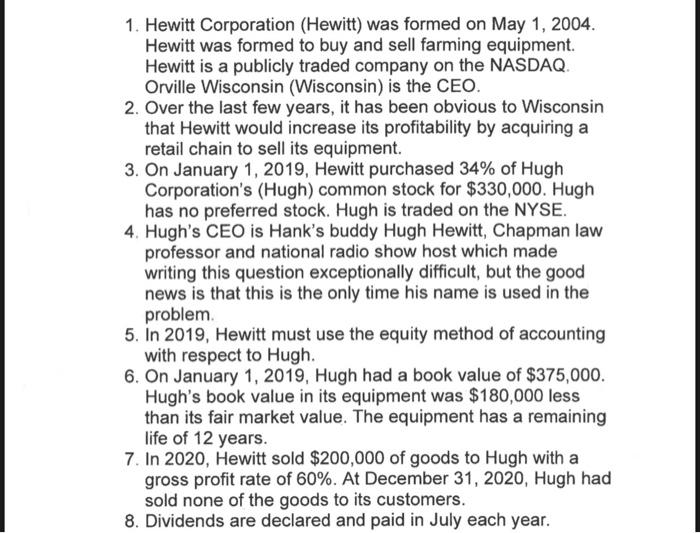

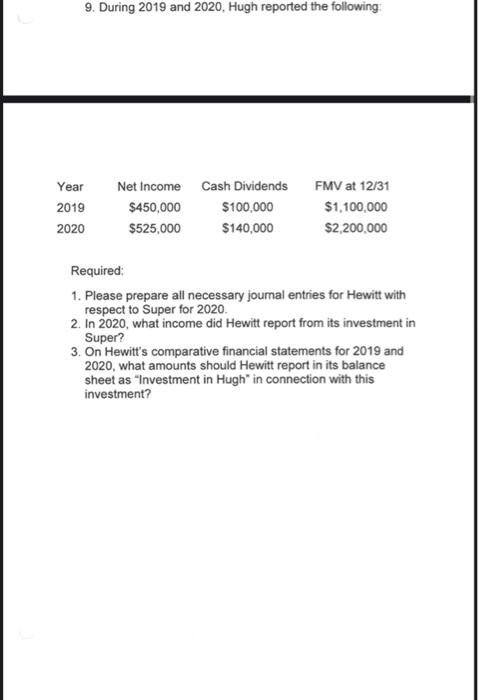

1. Hewitt Corporation (Hewitt) was formed on May 1, 2004. Hewitt was formed to buy and sell farming equipment. Hewitt is a publicly traded company on the NASDAQ. Orville Wisconsin (Wisconsin) is the CEO. 2. Over the last few years, it has been obvious to Wisconsin that Hewitt would increase its profitability by acquiring a retail chain to sell its equipment. 3. On January 1, 2019, Hewitt purchased 34% of Hugh Corporation's (Hugh) common stock for $330,000. Hugh has no preferred stock. Hugh is traded on the NYSE. 4. Hugh's CEO is Hank's buddy Hugh Hewitt, Chapman law professor and national radio show host which made writing this question exceptionally difficult, but the good news is that this is the only time his name is used in the problem 5. In 2019, Hewitt must use the equity method of accounting with respect to Hugh. 6. On January 1, 2019, Hugh had a book value of $375,000. Hugh's book value in its equipment was $180,000 less than its fair market value. The equipment has a remaining life of 12 years. 7. In 2020, Hewitt sold $200,000 of goods to Hugh with a gross profit rate of 60%. At December 31, 2020, Hugh had sold none of the goods to its customers. 8. Dividends are declared and paid in July each year. 9. During 2019 and 2020, Hugh reported the following Year 2019 2020 Net Income Cash Dividends $450,000 $100,000 $525,000 $140,000 FMV at 12/31 $1,100,000 $2,200,000 Required: 1. Please prepare all necessary journal entries for Hewitt with respect to Super for 2020. 2. In 2020, what income did Hewitt report from its investment in Super? 3. On Hewitt's comparative financial statements for 2019 and 2020, what amounts should Hewitt report in its balance sheet as "Investment in Hugh" in connection with this investment? 3. On Hewitt's comparative financial statements for 2019 and 2020, what amounts should Hewitt report in its balance sheet as "Investment in Hugh' in connection with this investment? 3 of 3 1. Hewitt Corporation (Hewitt) was formed on May 1, 2004. Hewitt was formed to buy and sell farming equipment. Hewitt is a publicly traded company on the NASDAQ. Orville Wisconsin (Wisconsin) is the CEO. 2. Over the last few years, it has been obvious to Wisconsin that Hewitt would increase its profitability by acquiring a retail chain to sell its equipment. 3. On January 1, 2019, Hewitt purchased 34% of Hugh Corporation's (Hugh) common stock for $330,000. Hugh has no preferred stock. Hugh is traded on the NYSE. 4. Hugh's CEO is Hank's buddy Hugh Hewitt, Chapman law professor and national radio show host which made writing this question exceptionally difficult, but the good news is that this is the only time his name is used in the problem 5. In 2019, Hewitt must use the equity method of accounting with respect to Hugh. 6. On January 1, 2019, Hugh had a book value of $375,000. Hugh's book value in its equipment was $180,000 less than its fair market value. The equipment has a remaining life of 12 years. 7. In 2020, Hewitt sold $200,000 of goods to Hugh with a gross profit rate of 60%. At December 31, 2020, Hugh had sold none of the goods to its customers. 8. Dividends are declared and paid in July each year. 9. During 2019 and 2020, Hugh reported the following Year 2019 2020 Net Income Cash Dividends $450,000 $100,000 $525,000 $140,000 FMV at 12/31 $1,100,000 $2,200,000 Required: 1. Please prepare all necessary journal entries for Hewitt with respect to Super for 2020. 2. In 2020, what income did Hewitt report from its investment in Super? 3. On Hewitt's comparative financial statements for 2019 and 2020, what amounts should Hewitt report in its balance sheet as "Investment in Hugh" in connection with this investment? 3. On Hewitt's comparative financial statements for 2019 and 2020, what amounts should Hewitt report in its balance sheet as "Investment in Hugh' in connection with this investment? 3 of 3