Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. How many cakes would Lady M need to sell in a year in order to break-even? Does this number seem feasible? 2. Assuming

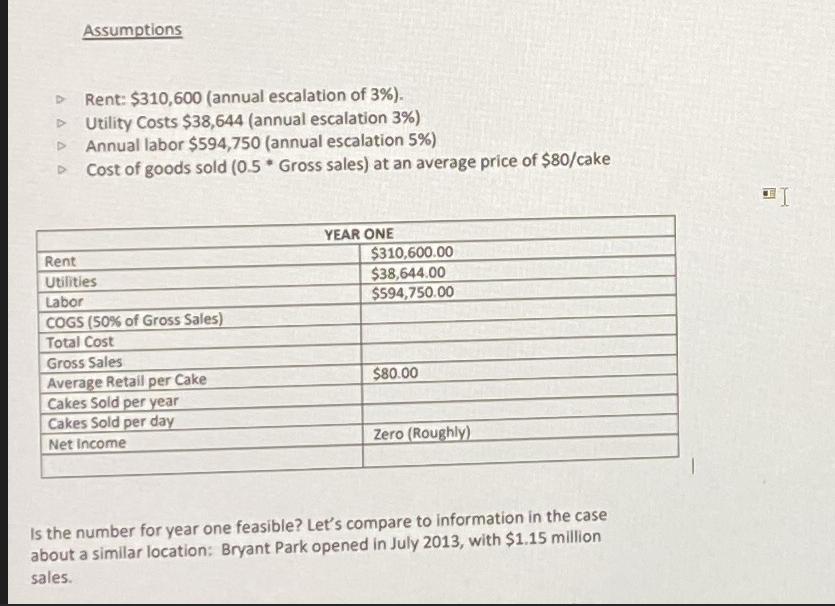

1. How many cakes would Lady M need to sell in a year in order to break-even? Does this number seem feasible? 2. Assuming sales in year one are break-even, how quickly would sales need to grow after the first year to pay the start-up costs within 5 years? Is this growth rate feasible? 3. What is your recommendation? Should Romaniszyn open the new location in the World Trade Center? Assumptions D Rent: $310,600 (annual escalation of 3%). Utility Costs $38,644 (annual escalation 3%) Annual labor $594,750 (annual escalation 5%) Cost of goods sold (0.5 Gross sales) at an average price of $80/cake A D Assumptions Rent: $310,600 (annual escalation of 3%). Utility Costs $38,644 (annual escalation 3%) Annual labor $594,750 (annual escalation 5%) Cost of goods sold (0.5 Gross sales) at an average price of $80/cake Rent Utilities Labor COGS (50% of Gross Sales) Total Cost Gross Sales Average Retail per Cake Cakes Sold per year Cakes Sold per day Net Income YEAR ONE $310,600.00 $38,644.00 $594,750.00 $80.00 Zero (Roughly) Is the number for year one feasible? Let's compare to information in the case about a similar location: Bryant Park opened in July 2013, with $1.15 million sales. I

Step by Step Solution

★★★★★

3.30 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To answer your questions well need to calculate the breakeven point assess the growth rate required to cover startup costs within five years and evalu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started