution, the company has express power in a general meeting to remove a director by ordinary resolution. Peter works mainly on the sales side of the business in London, whilst Norman spends much of his time acquiring carpets in India. Disputes arise between Peter and Norman. Peter alleges that Norman is engaging in improper practices in buying and selling carpets tom which he is deriving personal profits. Norman denies these allegations. Subsequently, Norman and George exercise their majority voting power at a general meeting of the company, to remove Peter from the board of directors. Advise Peter ch 6. Meetings (a) What are the requirements of the Act in respect of the holding of annual general meetings? s250R, 5250RA and s250N (b) What other types of meetings can be called? (c) What meetings can be called by directors? S248A-s2496 (d) What meetings can be called by shareholders and what requirements have to be met for such meetings? S249D (e) What are the requirements to give notice of the various meeting that can be called? See s249H, S249HA, 249J and s249K, $249L. (a) How do members vote at a general meeting? (s250) (b) Explain what is meant by a "poll". In what way, if any, can a member's right to demand a poll at common law be modified by a company's constitution? (a) Explain what is meant by a "proxy (b) What right does a member of (1) a public company (11) a proprietary company, have to appoint a proxy? (s249) 7 1. Fundraising and Disclosure Documents - Share Capital - Types of Sharee (a) What types of Disdosure Documents can be used for capital raising? (Sect9,5705, 709, 92) (b) When do you have to give a disclosure document to investors? (5704705.706.726.727. (c) What types of issues offers or invitations do not require a Disclosure Document? (see Sect708). (d) What particular benefit does the Offer Information Statement provide to a company raising capital? (Sect709 (4) 2. Explain the General Disclosure Test and the general requirements for disclosure for a prospectus. 5710 3. (a) What is the role of he ASIC in relation to he issue of a Disdosure Document? (Sect 741,711(7), 739,718 Note 1.) What is the requirement for lodging and pre-vetting a Disclosure Document? See Sect 718 and $727(3). (b) 4. Aust Co Ltd is a new technobgy company registered in Australa. The decision was oken to foat the company and a prospectusdisclosure document was issued in March. The prospectus contained a cbim that forecast the doubling of earnings in the next hee years. This was confirmed by the merchant bank MAC Bank Ltd who also advised on the fundraising. John was appointed a director of AustCo Ltd just before the prospectus was issued and was not involve its preparation. He is concerned that the forecast in the prospecus was overy optimistic. Two years down the track the company's share price has dropped after a fall in its earnings. Many investors are angry. Advise John of the potential lability that he and the company may face under the Corporations Act 2001. Also advise John of any detences that may be available under Corporations Act 2001 (5730-733) 5. Albert is the managing direcbr of Retai Pty Ltd. He advises that the company is trading profitably, but is in need of further capital forexpansion. He asks you whether it would be in order to place notices in several of the bocal shop windows, inviting people who might be interested in a sound investment, to apply to the company's secretary for shares in the company Advise. 6 (a) What is the nature of a share? (s1070A) (b) What is the contractual analysis the purchase of a share? 7. Is it correct to say that uncalled capital is an asset of the company and can a company borrow against its uncalled capital? 8. Broadly, what rights does a person acquire when they become a shareholder in a company? Why may company wish to have different classes of shares? a 9. Explain the rights attaching to the following types of shares: ordinary shares preference shares cumulative preference shares, participating preference shares; redeemable preference shares (5254A (2) (3) 10. In what ways do shareholders differ from debenture holders? In what ways are dividends to be distinguished from interest payments? 11. What restrictions, if any, are imposed on the alteration of class rights in respect of shares? (5246B-D) 2 1. What are the reasons for the rules established by the courts requiring companies to maintain their issued share capital? Action Insurance Ltd (Action) has faired well following losses following the Queensland flood in 2011, however, the Board is concerned that it shares are undervalued by the market. The Board is also concerned that the low share price may make the company a takeover target. Action decides to engage in a share buy back of 20% of its preference shares. Action also has "A" class shares that have the same rights as ordinary shares and "B" Class shares that have dividend rights but no voting rights. The Board proposes to reduce the number of its "A" class shares by 12% and depending on the market reaction it may consider a further reduction in the next 12 months. D) The directors seek your advice on the procedure to buy back the shares and the type of buy back scheme that can be used. The directors also seek you advice about the share capital reduction they propose to undertake Advise the directors of Action Insurance Pty Ltd. I) Your answer should consider the consequence of failing to comply with the share capital reduction procedure and the buy back procedure? (2560, 5257) 3 Maria a director of Action Insurance Ltd (Action). Action finds itself in a poor financial position following a jump in claims due to recent storm damage in Melbourne. Actions share price is falling. Bil the Managing director of Action proposes to lend Maria $1M through her company Maz Pty Ltd. Maz Pty Ltd will use the funds to buy shares in Action in order to prop up the share price The directors seek your advice as to the rules and the procedure that allow companies to provide financial assistance to a person for the purpose of or in connection with the acquisition of its shares or those of its holding company under the Corporations Act 2001. (S260A, s260B, s260C, s260D) Dividends 4. If directors are given a discretion as to whether or not a dividend is declared, in what circumstances, if any. willa court interfere with that discretion? (s254U). (s254W) 5. What test should be applied by the company before it dedares a dividend? (s254T) Can a shareholder sue to recover a declared dividend? If so on what basis? (s254V) Membership and Shareholding 6. Andrew, a shareholder in a smal family Proprietary company, wants to transfer his shares to his brother Michael. Andrew tells you that the directors approve the transfer and that the Secretary proposes simply to cancel his share certificate and issue a new certificate in Michael's name. Advise. s1071B 7 Danny agrees to sell his shares in Familia Pty Ltd to his cousin Minh. As a result of a falling out between Danny and his father and uncle, the directors of Familia Pty Ltd, they have indicated they will refuse to register the transfer. If directors of a company refuse to register a transfer of shares, in what circumstances, if any, will the transferee (Minh) have a remedy? (s1072G; s1071D-1071F) (also S232-235?) 