Question

1. How did the Lessor Company arrive at a $11,923 payment amount using the initial facts of the exercise? 2. How did the Lessor Company

1. How did the Lessor Company arrive at a $11,923 payment amount using the initial facts of the exercise?

1. How did the Lessor Company arrive at a $11,923 payment amount using the initial facts of the exercise?

2. How did the Lessor Company arrive at a $11,923 payment amount using the facts in Part D of the exercise?

3. Assume the same Fair Value and interest rates but the residual value is unguaranteed.

a) What payment would the Lessor expect from the Lessee?

b) At what amount would the RUA and the lease liability be recorded for the Lessee?

4. Assume same Fair Value, interest rates, lease term and residual value, but there is a bargain purchase option of $6,500 available for exercise at the end of the lease term.

a) What payment would the Lessor expect from the lease?

b) At what amount would the RUA and the lease liability be recorded for the Lessee?

(Please Show All Work)

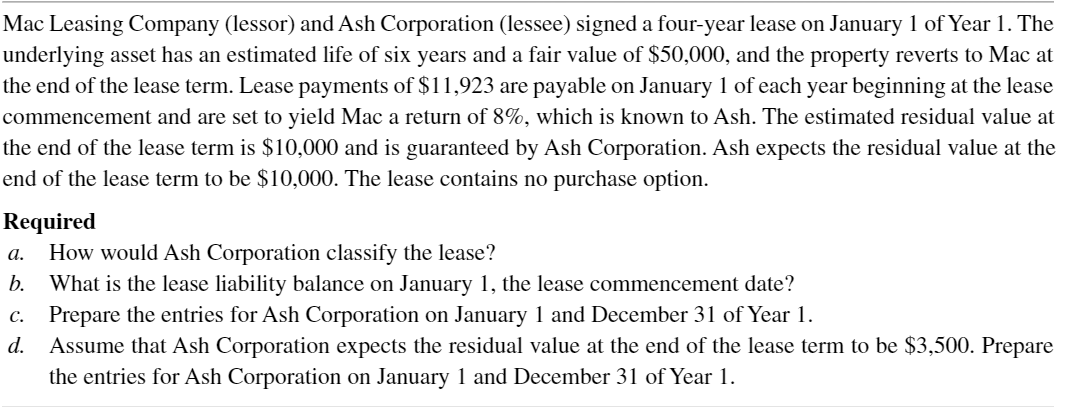

Mac Leasing Company (lessor) and Ash Corporation (lessee) signed a four-year lease on January 1 of Year 1 . The underlying asset has an estimated life of six years and a fair value of $50,000, and the property reverts to Mac at the end of the lease term. Lease payments of $11,923 are payable on January 1 of each year beginning at the lease commencement and are set to yield Mac a return of 8%, which is known to Ash. The estimated residual value at the end of the lease term is $10,000 and is guaranteed by Ash Corporation. Ash expects the residual value at the end of the lease term to be $10,000. The lease contains no purchase option. Required a. How would Ash Corporation classify the lease? b. What is the lease liability balance on January 1 , the lease commencement date? c. Prepare the entries for Ash Corporation on January 1 and December 31 of Year 1. d. Assume that Ash Corporation expects the residual value at the end of the lease term to be $3,500. Prepare the entries for Ash Corporation on January 1 and December 31 of Year 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started