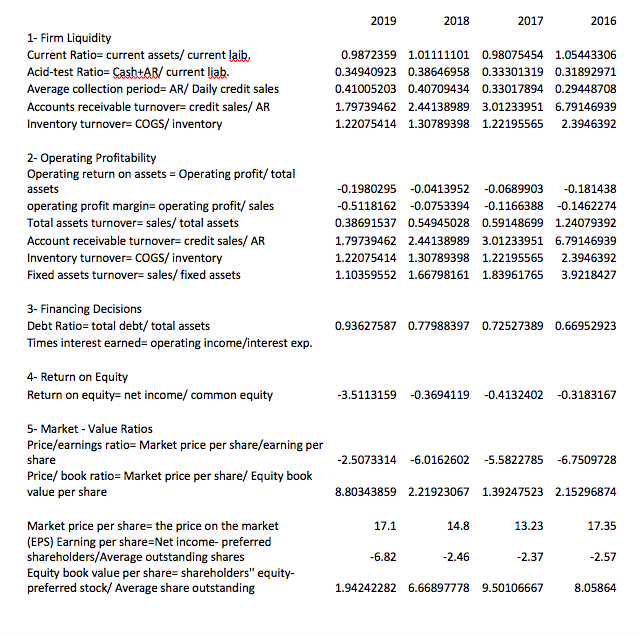

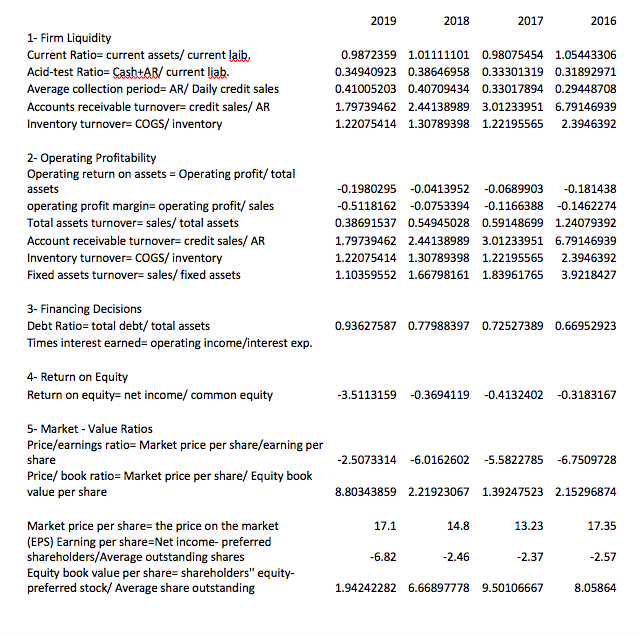

1- How is the Liquidity for this company for 4 years

2-the profitability for this company for 4 years

3-Asset Management and Long Term Liabilities

4-Recommendations

2019 2018 2017 2016 1- Firm Liquidity Current Ratio= current assets/ current laib. Acid-test Ratio=Cash+AR/ current liab. Average collection period= AR/ Daily credit sales Accounts receivable turnover=credit sales/ AR Inventory turnover=COGS/ inventory 0.9872359 1.01111101 0.98075454 1.05443306 0.34940923 0.38646958 0.33301319 0.31892971 0.41005203 0.40709434 0.33017894 0.29448708 1.79739462 2.44138989 3.01233951 6.79146939 1.22075414 1.30789398 1.22195565 2.3946392 2- Operating Profitability Operating return on assets = Operating profit/total assets operating profit margin= operating profit/ sales Total assets turnover=sales/ total assets Account receivable turnover=credit sales/ AR Inventory turnover=COGS/ inventory Fixed assets turnover= sales/fixed assets -0.1980295 -0.0413952 -0.0689903 -0.181438 -0.5118162 -0.0753394 -0.1166388 -0.1462274 0.38691537 0.54945028 0.59148699 1.24079392 1.79739462 2.44138989 3.01233951 6.79146939 1.22075414 1.30789398 1.22195565 2.3946392 1.10359552 1.66798161 1.83961765 3.9218427 3- Financing Decisions Debt Ratio total debt/total assets Times interest earned= operating income/interest exp. 0.93627587 0.77988397 0.72527389 0.66952923 4- Return on Equity Return on equity= net income/common equity -3.5113159 -0.3694119 -0.4132402 -0.3183167 5- Market - Value Ratios Price/earnings ratio=Market price per share/earning per share Price/ book ratio= Market price per share/Equity book value per share -2.5073314 -6.0162602 -5.5822785 -6.7509728 8.80343859 2.21923067 1.39247523 2.15296874 17.1 14.8 13.23 17.35 Market price per shares the price on the market (EPS) Earning per share=Net income-preferred shareholders/Average outstanding shares Equity book value per share= shareholders" equity- preferred stock/ Average share outstanding -6.82 -2.46 -2.37 -2.57 1.94242282 6.66897778 9.50106667 8.05864 2019 2018 2017 2016 1- Firm Liquidity Current Ratio= current assets/ current laib. Acid-test Ratio=Cash+AR/ current liab. Average collection period= AR/ Daily credit sales Accounts receivable turnover=credit sales/ AR Inventory turnover=COGS/ inventory 0.9872359 1.01111101 0.98075454 1.05443306 0.34940923 0.38646958 0.33301319 0.31892971 0.41005203 0.40709434 0.33017894 0.29448708 1.79739462 2.44138989 3.01233951 6.79146939 1.22075414 1.30789398 1.22195565 2.3946392 2- Operating Profitability Operating return on assets = Operating profit/total assets operating profit margin= operating profit/ sales Total assets turnover=sales/ total assets Account receivable turnover=credit sales/ AR Inventory turnover=COGS/ inventory Fixed assets turnover= sales/fixed assets -0.1980295 -0.0413952 -0.0689903 -0.181438 -0.5118162 -0.0753394 -0.1166388 -0.1462274 0.38691537 0.54945028 0.59148699 1.24079392 1.79739462 2.44138989 3.01233951 6.79146939 1.22075414 1.30789398 1.22195565 2.3946392 1.10359552 1.66798161 1.83961765 3.9218427 3- Financing Decisions Debt Ratio total debt/total assets Times interest earned= operating income/interest exp. 0.93627587 0.77988397 0.72527389 0.66952923 4- Return on Equity Return on equity= net income/common equity -3.5113159 -0.3694119 -0.4132402 -0.3183167 5- Market - Value Ratios Price/earnings ratio=Market price per share/earning per share Price/ book ratio= Market price per share/Equity book value per share -2.5073314 -6.0162602 -5.5822785 -6.7509728 8.80343859 2.21923067 1.39247523 2.15296874 17.1 14.8 13.23 17.35 Market price per shares the price on the market (EPS) Earning per share=Net income-preferred shareholders/Average outstanding shares Equity book value per share= shareholders" equity- preferred stock/ Average share outstanding -6.82 -2.46 -2.37 -2.57 1.94242282 6.66897778 9.50106667 8.05864