Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Hayward Industries manufactures dining chairs and tables. The controller currently uses traditional costing to allocate overhead to the two product lines based on

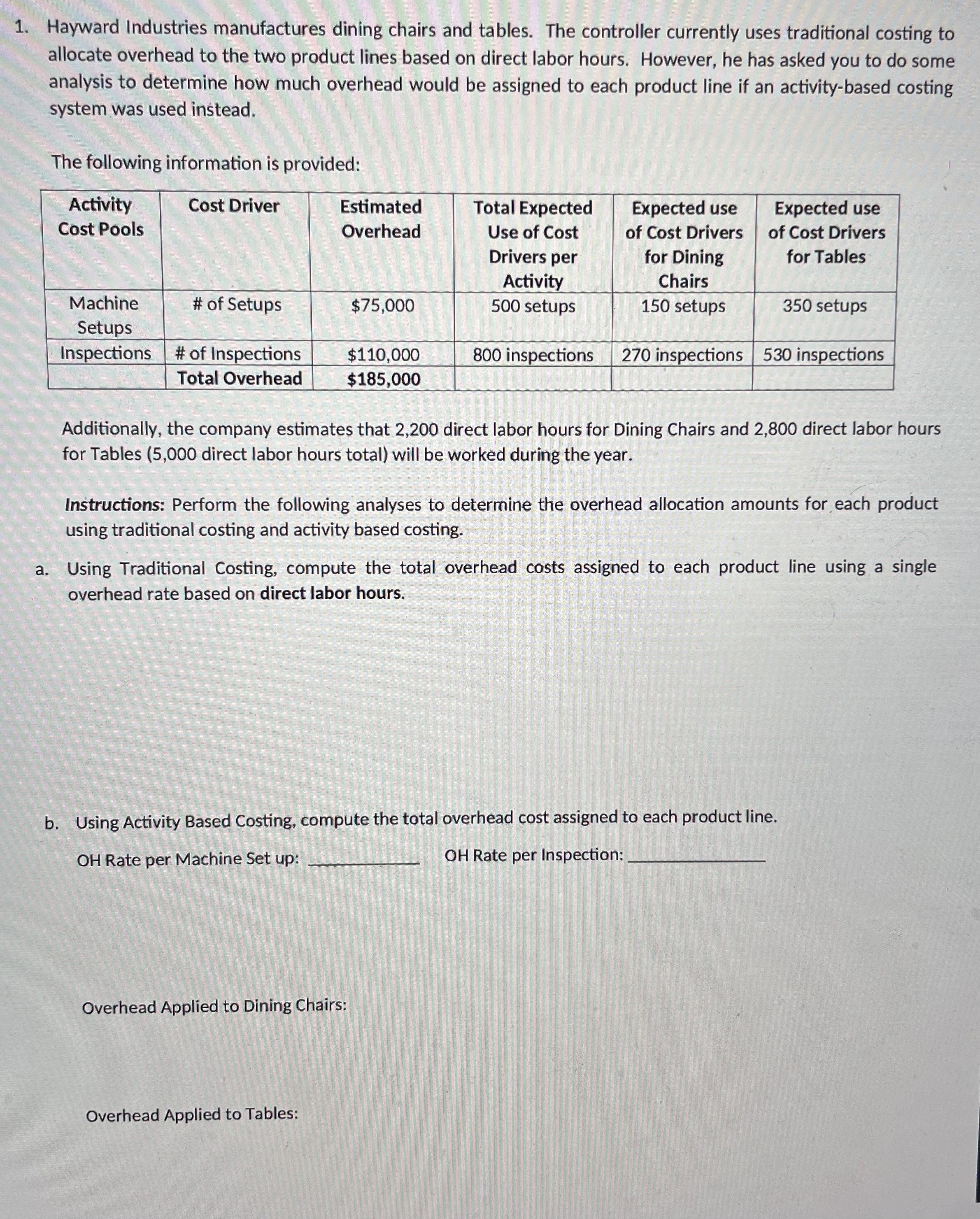

1. Hayward Industries manufactures dining chairs and tables. The controller currently uses traditional costing to allocate overhead to the two product lines based on direct labor hours. However, he has asked you to do some analysis to determine how much overhead would be assigned to each product line if an activity-based costing system was used instead. The following information is provided: Activity Cost Pools Cost Driver Estimated Total Expected Expected use Expected use Overhead Use of Cost of Cost Drivers of Cost Drivers Drivers per Activity Machine Setups # of Setups $75,000 500 setups for Dining Chairs 150 setups for Tables 350 setups Inspections # of Inspections Total Overhead $110,000 $185,000 800 inspections 270 inspections 530 inspections Additionally, the company estimates that 2,200 direct labor hours for Dining Chairs and 2,800 direct labor hours for Tables (5,000 direct labor hours total) will be worked during the year. Instructions: Perform the following analyses to determine the overhead allocation amounts for each product using traditional costing and activity based costing. a. Using Traditional Costing, compute the total overhead costs assigned to each product line using a single overhead rate based on direct labor hours. b. Using Activity Based Costing, compute the total overhead cost assigned to each product line. OH Rate per Machine Set up: Overhead Applied to Dining Chairs: Overhead Applied to Tables: OH Rate per Inspection:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer a Using Traditional Costing Total overhead costs 185000 Total direct labor hours 5000 hours O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started