Required: 1. How did the spill-related costs recognized by BP in its financial statements through 2014 differ from a statistical estimate of the total expected

Required:

1. How did the spill-related costs recognized by BP in its financial statements through 2014 differ from a statistical estimate of the total expected costs that the company's senior management might have prepared and used internally over the same time frame?

a) For each category of contingent liability - environmental, litigation and claims, and Clean Water Act penalties - BP asserts that is not possible to reliability estimate the full extent of the company's ultimate economic exposure. Identify a specific reason for this uncertainty for each category.

b) Why did BP maintain the $3,150 million provision for the penalty it will have to pay under the U.S. Clean Water Act after the district court's finding of gross negligence and willful misconduct called this amount into question?

c) In 2015 and 2016, BP recognized additional spill-related costs of $18.6 billion, bringing the total cumulative costs recognized across the four categories to over $66 billion. Based on the above information, make an informed guess about how these newly recognized costs were distributed across the four cost categories. How might accounting recognition and disclosure of contingent liabilities be improved to enable readers to formulate better estimates?

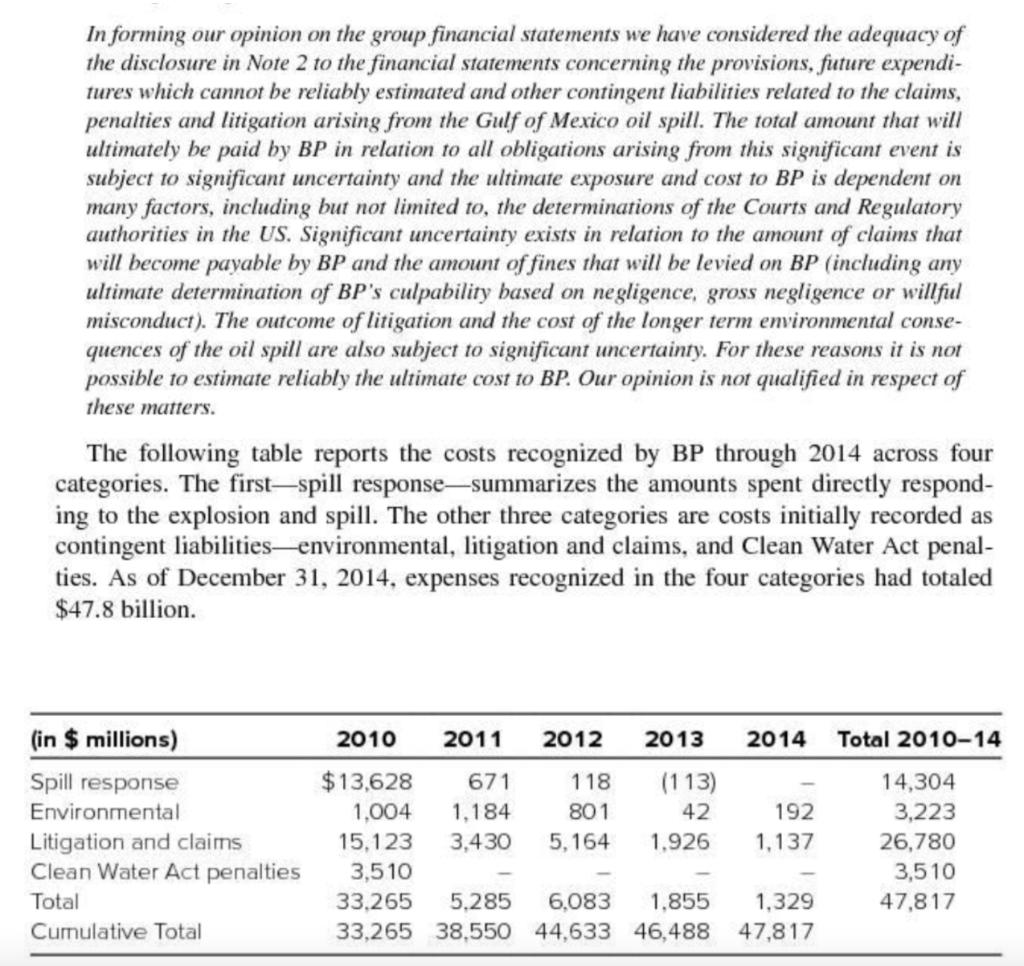

On April 20, 2010, an explosion at BP PLC's Macondo well in the Gulf of Mexico caused the largest oil spill and one of the worst environmental disasters in U.S. history. Because the incident occurred at the Deepwater Horizon drilling rig, this incident is often referred to as the Deepwater Horizon spill. Approximately 4.9 million barrels of oil were released, threatening the marine environment of the Gulf of Mexico as well as the environment and communities of the Gulf Coast region of the United States. In addition, 11 workers died and 17 were injured in the explosion. While BP bore primary legal responsibility for the spill, Transocean Corporation (the drilling rig operator) and Halliburton Company (the construction contractor) were also held partially responsible. The spill's financial costs to BP were enormous but also highly uncertain in the years that followed. Initially, the company incurred large costs to respond to the explosion and contain the spill. As time passed, the disaster set in motion a complex set of investigations and court cases that resulted in numerous fines and damage awards. In addition, BP made expensive commitments to support various environmental initiatives in the Gulf Cost region. BP-formerly named British Petroleum and headquartered in London-reports under IFRS and accounted for many of the spill's costs using IAS 37, Provisions, Contingent Liabilities, and Contingent Assets. As noted earlier in this chapter, IAS 37 requires accrual of contingent liabilities when they are probable and can be reliably estimated. From the 2010 fiscal year onward, the company disclosed among its significant judgments and esti- mates those required to account for the spill under IAS 37. Through 2014, KPMG, BP's auditor, included warnings of the uncertainties presented by these contingent liabilities in its auditor's reports. The following passage taken from KPMG's audit opinion in the 2014 annual report expresses these concerns:

Step by Step Solution

3.55 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

1 Although statistical estimates factor into the recognition of contingent liabilities accounting rules preclude recognition of contingent liabilities that are either less than probable or cannot be r...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started