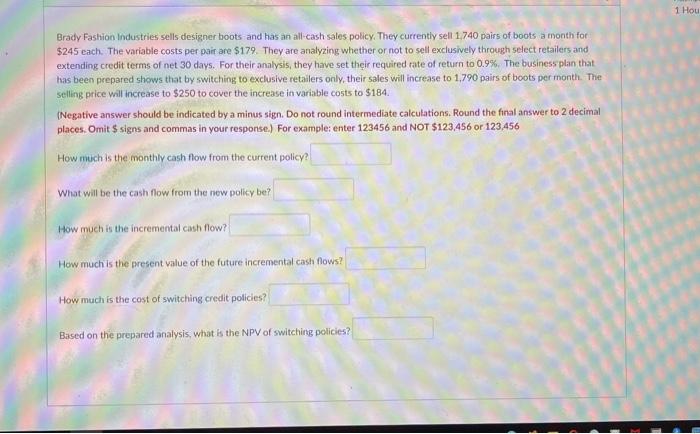

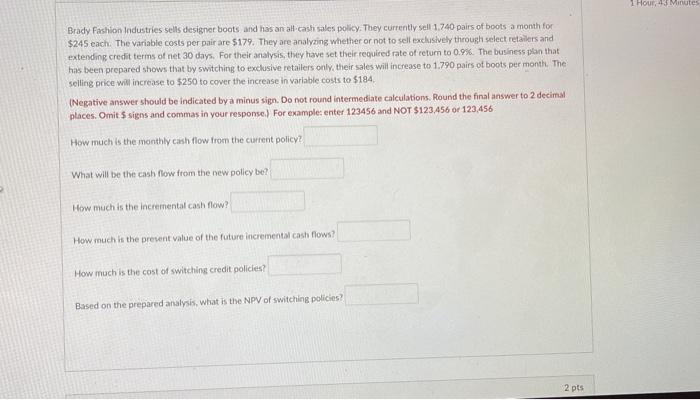

1 Hou Brady Fashion Industries sells designer boots and has an all-cash sales policy. They currently sell 1.740 pairs of boots a month for $245 each. The variable costs per pair are $179. They are analyzing whether or not to sell exclusively through select retailers and extending credit terms of net 30 days. For their analysis, they have set their required rate of return to 0.9%. The business plan that has been prepared shows that by switching to exclusive retailers only, their sales will increase to 1,790 pairs of boots per month. The selling price will increase to $250 to cover the increase in variable costs to $184. (Negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ signs and commas in your response.) For example: enter 123456 and NOT $123,456 or 123,456 How much is the monthly cash flow from the current policy? What will be the cash flow from the new policy be? How much is the incremental cash flow? How much is the present value of the future incremental cash flows? How much is the cost of switching credit policies? Based on the prepared analysis, what is the NPV of switching policies? 1 Hour 1 Minutes Brady Fashion Industries sells designer boots and has an all cash sales policy. They currently sell 1.740 pairs of boots a month for $245 each. The variable costs per pair are $179. They are analyzing whether or not to sell exclusively through select retailers and extending credit terms of net 30 days. For their analysis, they have set their required rate of return to 0.9%. The business plan that has been prepared shows that by switching to exclusive retailers only their sales will increase to 1.790 pairs of boots per month The selling price will increase to $250 to cover the increase in variable costs to $184 (Negative answer should be indicated by a minus sign. Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ signs and commas in your response.) For example: enter 123456 and NOT $123,456 of 123,456 How much is the monthly cash flow from the current policy? What will be the cash flow from the new policy be? How much is the incremental cash flow? How much is the present value of the future incremental cash flows? How much is the cost of switching credit policies? Based on the prepared analysis, what is the NPV of switching policies? 2 pts