Question

1. Given the choice between two assets with standard deviations of 15.30% each,a returnfor asset A of 10.80%and a returnfor asset B of 9.40%, a

1.

Given the choice between two assets with standard deviations of 15.30% each,a returnfor asset A of 10.80%and a returnfor asset B of 9.40%, a rational investor would choose:

A. asset B.

B. asset A.

C. either asset.

2.

Do not do any interim rounding,calculate values to 6 decimal places before converting to percentages, state the answer to two places, do not use labels (%, $). For example, if the value is 0.06458, the answer is 6.46.

K.J. Lee,CFA,an analyst with Water's Edge Securities,estimates the market risk premium is 6.30% and the risk-free rate is 1.15%. She's calculated the beta for Summerfield Tech as 0.68, and she estimates the expected return is:

3.

Monroe McIntyre has estimated the expected return for BruehlIndustries to be 10.50%. He notes the risk-free rate is 2.10% and the return of the market is 11.40%. Based on this information, he estimates Bruehl's beta to be:

A.0.74.

B.1.13.

C.0.90.

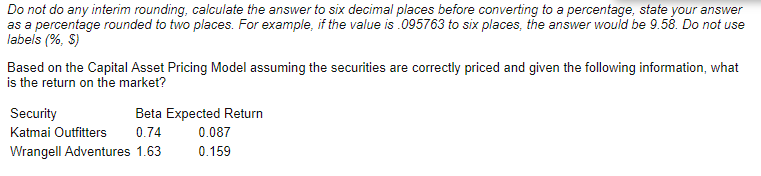

4.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started