8. 9. 10 Under the provisions of the Corporations Act, what is the difference between: (a) a "mortgage debenture"? (b) a "debenture"? (see s283BH) Explain what is a circulating and non circulating security interest under the PPS Act and under Corporations Act NU Cydes Pty Ltd is a family bi-cycling business. Jen and Peter are the director and shareholders of the company. Every year following the Tour de France the sale of bikes fall off significantly and causes cash flow difficulties. To over come this problem Jens father Bill agrees to lend NU Cycles money under a security agreement. The security agreement is registered under the PPS register. The loan under the security agreement is repayable on demand and is secured over the circulating security assets being the company's inventory. Bill discovers that Jen and Peter are about to divorce and demands immediate repayment of the loan. Nu Cycles cannot comply with the demand and Bill appoints a receiver to take possession of the company's inventory and to sell it. Advise Bill how the Corporations Act and the PPS Act affect his security interest in this case. (s588FP. $588FP (3) (a) and s588 (4). 1. 2. Members Remediea/Rights of Minority shareholders under Statute, Statutory Derivative Action What protection is afforded minority sharedders: (a) at common law? (b) under the Corporations Act? (c) Why was it necessary b introduce provisions into the Actin ebion to the protection of minority shareholders/members rights? Andrews is a minority shareholder in Traders Pty Ltd. He states that, recenty, Burton, the managing director, retired from the company owing b ill health. It has since been revealed that during his fire as managing director, Burton negligently aranged a sale by the company of a piece of its land at a price which was far bebw the market value. Andrews wants the company to institute legal proceedings against Buron, seeking damages. However, the company is aware that Burton's financial position is such that it is doubtful whether the company would succeed in recovering any damages from him. Accordingly, it is decided by a majority of the shareholders at a company meeting, that no action be taken. Andrews is not satisfied with this decision and wishes to bring an action himself against Burton, on behalf of the company Advise Andrews of his rights to bring a statutory derivatve action. Paul, Mark and Maria decide to go into business together to acquire and nun art galeries. They form a company, Colections Pty Ltd, to run the business. Paul holds 25% of the company's shares and Mark and Mara hold the remaining shares between them. Originally all three se direcbrs of the company. Paul seeks your advice. Poul complains that the business is not being run in the way in which he thinks it should be run. He believes that the company should spend more money in advertising its art exhibitions and that Mark and Maria gre too consenatve in her choice of exhibitors. He expresses these views to them on many occasions, but they reject his arguments. He discovers that recently, Mark and Maria have held direcbrs' meetings in his absence. Furthermore, ata general meeting of the company held last week, they used ther majority voting power to increase their own directors salories substantially, whist keeping Pouls sabry at the same figure Pou states that Mark and Maria now wish to acquire his shares; they made him an offer for his shares at price far bebw their real valle and when he reused the offer they used their majority voting power to remove him as a director. Poulfurher advises that, under the company's Constitution he is unable to sell his shares to a person outside the company without the consent of the directors and Mark and Mana have stated categoricaly that they will refuse their consent to any such transfer. Discuss the remedies if any, available to Poul 3. Wellworn Pty. Ltd. is engaged in the business of the acquisition and retail sale of floor coverings. The shareholders of the company are Peter, Norman and Norman's son, George. The company makes good profits, all of which are distributed as directors' remuneration. Under its Constitution, the company has express power in a general meeting to remove a director by ordinary resolution. Peter works mainly on the sales side of the business in London, whilst Norman spends much of his time acquiring carpets in India. Disputes arise between Peter and Norman. Peter alleges that Norman is engaging in improper practices in buying and selling carpets tom which he is deriving personal profits. Norman denies these allegations. Subsequently, Norman and George exercise their majority voting power at a general meeting of the company, to remove Peter from the board of directors. Advise Peter ch 6. Meetings (a) What are the requirements of the Act in respect of the holding of annual general meetings? s250R, 5250RA and s250N (b) What other types of meetings can be called? (c) What meetings can be called by directors? S248A-s2496 (d) What meetings can be called by shareholders and what requirements have to be met for such meetings? S249D (e) What are the requirements to give notice of the various meeting that can be called? See s249H, S249HA, 249J and s249K, $249L. (a) How do members vote at a general meeting? (s250) (b) Explain what is meant by a "poll". In what way, if any, can a member's right to demand a poll at common law be modified by a company's constitution? (a) Explain what is meant by a "proxy (b) What right does a member of (1) a public company (11) a proprietary company, have to appoint a proxy? (s249) 7