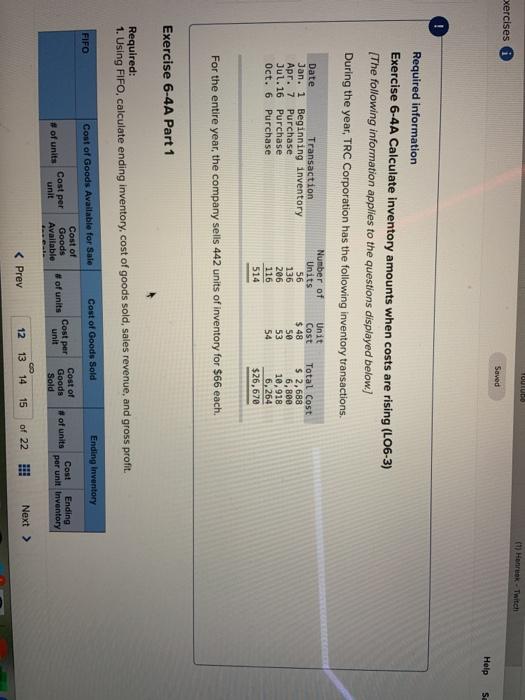

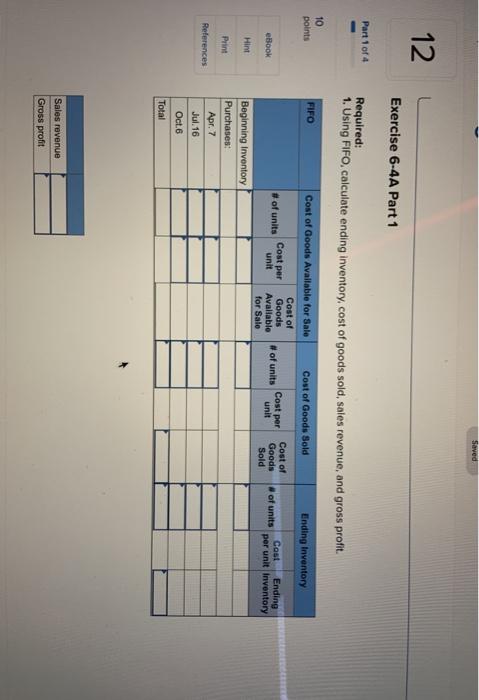

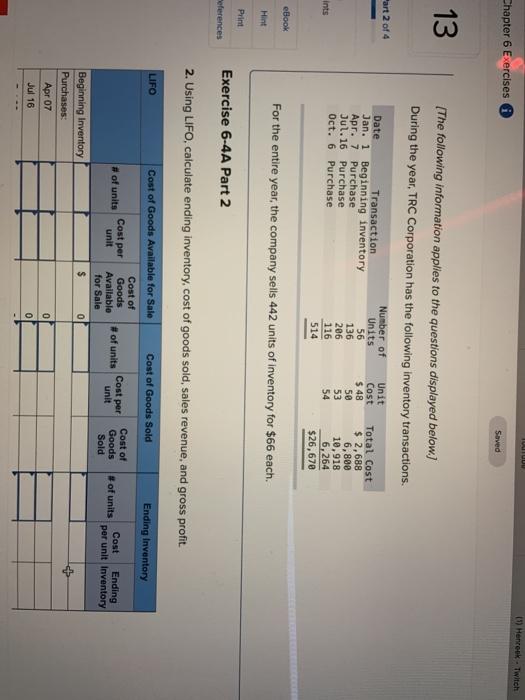

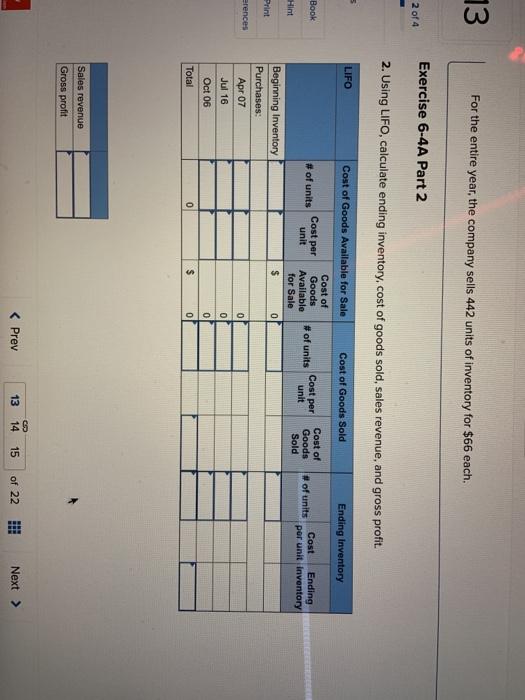

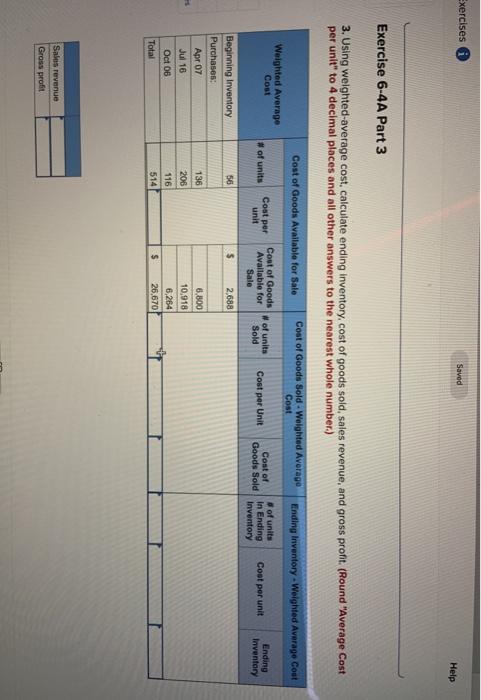

(1) Hanrenk - Twitch exercises Saved Help s ! Required information Exercise 6-4A Calculate inventory amounts when costs are rising (L06-3) [The following information applies to the questions displayed below.] During the year, TRC Corporation has the following inventory transactions. Date Transaction Jan. 1 Beginning inventory Apr. 7 Purchase Jul.16 Purchase Oct. 6 Purchase Number of Units 56 136 206 116 514 Unit Cost $ 48 50 53 54 Total Cost $ 2,688 6,888 18,918 6,264 $26,670 For the entire year, the company sells 442 units of inventory for $66 each. Exercise 6-4A Part 1 Required: 1. Using FIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. Ending Inventory Cost of Goods Sold FIFO Cost of Goods Available for Sale Cost of Goods Available Cost per Cost per unit Cost of Goods Sold # of units # of units # of units Cost Ending per unit Inventory unit Saved 12 Exercise 6-4A Part 1 Part 1 of 4 Required: 1. Using FIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. 10 points FIFO Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory # of units Cost per unit Cost of Goods Avaliable for Sale # of units Cost per eBook unit Cost of Goods Sold of units Cost Ending per unit Inventory Hint Print References Beginning Inventory Purchases: