Answered step by step

Verified Expert Solution

Question

1 Approved Answer

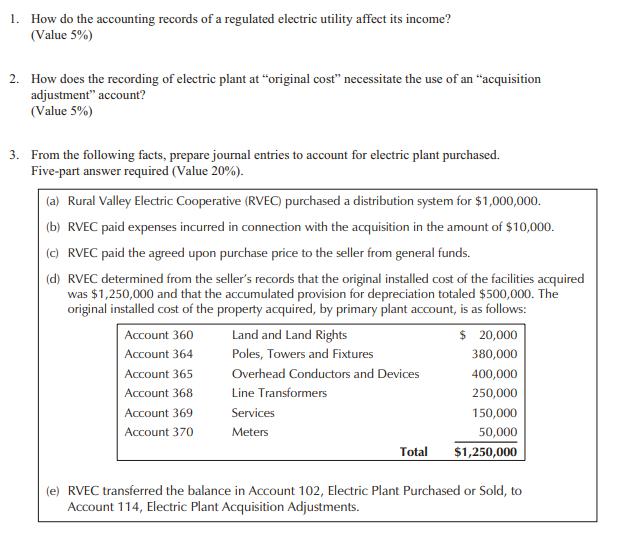

1. How do the accounting records of a regulated electric utility affect its income? (Value 5%) 2. How does the recording of electric plant

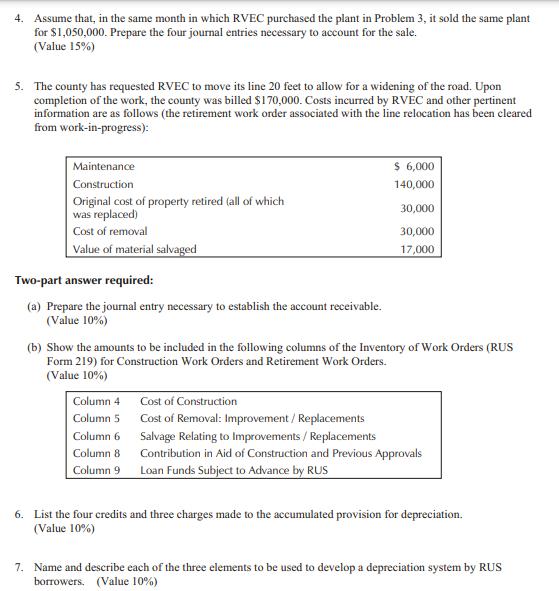

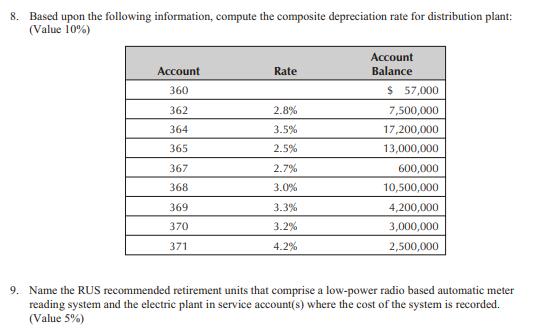

1. How do the accounting records of a regulated electric utility affect its income? (Value 5%) 2. How does the recording of electric plant at "original cost" necessitate the use of an "acquisition adjustment" account? (Value 5%) 3. From the following facts, prepare journal entries to account for electric plant purchased. Five-part answer required (Value 20%). (a) Rural Valley Electric Cooperative (RVEC) purchased a distribution system for $1,000,000. (b) RVEC paid expenses incurred in connection with the acquisition in the amount of $10,000. (c) RVEC paid the agreed upon purchase price to the seller from general funds. I cost (d) RVEC determined from the seller's records that the original installed cost of the facilities acquired was $1,250,000 and that the accumulated provision for depreciation totaled $500,000. The original installed cost of the property acquired, by primary plant account, is as follows: Land and Land Rights $ 20,000 Account 360 Account 364 Poles, Towers and Fixtures 380,000 Account 365 Overhead Conductors and Devices 400,000 Account 368 Line Transformers 250,000 Account 369 Services 150,000 Account 370 Meters 50,000 Total $1,250,000 (e) RVEC transferred the balance in Account 102, Electric Plant Purchased or Sold, to Account 114, Electric Plant Acquisition Adjustments. 4. Assume that, in the same month in which RVEC purchased the plant in Problem 3, it sold the same plant for $1,050,000. Prepare the four journal entries necessary to account for the sale. (Value 15%) 5. The county has requested RVEC to move its line 20 feet to allow for a widening of the road. Upon completion of the work, the county was billed $170,000. Costs incurred by RVEC and other pertinent information are as follows (the retirement work order associated with the line relocation has been cleared from work-in-progress): Maintenance $ 6,000 Construction 140,000 Original cost of property retired (all of which was replaced) 30,000 Cost of removal 30,000 Value of material salvaged 17,000 Two-part answer required: (a) Prepare the journal entry necessary to establish the account receivable. (Value 10%) (b) Show the amounts to be included in the following columns of the Inventory of Work Orders (RUS Form 219) for Construction Work Orders and Retirement Work Orders. (Value 10%) Column 4 Cost of Construction Column 5 Cost of Removal: Improvement / Replacements Column 6 Salvage Relating to Improvements / Replacements Contribution in Aid of Construction and Previous Approvals Column 8 Column 9 Loan Funds Subject to Advance by RUS 6. List the four credits and three charges made to the accumulated provision for depreciation. (Value 10%) 7. Name and describe each of the three elements to be used to develop a depreciation system by RUS borrowers. (Value 10%) 8. Based upon the following information, compute the composite depreciation rate for distribution plant: (Value 10%) Account Account Rate Balance 360 $ 57,000 362 2.8% 7,500,000 364 3.5% 17,200,000 365 2.5% 13,000,000 367 2.7% 600,000 368 3.0% 10,500,000 369 3.3% 4,200,000 370 3.2% 3,000,000 371 4.2% 2,500,000 9. Name the RUS recommended retirement units that comprise a low-power radio based automatic meter reading system and the electric plant in service account(s) where the cost of the system is recorded. (Value 5%)

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Lesson 9 Technical Concepts of RUS Electric Borrower Accounting Question 1 The Utility of accounting standards improves the reliance and credibility o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

625e7e6108187_99806.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started