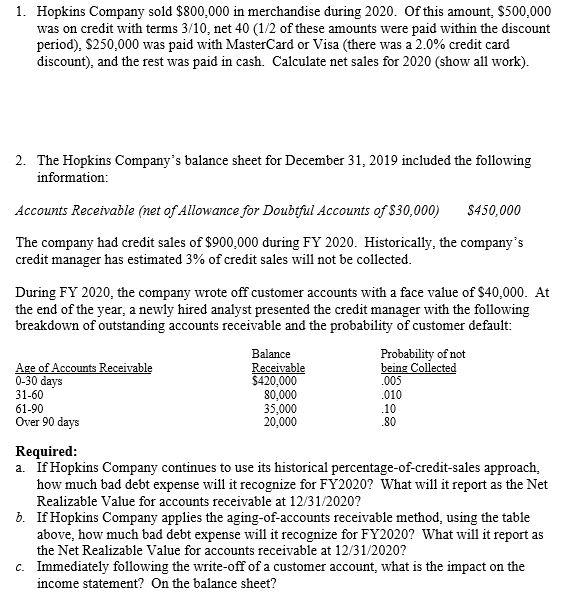

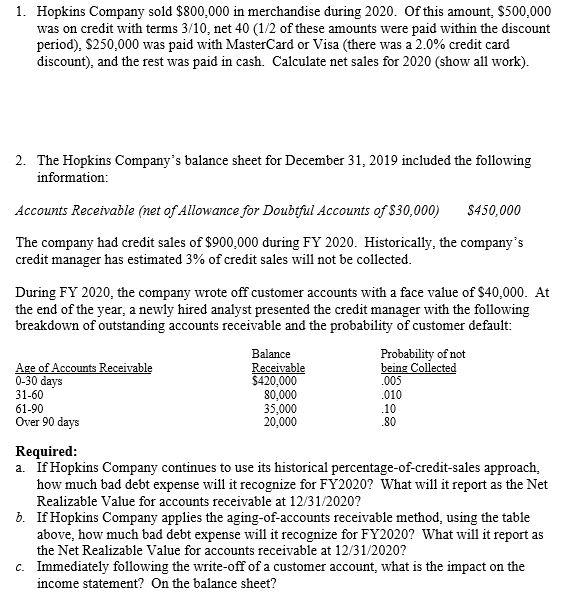

1. Hopkins Company sold $800,000 in merchandise during 2020. Of this amount, $500,000 was on credit with terms 3/10, net 40 (1/2 of these amounts were paid within the discount period), $250,000 was paid with MasterCard or Visa (there was a 2.0% credit card discount), and the rest was paid in cash. Calculate net sales for 2020 (show all work). 2. The Hopkins Company's balance sheet for December 31, 2019 included the following information: Accounts Receivable (net of Allowance for Doubtful Accounts of $30,000) $450,000 The company had credit sales of $900.000 during FY 2020. Historically, the company's credit manager has estimated 3% of credit sales will not be collected. During FY 2020, the company wrote off customer accounts with a face value of $40,000. At the end of the year, a newly hired analyst presented the credit manager with the following breakdown of outstanding accounts receivable and the probability of customer default: Balance Probability of not Age of Accounts Receivable Receivable being Collected 0-30 days $420,000 31-60 80,000 61-90 35,000 Over 90 days 20,000 Required: a. If Hopkins Company continues to use its historical percentage-of-credit-sales approach, how much bad debt expense will it recognize for FY2020? What will it report as the Net Realizable Value for accounts receivable at 12/31/2020? b. If Hopkins Company applies the aging-of-accounts receivable method, using the table above, how much bad debt expense will it recognize for FY2020? What will it report as the Net Realizable Value for accounts receivable at 12/31/2020? c. Immediately following the write-off of a customer account, what is the impact on the income statement? On the balance sheet? .005 .010 .10 .80 1. Hopkins Company sold $800,000 in merchandise during 2020. Of this amount, $500,000 was on credit with terms 3/10, net 40 (1/2 of these amounts were paid within the discount period), $250,000 was paid with MasterCard or Visa (there was a 2.0% credit card discount), and the rest was paid in cash. Calculate net sales for 2020 (show all work). 2. The Hopkins Company's balance sheet for December 31, 2019 included the following information: Accounts Receivable (net of Allowance for Doubtful Accounts of $30,000) $450,000 The company had credit sales of $900.000 during FY 2020. Historically, the company's credit manager has estimated 3% of credit sales will not be collected. During FY 2020, the company wrote off customer accounts with a face value of $40,000. At the end of the year, a newly hired analyst presented the credit manager with the following breakdown of outstanding accounts receivable and the probability of customer default: Balance Probability of not Age of Accounts Receivable Receivable being Collected 0-30 days $420,000 31-60 80,000 61-90 35,000 Over 90 days 20,000 Required: a. If Hopkins Company continues to use its historical percentage-of-credit-sales approach, how much bad debt expense will it recognize for FY2020? What will it report as the Net Realizable Value for accounts receivable at 12/31/2020? b. If Hopkins Company applies the aging-of-accounts receivable method, using the table above, how much bad debt expense will it recognize for FY2020? What will it report as the Net Realizable Value for accounts receivable at 12/31/2020? c. Immediately following the write-off of a customer account, what is the impact on the income statement? On the balance sheet? .005 .010 .10 .80