Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. How much is the goodwill on January 1, 20x1? 2. How much is the total assets on January 1, 20x1, after business combination? 3.

1. How much is the goodwill on January 1, 20x1?

2. How much is the total assets on January 1, 20x1, after business combination?

3. How much is the total liabilities on January 1, 20x1, after business combination?

4. How much is the total effect on share premium on December 31, 20x1?

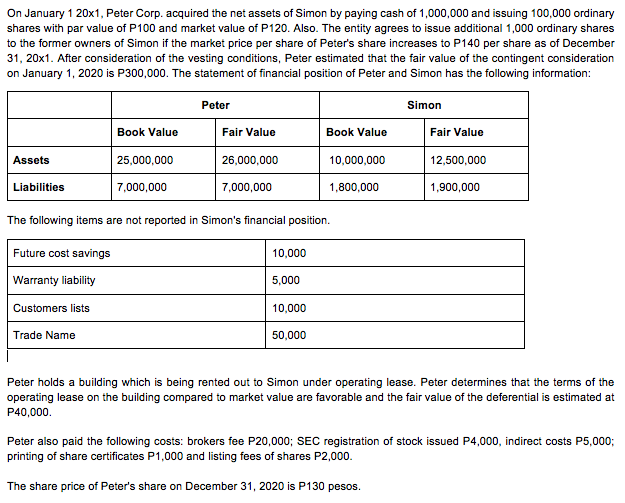

On January 1 20x1, Peter Corp. acquired the net assets of Simon by paying cash of 1,000,000 and issuing 100,000 ordinary shares with par value of P100 and market value of P120. Also. The entity agrees to issue additional 1,000 ordinary shares to the former owners of Simon if the market price per share of Peter's share increases to P140 per share as of December 31, 20x1. After consideration of the vesting conditions, Peter estimated that the fair value of the contingent consideration on January 1, 2020 is P300,000. The statement of financial position of Peter and Simon has the following information: Peter Simon Fair Value Book Value 25,000,000 Book Value 10,000,000 Fair Value 12,500,000 Assets 26,000,000 Liabilities 7,000,000 7,000,000 1,800,000 1,900,000 The following items are not reported in Simon's financial position. Future cost savings 10,000 5,000 Warranty liability Customers lists Trade Name 10,000 50,000 Peter holds a building which is being rented out to Simon under operating lease. Peter determines that the terms of the operating lease on the building compared to market value are favorable and the fair value of the deferential is estimated at P40,000 Peter also paid the following costs: brokers fee P20,000; SEC registration of stock issued P4,000, indirect costs P5,000; printing of share certificates P1,000 and listing fees of shares P2,000. The share price of Peter's share on December 31, 2020 is P130 pesosStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started