Question

1.. How much income is taxed at the federal marginal tax rate? 2. What is the taxpayers average tax rate using taxable income? 3. List

1.. How much income is taxed at the federal marginal tax rate? 2. What is the taxpayers average tax rate using taxable income? 3. List three items other than employment income that would affect RRSP contribution room. 4. How much total tax reduction would result from an RRSP contribution of $12,000 for this client? Show your calculation. 5. How much total tax reduction would result from medical expenses of $4,500 for this client? Show your calculation.

Please answer as all of these are just pairs of one question. I have just broke for a clear understanding.

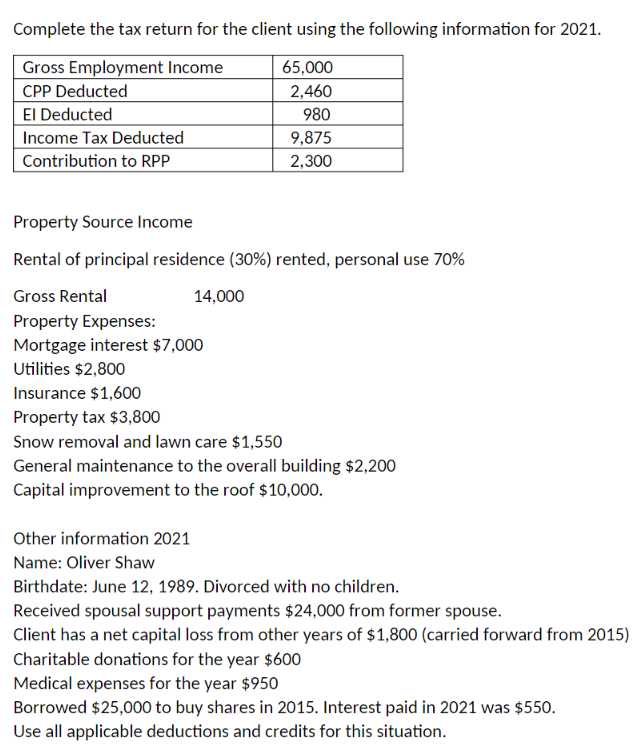

Complete the tax return for the client using the following information for 2021. Property Source Income Rental of principal residence (30\%) rented, personal use 70% Gross Rental 14,000 Property Expenses: Mortgage interest $7,000 Utilities $2,800 Insurance $1,600 Property tax $3,800 Snow removal and lawn care $1,550 General maintenance to the overall building $2,200 Capital improvement to the roof $10,000. Other information 2021 Name: Oliver Shaw Birthdate: June 12, 1989. Divorced with no children. Received spousal support payments $24,000 from former spouse. Client has a net capital loss from other years of $1,800 (carried forward from 2015) Charitable donations for the year $600 Medical expenses for the year $950 Borrowed $25,000 to buy shares in 2015. Interest paid in 2021 was $550. Use all applicable deductions and credits for this situation. Complete the tax return for the client using the following information for 2021. Property Source Income Rental of principal residence (30\%) rented, personal use 70% Gross Rental 14,000 Property Expenses: Mortgage interest $7,000 Utilities $2,800 Insurance $1,600 Property tax $3,800 Snow removal and lawn care $1,550 General maintenance to the overall building $2,200 Capital improvement to the roof $10,000. Other information 2021 Name: Oliver Shaw Birthdate: June 12, 1989. Divorced with no children. Received spousal support payments $24,000 from former spouse. Client has a net capital loss from other years of $1,800 (carried forward from 2015) Charitable donations for the year $600 Medical expenses for the year $950 Borrowed $25,000 to buy shares in 2015. Interest paid in 2021 was $550. Use all applicable deductions and credits for this situationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started