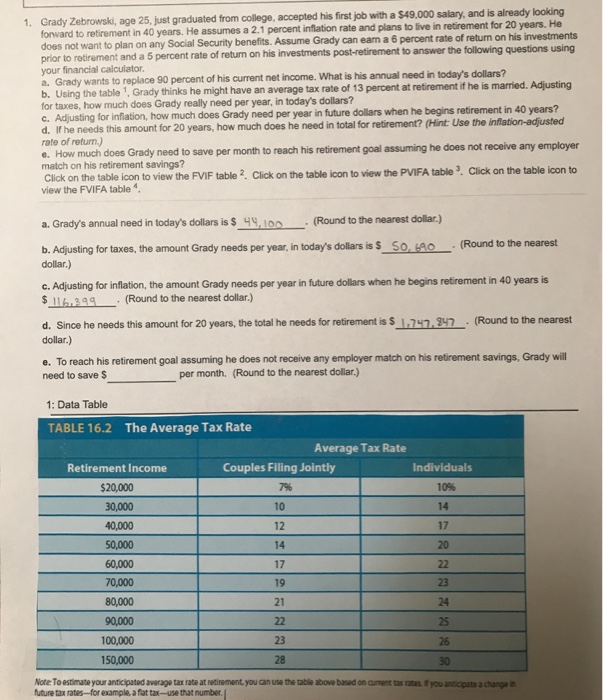

1. Grady Zebrowski, age 25, just graduated from college, acepted his first job with a $49,000 salary, and is already looking to retirement in 40 years. He assumes a 2.1 percent inflation rate and plans to live in does not want to plan on any Social Security benefts. Assume Grady can earm a 6 percent rate of return prior to retirament and a 5 percent rate of return on his investments post-retirement to answer the your financial calculator a. Grady wants to replace 90 percent of his current net income. What is his annual need in today's dollars? the table 1, Grady thinks he might have an average tax rate of 13 percent at retirement if he is married. Adjusting for taxes, how much does Grady really need per year, in today's dollars? c. Adjusting for infiation, how much does Grady need per year i d. If he needs this amount for 20 years, how much does he need in total for retirement? (Hint: Use the inflation-adjusted rate of return.) e. How much does Grady need to save per month to reach his retirement goal assuming he does not receive any employer match on his retirement savings? Click on the table icon to view the FVIF table 2, Click on the table icon to view the PVIFA table 3. Click on the table icon to view the FVIFA table future dollars when he begins retirement in 40 years? a, Grady's annual need in today's dollars is $.410 -(Round to the nearest dolar) b. Adjusting for taxes, the amount Grady needs per year,in today's dollars is S So O(Round to the nearest dollar.) c. Adjusting for inflation, the amount Grady needs per year in future dollars when he begins retirement in 40 years is $ 11 399(Round to the nearest dollar.) (Round to the nearest d. Since he needs this amount for 20 years, the total he needs for retirement is s dollar.) 3n . e. To reach his retirement goal assuming he does not receive any employer match on his retirement savings, Grady will need to save $ per month. (Round to the nearest dollar.) 1: Data Table TABLE 16.2 The Average Tax Rate Average Tax Rate Couples Filing Jointly Individuals Retirement Income $20,000 30,000 40,000 0,000 60,000 10% 14 17 20 12 14 17 19 21 80,000 90,000 100,000 150,000 24 25 26 30 23 28 Note To estimate your anticipated average tax rate at netinement you can use the table above based on cunent tax rates if you antiopata a change in future tax rates-for example, a flat tax-use that number