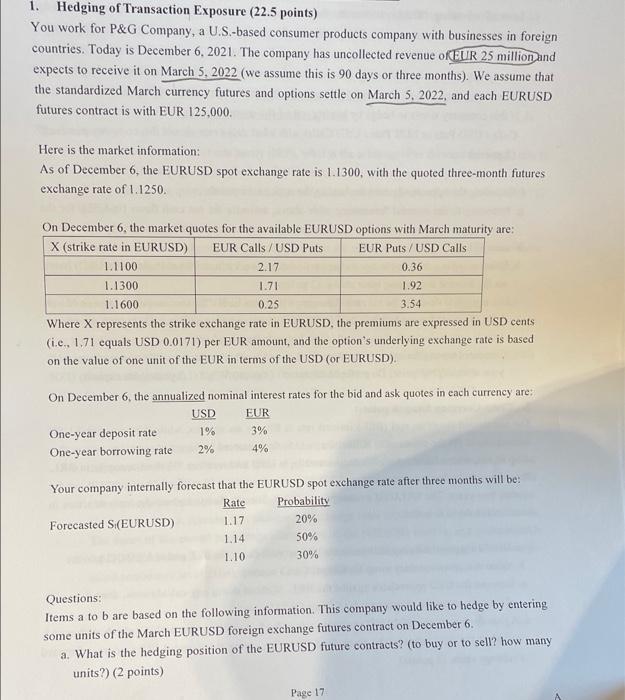

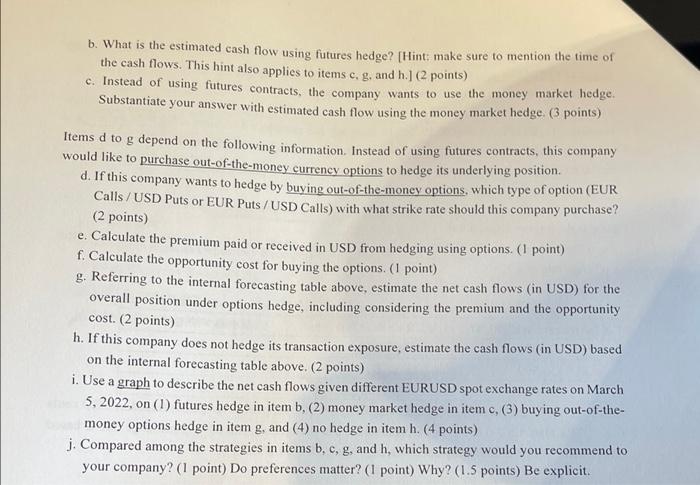

1. Hedging of Transaction Exposure (22.5 points) You work for P&G Company, a U.S.-based consumer products company with businesses in foreign countries. Today is December 6, 2021. The company has uncollected revenue KEUR 25 million and expects to receive it on March 5, 2022 (we assume this is 90 days or three months). We assume that the standardized March currency futures and options settle on March 5, 2022, and each EURUSD futures contract is with EUR 125,000 Here is the market information: As of December 6, the EURUSD spot exchange rate is 1.1300, with the quoted three-month futures exchange rate of 1.1250. On December 6, the market quotes for the available EURUSD options with March maturity are: X (strike rate in EURUSD) EUR Calls /USD Puts EUR Puts/USD Calls 1.1100 2.17 0.36 1.1300 1.71 1.92 1.1600 0.25 3.54 Where X represents the strike exchange rate in EURUSD, the premiums are expressed in USD cents (i.c., 1.71 cquals USD 0.0171) per EUR amount, and the option's underlying exchange rate is based on the value of one unit of the EUR in terms of the USD (or EURUSD). On December 6, the annualized nominal interest rates for the bid and ask quotes in each currency are: USD EUR One-year deposit rate 1% 3% One-year borrowing rate 2% 4% Your company internally forecast that the EURUSD spot exchange rate after three months will be Rate Probability Forecasted S(EURUSD) 1.17 20% 1.14 50% 1.10 30% Questions: Items a to b are based on the following information. This company would like to hedge by entering some units of the March EURUSD foreign exchange futures contract on December 6. a. What is the hedging position of the EURUSD future contracts? (to buy or to sell? how many units?) (2 points) Page 17 b. What is the estimated cash flow using futures hedge? [Hint: make sure to mention the time of the cash flows. This hint also applies to items c. g, and h.)(2 points) c. Instead of using futures contracts, the company wants to use the money market hedge. Substantiate your answer with estimated cash flow using the money market hedge. (3 points) Items d to g depend on the following information. Instead of using futures contracts, this company would like to purchase out-of-the-money currency options to hedge its underlying position. d. If this company wants to hedge by buying out-of-the-money options, which type of option (EUR Calls/USD Puts or EUR Puts /USD Calls) with what strike rate should this company purchase? (2 points) e. Calculate the premium paid or received in USD from hedging using options. (1 point) f. Calculate the opportunity cost for buying the options. (1 point) g. Referring to the internal forecasting table above, estimate the net cash flows (in USD) for the overall position under options hedge, including considering the premium and the opportunity cost. (2 points) h. If this company does not hedge its transaction exposure, estimate the cash flows (in USD) based on the internal forecasting table above. (2 points) i. Use a graph to describe the net cash flows given different EURUSD spot exchange rates on March 5, 2022, on (1) futures hedge in item b, (2) money market hedge in item c, (3) buying out-of-the- money options hedge in item g, and (4) no hedge in item h. (4 points) j. Compared among the strategies in items b, c, g, and h, which strategy would you recommend to your company? (1 point) Do preferences matter? (1 point) Why? (1.5 points) Be explicit 1. Hedging of Transaction Exposure (22.5 points) You work for P&G Company, a U.S.