Question

1) Given the information provided in the table above. Assuming that the share of exports and domestic consumption for Energy Power remains unchanged from 2019

1) Given the information provided in the table above.

Assuming that the share of exports and domestic consumption for Energy Power remains unchanged from 2019 to 2020. Estimate: the cash flow in terms of Australian dollars for Energy Power using 2020 exchange rates. (5 Marks)

2) If the export shares/weights, and the sell to Australian producers remain unchanged. Please rank the currencies of China, India and Japan in terms of positive/or negative percentage contributions to the company cashflows from 2019 to 2020. (5 Marks)

3) Assume that the Covid-19 pandemic during 2020 has decreased exports the demand for the company (while keeping Australian demand unchanged). Estimate the revenue (or cash flow) under the following scenarios

a) Exports to Japan declined by 20%, Indian exports declined by 10% and Chinese exports declined by 10%. (4 Marks)

b) Exports to Japan declined by 10%, Indian exports declined by 20% and Chinese exports are unchanged. (4 Marks)

4) Assume that from 2020 to 2021 inflation increases in Australia from 1% to 4% while in other countries inflation remains unchanged for the same period.

a) Explain using the appropriate theories and/or mechanism learned in class what is expected to happen to all bilateral exchange rates. (3 Marks)

b) Explain how higher inflation only in Australia is expected to affect the revenue/cash flow of Energy Power for 2021

(3 Marks)

c) In response to this increase in inflation, the Reserve Bank of Australia (RBA) is expected to act. Explain the likely response for the RBA (under the current scenario), and the expected effect on Energy Power cash flow for 2021.

5) Since the start of the Covid-19 pandemic different forces have affected the Australian/US bilateral exchange rate (AUD). Everything else being equal, explain the mechanisms and effects in which the following changes in the Australian economy (related to the US) would affect the AUD:

-increase in inflation (2 marks) -increase in income (2 marks) -decrease in expected inflation. (2 marks)

That's the whole question. Could you be more detailed about what kind of information you looking for please?

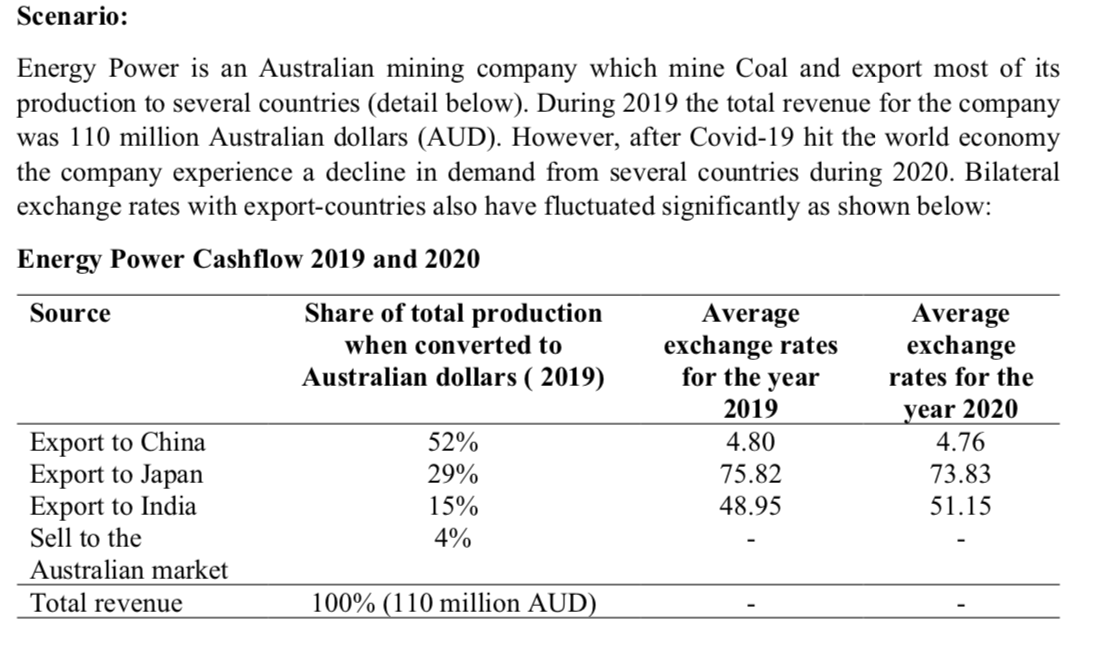

Scenario: Energy Power is an Australian mining company which mine Coal and export most of its production to several countries (detail below). During 2019 the total revenue for the company was 110 million Australian dollars (AUD). However, after Covid-19 hit the world economy the company experience a decline in demand from several countries during 2020. Bilateral exchange rates with export-countries also have fluctuated significantly as shown below: Energy Power Cashflow 2019 and 2020 Source Share of total production Average Average when converted to exchange rates exchange Australian dollars ( 2019) for the year rates for the 2019 Export to China 52% 4.80 4.76 Export to Japan 29% 75.82 73.83 Export to India 15% 48.95 51.15 Sell to the 4% Australian market Total revenue 100% (110 million AUD) year 2020 Scenario: Energy Power is an Australian mining company which mine Coal and export most of its production to several countries (detail below). During 2019 the total revenue for the company was 110 million Australian dollars (AUD). However, after Covid-19 hit the world economy the company experience a decline in demand from several countries during 2020. Bilateral exchange rates with export-countries also have fluctuated significantly as shown below: Energy Power Cashflow 2019 and 2020 Source Share of total production Average Average when converted to exchange rates exchange Australian dollars ( 2019) for the year rates for the 2019 Export to China 52% 4.80 4.76 Export to Japan 29% 75.82 73.83 Export to India 15% 48.95 51.15 Sell to the 4% Australian market Total revenue 100% (110 million AUD) year 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started