Answered step by step

Verified Expert Solution

Question

1 Approved Answer

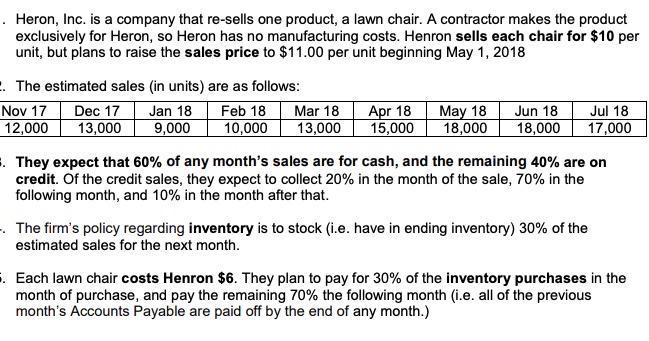

. Heron, Inc. is a company that re-sells one product, a lawn chair. A contractor makes the product exclusively for Heron, so Heron has

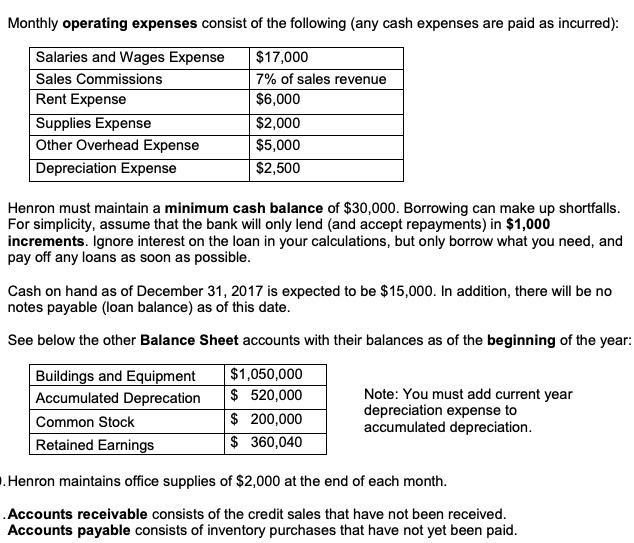

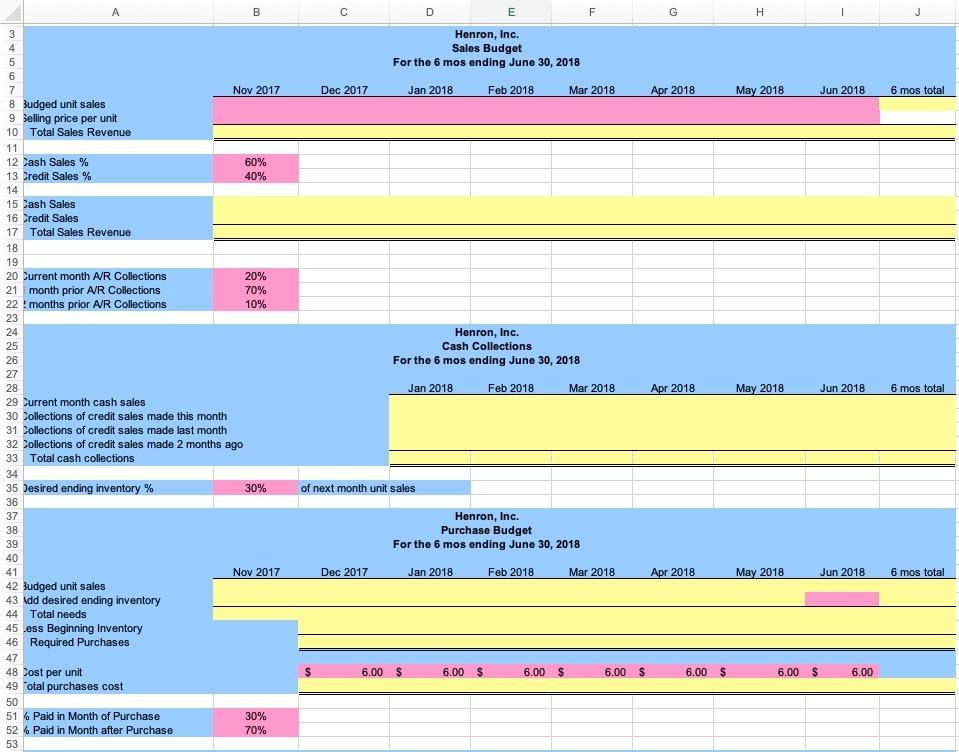

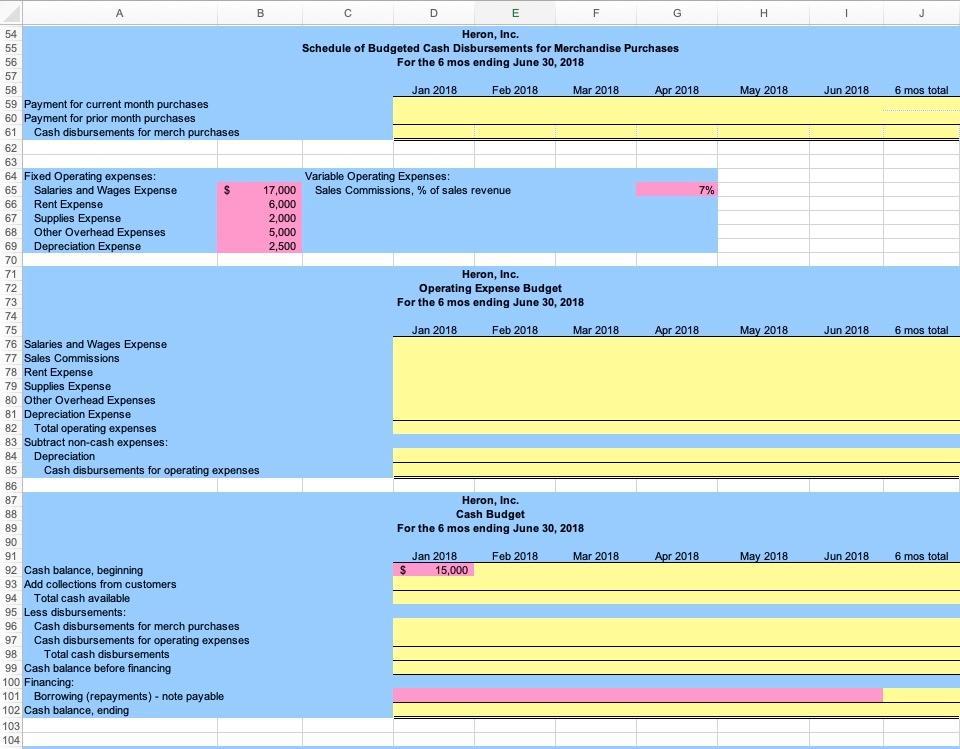

. Heron, Inc. is a company that re-sells one product, a lawn chair. A contractor makes the product exclusively for Heron, so Heron has no manufacturing costs. Henron sells each chair for $10 per unit, but plans to raise the sales price to $11.00 per unit beginning May 1, 2018 2. The estimated sales (in units) are as follows: Dec 17 Jan 18 13,000 9,000 Nov 17 12,000 Feb 18 10,000 Mar 18 13,000 Apr 18 15,000 May 18 Jun 18 18,000 18,000 Jul 18 17,000 . They expect that 60% of any month's sales are for cash, and the remaining 40% are on credit. Of the credit sales, they expect to collect 20% in the month of the sale, 70% in the following month, and 10% in the month after that. The firm's policy regarding inventory is to stock (i.e. have in ending inventory) 30% of the estimated sales for the next month. 5. Each lawn chair costs Henron $6. They plan to pay for 30% of the inventory purchases in the month of purchase, and pay the remaining 70% the following month (i.e. all of the previous month's Accounts Payable are paid off by the end of any month.) Monthly operating expenses consist of the following (any cash expenses are paid as incurred): Salaries and Wages Expense $17,000 Sales Commissions 7% of sales revenue Rent Expense $6,000 $2,000 $5,000 $2,500 Supplies Expense Other Overhead Expense Depreciation Expense Henron must maintain a minimum cash balance of $30,000. Borrowing can make up shortfalls. For simplicity, assume that the bank will only lend (and accept repayments) in $1,000 increments. Ignore interest on the loan in your calculations, but only borrow what you need, and pay off any loans as soon as possible. Cash on hand as of December 31, 2017 is expected to be $15,000. In addition, there will be no notes payable (loan balance) as of this date. See below the other Balance Sheet accounts with their balances as of