-based consumer products company with businesses in foreign countries. Today is December 6, 2021. The company has uncollected revenue KEUR 25 million and expects to receive it on March 5, 2022 (we assume this is 90 days or three months). We assume that the standardized March currency futures and options settle on March 5, 2022, and each EURUSD futures contract is with EUR 125,000 Here is the market information: As of December 6, the EURUSD spot exchange rate is 1.1300, with the quoted three-month futures exchange rate of 1.1250. On December 6, the market quotes for the available EURUSD options with March maturity are: X (strike rate in EURUSD) EUR Calls /USD Puts EUR Puts/USD Calls 1.1100 2.17 0.36 1.1300 1.71 1.92 1.1600 0.25 3.54 Where X represents the strike exchange rate in EURUSD, the premiums are expressed in USD cents (i.c., 1.71 cquals USD 0.0171) per EUR amount, and the option's underlying exchange rate is based on the value of one unit of the EUR in terms of the USD (or EURUSD). On December 6, the annualized nominal interest rates for the bid and ask quotes in each currency are: USD EUR One-year deposit rate 1% 3% One-year borrowing rate 2% 4% Your company internally forecast that the EURUSD spot exchange rate after three months will be Rate Probability Forecasted S(EURUSD) 1.17 20% 1.14 50% 1.10 30% Questions: Items a to b are based on the following information. This company would like to hedge by entering some units of the March EURUSD foreign exchange futures contract on December 6. a. What is the hedging position of the EURUSD future contracts? (to buy or to sell? how many units?) (2 points) Page 17 b. What is the estimated cash flow using futures hedge? [Hint: make sure to mention the time of the cash flows. This hint also applies to items c. g, and h.)(2 points) c. Instead of using futures contracts, the company wants to use the money market hedge. Substantiate your answer with estimated cash flow using the money market hedge. (3 points) Items d to g depend on the following information. Instead of using futures contracts, this company would like to purchase out-of-the-money currency options to hedge its underlying position. d. If this company wants to hedge by buying out-of-the-money options, which type of option (EUR Calls/USD Puts or EUR Puts /USD Calls) with what strike rate should this company purchase? (2 points) e. Calculate the premium paid or received in USD from hedging using options. (1 point) f. Calculate the opportunity cost for buying the options. (1 point) g. Referring to the internal forecasting table above, estimate the net cash flows (in USD) for the overall position under options hedge, including considering the premium and the opportunity cost. (2 points) h. If this company does not hedge its transaction exposure, estimate the cash flows (in USD) based on the internal forecasting table above. (2 points) i. Use a graph to describe the net cash flows given different EURUSD spot exchange rates on March 5, 2022, on (1) futures hedge in item b, (2) money market hedge in item c, (3) buying out-of-the- money options hedge in item g, and (4) no hedge in item h. (4 points) j. Compared among the strategies in items b, c, g, and h, which strategy would you recommend to your company? (1 point) Do preferences matter? (1 point) Why? (1.5 points) Be explicit