Answered step by step

Verified Expert Solution

Question

1 Approved Answer

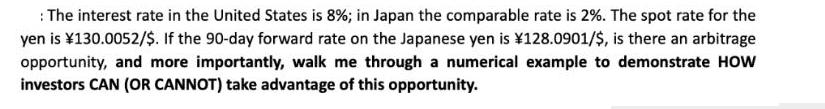

: The interest rate in the United States is 8%; in Japan the comparable rate is 2%. The spot rate for the yen is

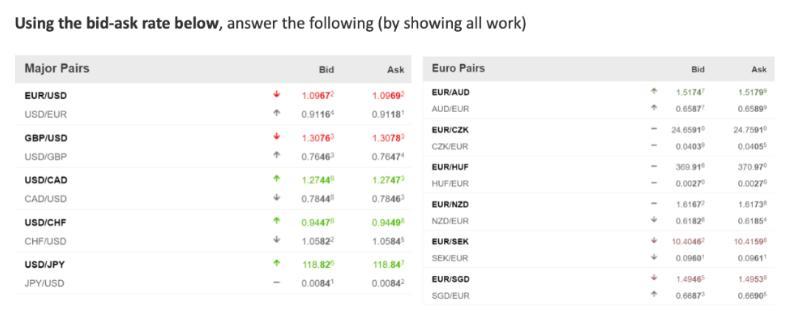

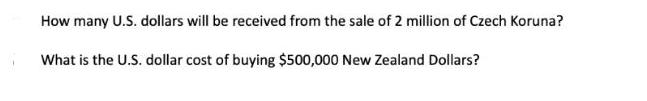

: The interest rate in the United States is 8%; in Japan the comparable rate is 2%. The spot rate for the yen is 130.0052/$. If the 90-day forward rate on the Japanese yen is 128.0901/$, is there an arbitrage opportunity, and more importantly, walk me through a numerical example to demonstrate HOW investors CAN (OR CANNOT) take advantage of this opportunity. Using the bid-ask rate below, answer the following (by showing all work) Major Pairs EUR/USD USD/EUR GBP/USD USD/GBP USD/CAD CAD/USD USD/CHF CHF/USD USD/JPY JPY/USD 4 Bid 1.09672 0,9116 1.3076 0.7646 1.2744 0.7844 0.9447 1.0582 118.82 0.0084 Ask 1.0969 0.9118 1.3078 0.7647 1.2747 0.7846 0.9449 1.0584 118.84 0.0084 Euro Pairs EUR/AUD AUD/EUR EURICZK CZK/EUR EUR/HUF HUF/EUR EUR/NZD NZD/EUR EUR/SEK SEK/EUR EUR/SGD SGD/EUR * Bid 1.5174 0.65877 24.6591 0.0403 369.91 0.0027 1.61677 0.6182 10.4046 0,0960 1.49465 0,6687 Ask 1.5179 0.6589 24.75010 0.0405 370.970 0.00270 1.6173 0.6185 10.4159 0.0061 1.4953 0.6690 How many U.S. dollars will be received from the sale of 2 million of Czech Koruna? What is the U.S. dollar cost of buying $500,000 New Zealand Dollars?

Step by Step Solution

★★★★★

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To determine if there is an arbitrage opportunity we need to compare the forward rate with the impli...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started