Answered step by step

Verified Expert Solution

Question

1 Approved Answer

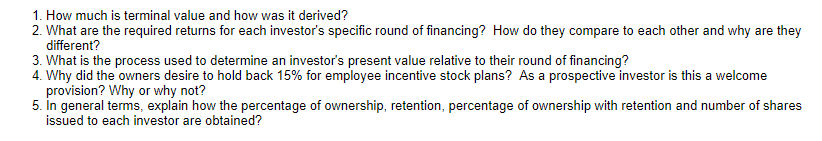

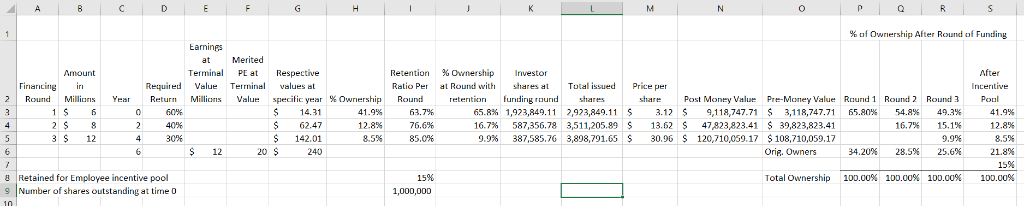

1. How much is terminal value and how was it derived? 2. What are the required returns for each investor's specific round of financing? How

1. How much is terminal value and how was it derived? 2. What are the required returns for each investor's specific round of financing? How do they compare to each other and why are they different? 3. What is the process used to determine an investor's present value relative to their round of financing? 4. Why did the owners desire to hold back 15% for employee incentive stock plans? As a prospective investor is this a welcome provision? Why or why not? 5. In general terms, explain how the percentage of ownership, retention, percentage of ownership with retention and number of shares issued to each investor are obtained? % Ownership After Round of Funding at Merited Terminl PE at Respective values at Retention %Ownership Investor Ratio Per a Roud withshares a Totaissued Price per Finacingir 2|Round Milliars Year Return Millicns Value specific year %Ownership Round retention funding rund shares Required Vale T Pre-Mcmey Value 3,1 18,747.71 16.7% 587,356.78 3,511,205.89 $ 13.62 $ 47,823,823.41 $ 39,823,823.41 9.9% 387,585.76 3,898,791.65 $ 30.96 $ 120,710,059.17 $108,710,059.17 Post Money Value $ Rund 1 65.80% Round 2 54.8% 16.7% Round 3 49.3% 15.1% 90% 25.6% share Pol 1 $ 6 14.31 $ 62.47 $ 142.01 60% 65.8% 1,923,849 1 12,923,849.11 $ 3.12 9,1 18,747.71 $ 41.9% 12.8% 8.5% 63.7% 76.6% 85.0% 41.9% 12.8% 8.5% 21.8% 15% 100.00% 3 $ 12 $ 12 20 Orip. Owners 34.20% 28.5% Retained for Employee incentive pool 9 Number of share outstanding at time 0 15% 1,000,000 Total Ownership 100.00% 100.00% 100.00% 1. How much is terminal value and how was it derived? 2. What are the required returns for each investor's specific round of financing? How do they compare to each other and why are they different? 3. What is the process used to determine an investor's present value relative to their round of financing? 4. Why did the owners desire to hold back 15% for employee incentive stock plans? As a prospective investor is this a welcome provision? Why or why not? 5. In general terms, explain how the percentage of ownership, retention, percentage of ownership with retention and number of shares issued to each investor are obtained? % Ownership After Round of Funding at Merited Terminl PE at Respective values at Retention %Ownership Investor Ratio Per a Roud withshares a Totaissued Price per Finacingir 2|Round Milliars Year Return Millicns Value specific year %Ownership Round retention funding rund shares Required Vale T Pre-Mcmey Value 3,1 18,747.71 16.7% 587,356.78 3,511,205.89 $ 13.62 $ 47,823,823.41 $ 39,823,823.41 9.9% 387,585.76 3,898,791.65 $ 30.96 $ 120,710,059.17 $108,710,059.17 Post Money Value $ Rund 1 65.80% Round 2 54.8% 16.7% Round 3 49.3% 15.1% 90% 25.6% share Pol 1 $ 6 14.31 $ 62.47 $ 142.01 60% 65.8% 1,923,849 1 12,923,849.11 $ 3.12 9,1 18,747.71 $ 41.9% 12.8% 8.5% 63.7% 76.6% 85.0% 41.9% 12.8% 8.5% 21.8% 15% 100.00% 3 $ 12 $ 12 20 Orip. Owners 34.20% 28.5% Retained for Employee incentive pool 9 Number of share outstanding at time 0 15% 1,000,000 Total Ownership 100.00% 100.00% 100.00%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started