Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. How much is Employee Benefit Expense? 2. How much is Net remeasurement gain? 3. How much is the ending balance of Accrued-benefit-cost at year-end?

1. How much is Employee Benefit Expense?

2. How much is Net remeasurement gain?

3. How much is the ending balance of Accrued-benefit-cost at year-end?

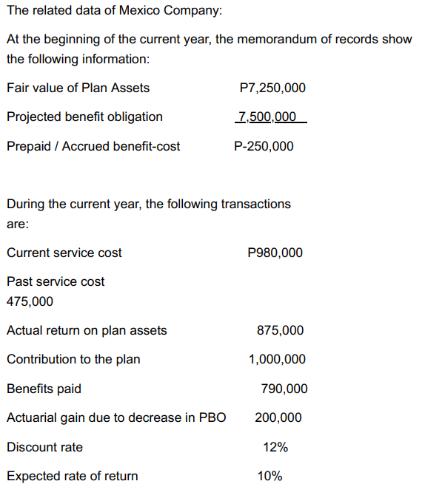

The related data of Mexico Company: At the beginning of the current year, the memorandum of records show the following information: Fair value of Plan Assets Projected benefit obligation Prepaid /Accrued benefit-cost During the current year, the following transactions are: Current service cost Past service cost 475,000 Actual return on plan assets Contribution to the plan P7,250,000 7,500,000 P-250,000 Benefits paid Actuarial gain due to decrease in PBO Discount rate Expected rate of return P980,000 875,000 1,000,000 790,000 200,000 12% 10%

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Using the given information we can calculate various actuarial items related to the companys defined ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started