the beginning of the year: $1,050,000 $ 520,000 $ 200,000 $360,040 Buildings and Equipment Accumulated Deprecation Common Stock Retained Earnings Note: You must add current year depreciation expense to accumulated depreciation. .Henron maintains office supplies of $2,000 at the end of each month. Accounts receivable consists of the credit sales that have not been received. Accounts payable consists of inventory purchases that have not yet been paid. 3 4 5 6 A 7 8 Budged unit sales 9 Selling price per unit 10 Total Sales Revenue 11 12 Cash Sales % 13 Credit Sales % 14 15 Cash Sales 16 Credit Sales 17 Total Sales Revenue 34 35 Desired ending inventory% 36 37 38 39 40 41 42 Budged unit sales 43 Add desired ending inventory 44 Total needs 18 19 20 Current month A/R Collections 21 month prior A/R Collections 22 months prior A/R Collections 23 24 25 26 27 28 29 Current month cash sales 30 Collections of credit sales made this month 31 Collections of credit sales made last month 32 Collections of credit sales made 2 months ago 33 Total cash collections 45 Less Beginning Inventory 46 Required Purchases 47 48 Cost per unit 49 Total purchases cost 50 51 % Paid in Month of Purchase 52 % Paid in Month after Purchase 53 B Nov 2017 60% 40% 20% 70% 10% 30% Nov 2017 30% 70% Dec 2017 $ E Henron, Inc. Sales Budget For the 6 mos ending June 30, 2018 Dec 2017 of next month unit sales Jan 2018 Henron, Inc. Cash Collections For the 6 mos ending June 30, 2018 Jan 2018 Feb 2018 6.00 $ Feb 2018 6.00 $ Henron, Inc. Purchase Budget For the 6 mos ending June 30, 2018 Jan 2018 Feb 2018 Mar 2018 6.00 $ F Mar 2018 Mar 2018 6.00 $ Apr 2018 Apr 2018 Apr 2018 6.00 $ H May 2018 May 2018 May 2018 6.00 $ Jun 2018 Jun 2018 Jun 2018 6.00 6 mos total 6 mos total 6 mos total 54 55 56 57 58 59 Payment for current month purchases 60 Payment for prior month purchases 61 Cash disbursements for merch purchases 85 28348688RFNRNRRERRS583028 64 Fixed Operating expenses: Salaries and Wages Expense Rent Expense 67 Supplies Expense Other Overhead Expenses Depreciation Expense 66 69 70 71 72 73 74 75 76 77 Sales Commissions 78 Rent Expense 87 79 Supplies Expense 80 Other Overhead Expenses 81 Depreciation Expense Total operating expenses 83 