Answered step by step

Verified Expert Solution

Question

1 Approved Answer

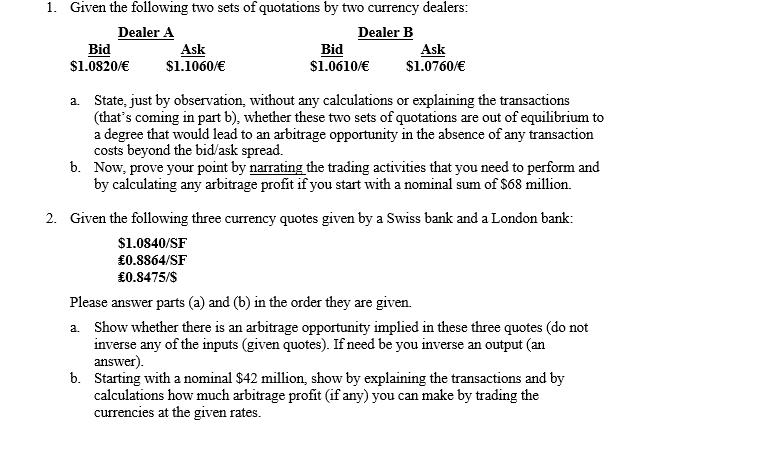

1. Given the following two sets of quotations by two currency dealers: Dealer A Dealer B Bid $1.0820/ Ask $1.1060/ Bid $1.0610/ Ask $1.0760/

1. Given the following two sets of quotations by two currency dealers: Dealer A Dealer B Bid $1.0820/ Ask $1.1060/ Bid $1.0610/ Ask $1.0760/ a. State, just by observation, without any calculations or explaining the transactions (that's coming in part b), whether these two sets of quotations are out of equilibrium to a degree that would lead to an arbitrage opportunity in the absence of any transaction costs beyond the bid/ask spread. b. Now, prove your point by narrating the trading activities that you need to perform and by calculating any arbitrage profit if you start with a nominal sum of $68 million. 2. Given the following three currency quotes given by a Swiss bank and a London bank: $1.0840/SF 0.8864/SF 0.8475/$ Please answer parts (a) and (b) in the order they are given. a. Show whether there is an arbitrage opportunity implied in these three quotes (do not inverse any of the inputs (given quotes). If need be you inverse an output (an answer). b. Starting with a nominal $42 million, show by explaining the transactions and by calculations how much arbitrage profit (if any) you can make by trading the currencies at the given rates.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Given the quotations from Dealer A and Dealer B Dealer A Bid 11060 Ask 10820 Dealer B Bid 10610 Ask 10760 a By observation we can see that the quotati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started