Apr. 7 Jul. 16 Oct.6 Total Sales revenue Gross profit TUTU 11) Herreek - Twitch Chapter 6 Exercises Saved 13 art 2 of 4 [The following information applies to the questions displayed below) During the year, TRC Corporation has the following inventory transactions. Number of Date Unit Transaction Units Jan. 1 Beginning inventory Cost Total Cost 56 $ 48 Apr. 7 Purchase $ 2,688 136 50 Jul. 16 Purchase 6,800 206 53 10,918 Oct. 6 Purchase 116 54 6,264 514 $26,670 Ints eBook For the entire year, the company sells 442 units of inventory for $66 each. Hint Print Exercise 6-4A Part 2 eferences 2. Using LIFO, calculate ending inventory, cost of goods sold, sales revenue and gross profit LIFO Cost of Goods Available for Sale Cost of Cost of Goods Sold Ending Inventory Cost per # of units Cost per #of units unit Cost of Goods Sold unit Goods Available for Sale $ 0 of units Cost Ending per unit Inventory Beginning Inventory Purchases: Apr 07 0 Jul 16 0 13 For the entire year, the company sells 442 units of inventory for $66 each. Exercise 6-4A Part 2 2 of 4 2. Using LIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit. LIFO Cost of Goods Available for Sale Cost of Goods Sold Ending Inventory Book # of units Cost per Cost per unit # of units Cost of Goods Available for Sale s 0 unit Cost of Goods Sold # of units Cost Ending por unit Inventory Hint Print erences Beginning Inventory Purchases: Apr 07 Jul 16 Oct 06 Total Oo oo 0 $ Sales revenue Gross profit