Subtract non-cash expenses: Depreciation Cash disbursements for operating expenses 89 90 91 92 Cash balance, beginning 93 Add collections from customers 94 96 95 Less disbursements: 97 Salaries and Wages Expense 98 99 100 101 102 104 Total cash available B Cash disbursements for merch purchases Cash disbursements for operating expenses Total cash disbursements Cash balance before financing Financing: Borrowing (repayments) - note payable Cash balance, ending 17,000 6,000 2,000 5,000 2,500 o E Heron, Inc. Schedule of Budgeted Cash Disbursements for Merchandise Purchases For the 6 mos ending June 30, 2018 Jan 2018 Variable Operating Expenses: Sales Commissions, % of sales revenue Feb 2018 Heron, Inc. Operating Expense Budget For the 6 mos ending June 30, 2018 Jan 2018 Feb 2018 $ Jan 2018 15,000 Heron, Inc. Cash Budget For the 6 mos ending June 30, 2018 FL Mar 2018 Feb 2018 Mar 2018 C Mar 2018 Apr 2018 7% Apr 2018 Apr 2018 H May 2018 May 2018 May 2018 Jun 2018 Jun 2018 6 mos total 6 mos total Jun 2018 6 mos total A 105 106 107 108 109 110 Sales, net 111 Cost of Goods Sold 112 Gross margin 113 Total operating expenses 114 Net Income 115 116 117 118 119 120 Retained Earnings, beginning 121 Add Net Income 122 Retained Earnings, ending 123 Heron, Inc. Budgeted Statement of Retained Earnings For the 6 mos ending June 30, 2018 124 125 126 127 128 Assets: 129 Current Assets: 130 Cash 131 Accounts Receivable 132 Office Supplies 133 134 135 Plant and Equipment: 136 Buildings and Equipment 137 Accumulated Depreciation 138 Total Plant and Equipment 139 Total assets Heron, Inc. Budgeted Balance Sheet As of June 30, 2018 Merchandise Inventory Total Current Assets 140 141 Liabilities: 142 Accounts Payable 143 B 144 Equity: 145 Common Stock 146 Retained Earnings 147 Total Equity 148 Total liabilities and equity 2,000 1,050,000 (520,000) 200,000 C 370,660 E Heron, Inc. Budgeted Income Statement For the 6 mos ending June 30, 2018 D Jan 2018 Feb 2018 F Mar 2018 G Apr 2018 H May 2018 1 Jun 2018 J 6 mos total

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Sales Forecast and Budget Req 1 Budgeted unit sales Selling price per unit Total sales Cash sales Cr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started